Michael Saylor’s Strategy has just announced its latest Bitcoin acquisition. Here’s how much the company has expanded its holdings with this buy.

Strategy Has Added Another 487 BTC To Its Treasury

In a new post on X, Strategy Chairman Michael Saylor has revealed the latest routine Monday purchase for the company’s Bitcoin treasury. With this buy, the firm has added another 487 BTC to its treasury, taking its total holdings to 641,692 BTC.

The purchase involved an average token price of $102,557 and cost Strategy a total of $49.9 million. The company’s recent acquisitions have been relatively modest, and it seems this new one is no different.

Strategy funded the buy, which occurred between November 3rd and 9th, using sales of its STRF, STRK, STRD, and STRC at-the-market (ATM) stock offerings, according to the filing with the US Securities and Exchange Commission (SEC).

CryptoQuant community analyst Maartunn has identified an interesting pattern when it comes to Strategy purchases: the firm tends to buy around weekly highs in the Bitcoin price. But as the new chart shared by Maartunn in an X post shows, the latest acquisition hasn’t fit the pattern.

As displayed in the above graph, this Strategy purchase has come near a local bottom in the cryptocurrency’s price instead. Thus, these tokens haven’t immediately gone underwater like some of those purchased earlier.

The company’s total investment into its Bitcoin stack has increased to $47.54 billion following the latest purchase, putting the average buying price of all tokens at $74,079. This means that as long as BTC’s spot price trades above this level, Saylor’s firm wouldn’t go underwater.

At the current exchange rate, Strategy’s treasury is valued at almost $67.7 billion, so the company is in a profit of more than 42%. A significant figure, despite the bearish action BTC has faced recently.

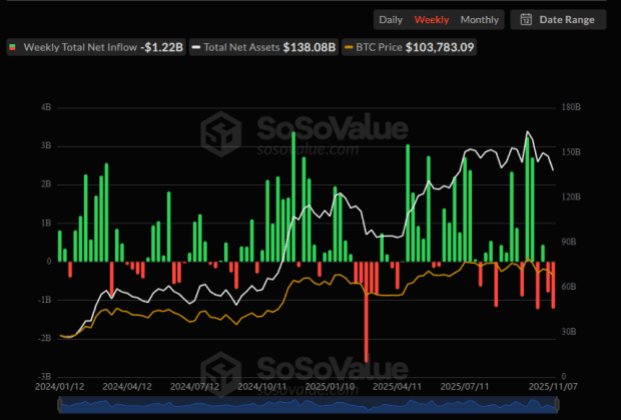

While Strategy has continued its Bitcoin buying spree, outflows have occurred elsewhere in the sector: the US spot exchange-traded funds (ETFs). As the below data from SoSoValue shows, the last week saw a negative netflow from these funds.

From the chart, it’s apparent that Bitcoin spot ETFs saw a red netflow of $1.22 billion in the last week, continuing the trend of outflows from the previous week, which saw almost $800 million exiting from these investment vehicles.

The BTC price has started the new week with a recovery surge, however, so it only remains to be seen how the netflow will develop in the coming days.

BTC Price

Bitcoin broke above $106,000 during its rally earlier on Monday, but the asset has since seen a small pullback as its price is now back at $105,800.