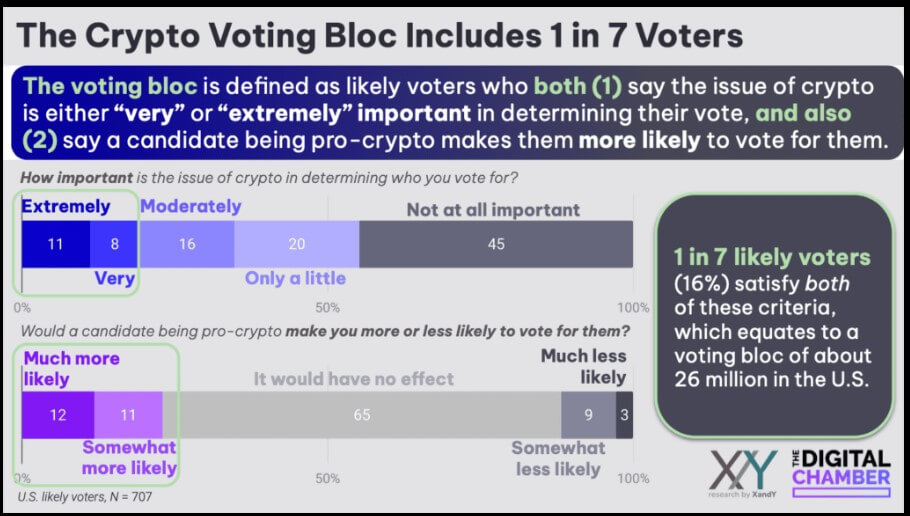

A survey by the Digital Chamber, a pro-crypto trade group, reveals that the crypto industry could impact the upcoming US Presidential Election even more than anticipated. An estimated 26 million voters are in the sector’s voting bloc.

The survey found that 16% of the 1,004 respondents, or roughly one in seven, consider a candidate’s stance on crypto to be “extremely” or “very” important in shaping their vote.

This group, dubbed the “Crypto Voting Bloc,” includes voters from both major political parties inclined to back candidates with pro-crypto policies.

Notably, 25% of Democratic and 21% of Republican voters said that a candidate’s position on crypto could influence their support. This data suggests that pro-crypto candidates may have an advantage in the race.

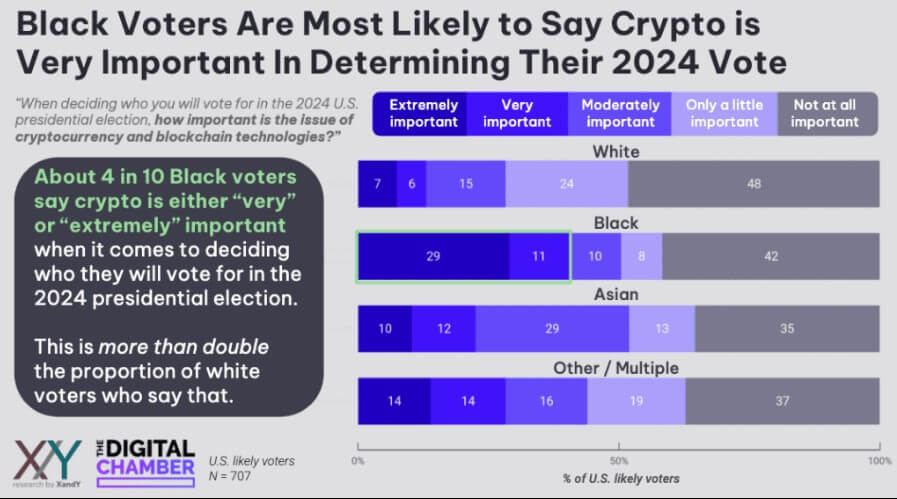

The survey also highlights demographic differences in crypto enthusiasm. About 40% of Black voters indicated that crypto is “very” or “extremely” important in deciding their vote for the 2024 election—more than twice the percentage of White voters who said the same.

Additionally, Republican and Democrat respondents agreed that supporting the crypto industry should be a medium-level priority for the next president and Congress.

Meanwhile, the survey also revealed a perception gap among voters: Those planning to vote for Donald Trump believe he supports crypto more than Kamala Harris does, while Harris supporters think the opposite.

Perianne Boring, founder and CEO of the Digital Chamber, stressed that these results should be “a wake-up call for policymakers” as the presidential election is expected to be highly competitive.

Boring added:

“Voters are sending a clear message—they want smart, balanced regulation that protects consumers without stifling innovation. Embracing a pro-crypto stance is a powerful opportunity for candidates to connect with this rapidly growing base.”

Unsurprisingly, the two major candidates for the White House have signaled a more favorable stance toward crypto during this election cycle.

However, data from Polymarket indicates that crypto bettors favor Trump’s potential presidency over Harris’s.

The post Survey suggests Democrat voters see crypto as slightly more important to election than Republicans appeared first on CryptoSlate.