Ethereum (ETH) is under a pivotal week as traders weigh a mix of macroeconomic expectations, institutional developments, and strengthening technical signals.

Related Reading: Midnight Goes Live As Cardano Founder Targets A $10 Billion Ecosystem

With the Federal Reserve set to deliver its next rate decision, market participants are watching how Ethereum’s recent momentum interacts with a broader risk-on environment.

The second largest cap cryptocurrency has already staged a notable rebound, breaking key resistance levels and drawing renewed interest from both retail and institutional investors.

Fed Expectations Drive Ethereum Position Repricing

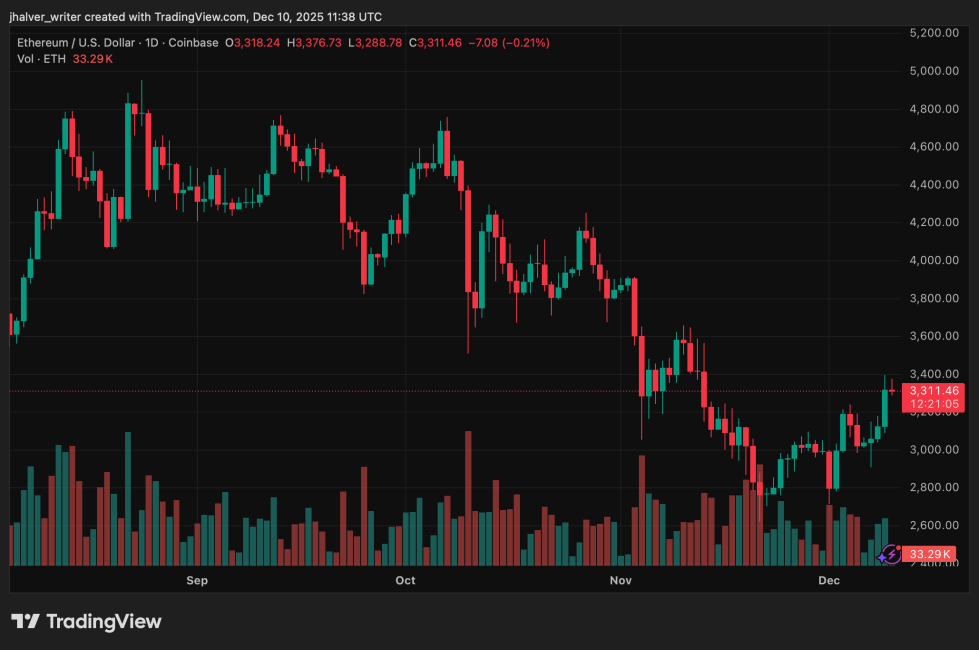

Ethereum surged past $3,300 and briefly approached $3,400 after recording a 6% jump over the past 24 hours.

The rally comes as traders price in a high probability, close to 90%, that the Federal Reserve will announce a 25-basis-point rate cut. Lower interest rates tend to improve liquidity conditions, a factor that has historically supported digital assets.

Bitcoin’s recovery above $94,000 added further confidence to the market, though Ethereum outperformed on a relative basis. The ETH/BTC ratio reached its strongest point since late October, indicating a shift of capital from Bitcoin to Ethereum.

Spot Ethereum ETFs also saw $177.7 million in inflows on December 9, surpassing Bitcoin’s inflows on the same day.

Institutional Moves Add to Bullish Sentiment

One major catalyst behind this shift has been BlackRock’s filing for the iShares Ethereum Staking Trust ETF. The fund would offer exposure not only to ETH’s price but also to staking rewards, expanding access to yield-bearing strategies.

Analysts note that such products could increase liquidity inflows into Ethereum, especially as institutional portfolios diversify beyond Bitcoin. This filing arrives at a time when the amount of ETH held on centralized exchanges has fallen to its lowest level since 2015, roughly 8.7% of the total supply.

Large buyers, including Bitmine Immersion, have accumulated billions of dollars’ worth of ETH in recent months. Combined, these developments indicate a tightening of supply conditions.

Technical Breakouts Reinforce the Trend

Chart analysts highlight that Ethereum has broken above a downward trendline that previously capped rallies for nearly two months.

Momentum indicators, including MACD and RSI, show increasing buyer strength despite approaching overbought territory. Ethereum’s break above the $3,300 zone has shifted focus toward the next resistance level at $3,500, with wave-pattern analysis suggesting potential upside toward $3,600.

Related Reading: Bitwise Rolls Out New ETF For Broad Crypto Exposure, Including BTC, XRP, And ADA

Analysts such as Captain Faibik argue that a confirmed breakout could support a rally of up to 30%, targeting the $4,200–$4,300 region if bullish conditions persist. However, the Fed’s upcoming decision remains a key variable in determining whether momentum continues or cools.

Cover image from ChatGPT, ETHUSD chart from Tradingview