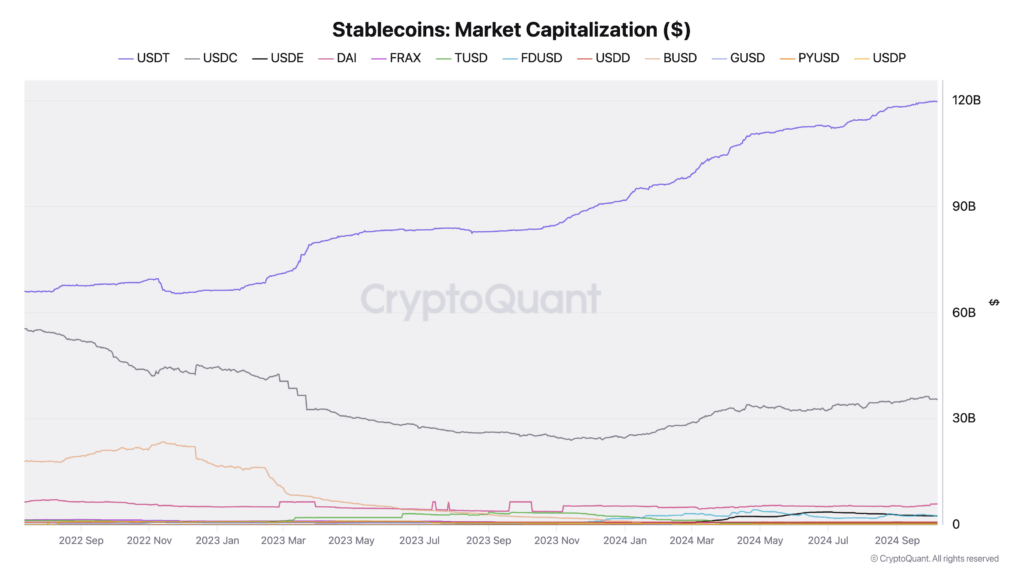

CryptoQuant data reveals that crypto market liquidity has reached unprecedented levels, with the total market capitalization of major USD-backed stablecoins hitting $169 billion in late September—a 31% increase year-to-date. This surge is primarily driven by Tether’s USDT, which has seen significant growth in balances on centralized exchanges.

USDT (ERC20 on Ethereum) balances on exchanges rose to 22.7 billion in October, marking a 54% increase of $8 billion since the beginning of the year. Centralized exchanges also hold approximately $8.5 billion of USDT issued on the TRON network. These elevated stablecoin balances are positively correlated with higher Bitcoin and crypto prices, although Bitcoin’s price has remained relatively flat despite a 20% growth in USDT balances since August.

Since the bull cycle began in January 2023, USDT (ERC20) on exchanges increased from $9.2 billion to $22.7 billion, a 146% rise. The influx of stablecoins into exchanges suggests increased liquidity and potential for market movement.

Meanwhile, Ripple has entered the stablecoin market with the launch of RLUSD, its US dollar-backed stablecoin introduced in late September. RLUSD has reached a market capitalization of $47 million and operates on both the XRP Ledger and Ethereum networks. This move positions Ripple in the expanding market for remittances and money transfers.

The increased liquidity from stablecoins like USDT and the emergence of new players like Ripple’s RLUSD could signal upcoming shifts in the crypto market landscape.

The post Tether fuels market liquidity surge as stablecoins reach $169 billion appeared first on CryptoSlate.