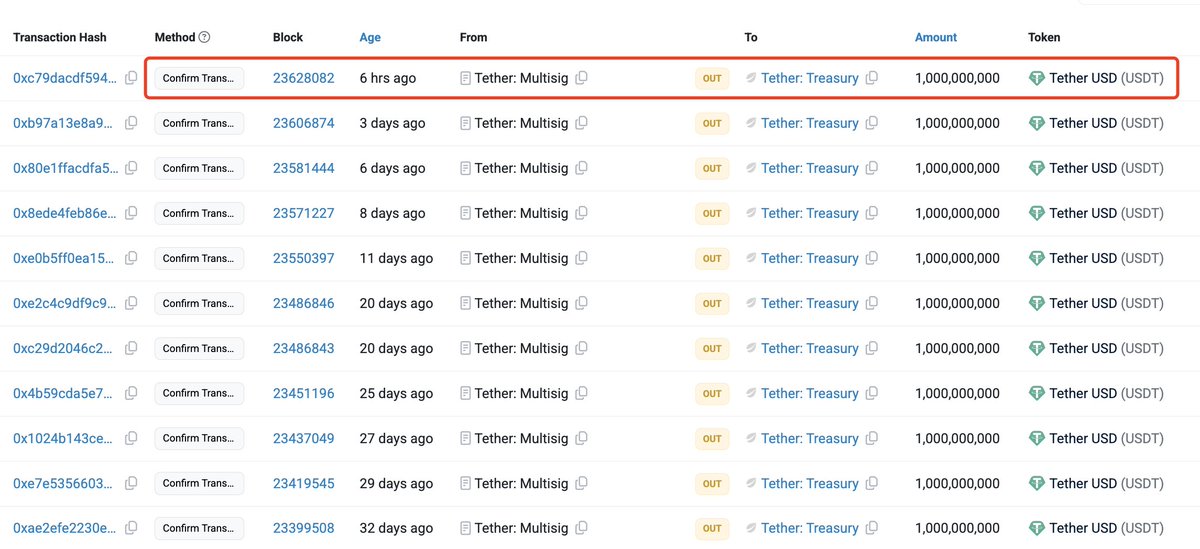

Tether has just minted another 1 billion USDT, only hours ago, reigniting debate over stablecoin-driven liquidity flows across the crypto market. The mint comes at a crucial time — Bitcoin is struggling to reclaim higher levels after weeks of volatility, while altcoins continue to bleed as if a full-blown bear market were underway.

These mints tend to inject liquidity into exchanges, providing the capital needed for traders and market makers to re-enter positions or stabilize volatile price swings. While not always an immediate bullish catalyst, they frequently precede recoveries in market sentiment and volume.

The latest mint follows a wave of renewed uncertainty across the crypto landscape, with investors closely watching Bitcoin’s $110K level as a make-or-break support zone. Altcoins, meanwhile, are experiencing double-digit declines, raising concerns that risk appetite remains weak.

If history is any indication, this new influx of stablecoin liquidity could be setting the stage for a short-term rebound — or at least a temporary relief rally — as liquidity begins to circulate across major exchanges and derivative markets in the days ahead.

A Liquidity Wave That Could Shake the Market

According to data from Lookonchain, Tether and Circle have collectively minted over $7 billion in stablecoins since the October 10 market crash. This surge in new supply marks one of the most significant liquidity injections since midyear, sparking speculation about its potential impact on Bitcoin and the broader crypto market.

Stablecoin mints on this scale often act as precursors to major price swings. While not a direct form of buying, they indicate that fresh capital is being positioned to enter the market — typically through market makers, institutional desks, or exchanges preparing for renewed trading activity. In this context, the $7 billion influx suggests that liquidity conditions are improving after the sharp drawdown that liquidated billions in long positions earlier this month.

Related Reading: 2,496 Bitcoin Moved After Years Of Inactivity – Long-Term Holders Take Action

However, such rapid capital movement can also heighten volatility. As this liquidity begins to circulate, it can amplify both sides of the market — first triggering relief rallies as buyers re-enter, and then sharp corrections as leveraged positions unwind.

For Bitcoin, the timing is especially critical. With BTC still struggling to hold above $108K–$110K, this new liquidity could determine whether the next move is a bullish breakout or another leg lower. Historically, large stablecoin issuances have preceded upward shifts in Bitcoin’s price, but in a fragile market, they can also fuel speculative whipsaws.

Tether’s USDT Dominance Rebounds As Traders Seek Stability

Tether’s market dominance has risen sharply to around 5.06%, signaling a notable shift in sentiment as investors move capital into stablecoins amid heightened market volatility. The weekly chart shows a strong rebound from the 4.6% level, with USDT dominance now testing resistance near the 100-week moving average. This uptick coincides with the broader crypto market downturn following Bitcoin’s failure to hold key support at $110K and widespread selling across altcoins.

Historically, rising USDT dominance reflects increased demand for safety — traders exiting volatile assets and parking capital in stablecoins to wait for clearer market direction. This pattern often precedes periods of accumulation, as sidelined liquidity builds up, ready to re-enter once confidence returns.

From a technical standpoint, the structure suggests that a sustained breakout above 5.2% could extend the dominance rally toward 6%, a level last seen during previous market corrections. However, rejection here would imply stabilization and potential capital rotation back into risk assets.

Featured image from ChatGPT, chart from TradingView.com