Stablecoin issuer Tether boasted gains of approximately $2.85 billion during the fourth quarter of last year. The performance led to more profit than Wall Street giant Goldman Sachs, Bitwise chief investment officer Matt Hougan highlighted on X.

Goldman Sachs reported a profit of $2.01 billion in the last three months of the previous year, while Tether’s Q4 report revealed that its profits comprised $1 billion from U.S. Treasury bills and $1.85 billion from holdings in Gold and Bitcoin.

This remarkable performance can be attributed to the surge in the crypto market, driven by the enthusiasm surrounding the spot Bitcoin exchange-traded fund (ETF) between October and December 2023. During this period, Bitcoin’s value skyrocketed to over $42,000 from around $27,000, coinciding with Tether’s USDT supply rising to nearly 92 billion from approximately 83 billion tokens.

Observers noted that the increased demand for Tether’s fiat-backed stablecoin signaled a growing interest from institutional investors entering the market. CryptoSlate’s data shows that Tether’s USDT supply has risen to $96.2 billion as of press time.

However, despite its impressive performance, Tether’s overall profit for the year was $6.2 billion, notably lower than Goldman Sachs’s earnings of $8.52 billion.

Meanwhile, Paolo Ardoino, Tether’s CEO, emphasized that these substantial profits emphasize the company’s financial strength throughout the year.

“The substantial net profits generated not only in the last quarter of the year but throughout the year, amounting to $6.2 billion, showcases our financial strength,” Ardoino said.

Goldman Sachs, a globally renowned investment banking firm, holds the status of the second-largest investment bank in the world by revenue and is recognized as a systemically important financial institution by the Financial Stability Board.

Over $5 billion in excess reserves

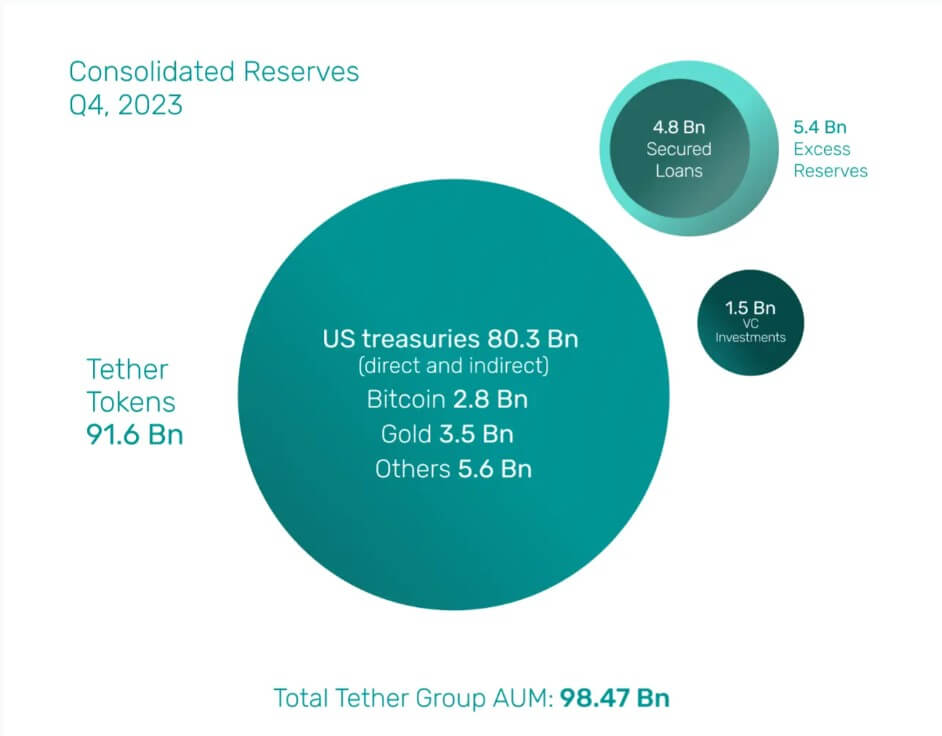

The substantial profit margin enabled Tether to bolster its excess reserves to $5.4 billion. Of this, $640 million was allocated to various project investments, including sustainable energy, Bitcoin mining, AI infrastructure, and P2P communications. Tether does not consider these investments part of its reserves.

“Our investments in sustainable energy, Bitcoin mining, data, AI infrastructure, and P2P telecommunications technology illustrate our commitment to a more sustainable and inclusive financial future,” Ardoino explained.

BDO Italia, a prominent global accounting firm conducting Tether’s attestations, verified that the stablecoin’s excess reserves entirely covered its $4.8 billion in outstanding unsecured loans. Tether highlighted its achievement in eliminating the risk of secured loans from its token reserves.

As of December 31, 2023, Tether’s held assets were valued at $98.47 billion, with liabilities amounting to $91.59 billion.

The post Tether reports $5B reserve excess after making more profit than Goldman Sachs last quarter appeared first on CryptoSlate.