Quick Take

- Luna collapse (May-June 2022) pushed Bitcoin below $20,000.

- Bitcoin lost $10,000 in value over 10 days in June 2022.

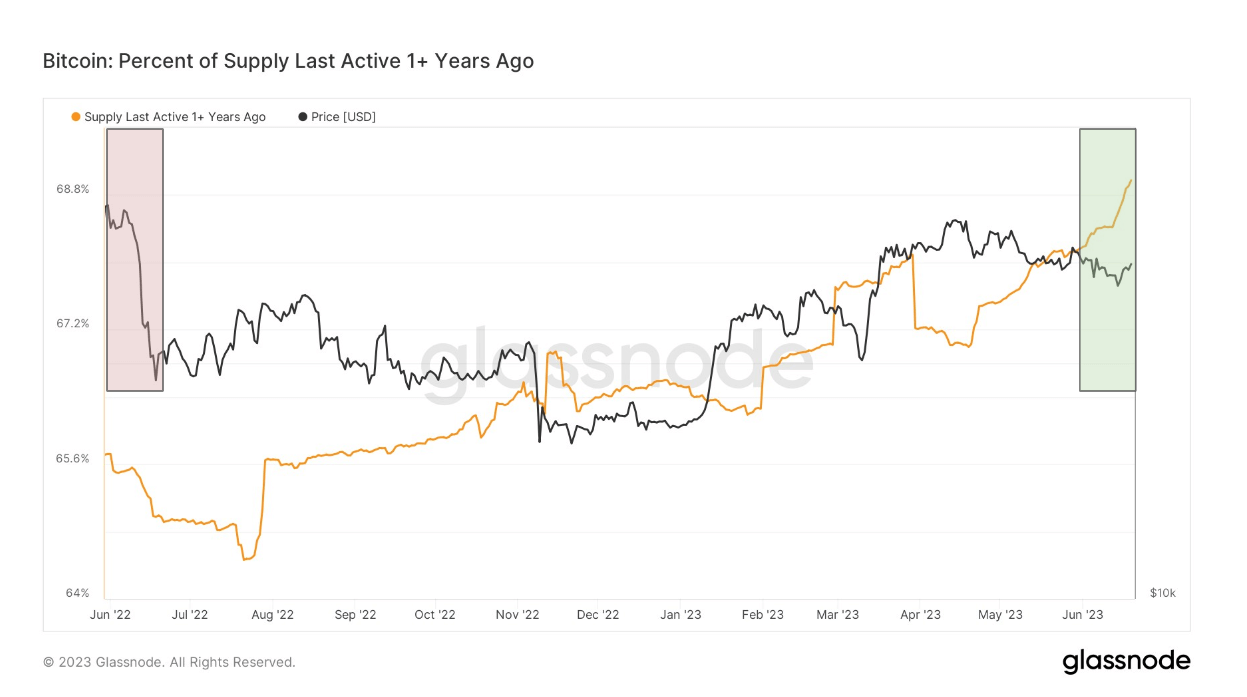

- Long-term holders now hold the purchased Bitcoin.

- 69% of Bitcoin’s supply was last active over 1 year ago, surging since the start of 2023.

- Despite a 75% price drop in 2022, Bitcoin’s unwavering buy-and-hold philosophy seems to persist throughout the bear market.

The post The Luna collapse impact on Bitcoin one year on appeared first on CryptoSlate.