Ethereum is once again in the spotlight after smashing through its previous all-time high, reaching $4,886 on Friday with an explosive 14% daily surge. This breakout underscores the strength of ETH’s ongoing bullish trend and highlights its growing dominance in the crypto market. While Bitcoin has been consolidating around familiar levels, Ethereum has become the focal point of institutional interest, with large players increasingly allocating capital to the asset.

Fundamentals remain robust, as both on-chain and market data confirm that Ethereum demand is accelerating. Institutions, funds, and whales are not only holding but also aggressively adding to their positions, signaling conviction in Ethereum’s long-term value. According to Arkham Intelligence, Tom Lee’s Bitmine has just bought $45 million worth of ETH, further cementing the narrative of large-scale accumulation. This move aligns with a broader trend of influential investors and organizations betting on Ethereum as the backbone of decentralized finance and the leading smart contract platform.

The combination of new highs, institutional adoption, and growing market confidence places Ethereum at the center of attention heading into the next phase of the cycle. Bulls now expect price discovery to unfold, potentially pushing ETH toward uncharted territory.

Institutional Accumulation Signals Bullish Upside

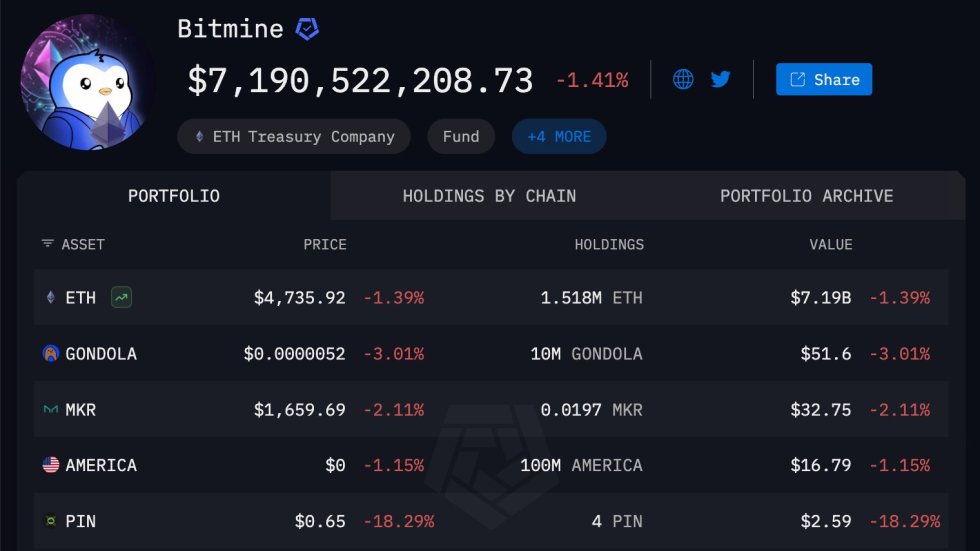

Ethereum’s rally is increasingly being fueled by deep-pocketed institutional players, with Arkham reporting that BitMine now holds $7 billion worth of ETH. This staggering position makes BitMine the largest corporate holder of Ethereum, with 1.518 million ETH under its control—equivalent to roughly 1.3% of the total supply. Far from slowing down, BitMine continues to accumulate, reinforcing the narrative that institutions see Ethereum as a cornerstone asset for the future of digital finance.

Close behind is SharpLink Gaming, the second-largest corporate holder, which has amassed 729,000 ETH valued at approximately $3.2 billion. Together, these two players represent a significant concentration of Ethereum in corporate treasuries, underscoring the scale of institutional conviction. Analysts point out that such accumulation not only locks away massive amounts of ETH from circulation but also shifts market dynamics by tightening available supply.

When large entities consistently buy and hold, it often signals confidence in both the asset’s utility and long-term price appreciation. Many market participants view Ethereum’s latest breakout above its 2021 all-time high as only the beginning, with corporate demand providing a strong foundation for further gains. If this pace of accumulation continues, Ethereum could be entering the kind of supercycle many investors have long anticipated.

Weekly Outlook: Key Resistance In Play

Ethereum’s weekly chart shows a powerful rebound that has carried the asset to new highs not seen since late 2021. After finding strong support near the $2,400 region earlier this year, ETH has staged a decisive rally, surging past its long-term moving averages (50, 100, and 200-week SMAs) and breaking through resistance levels that previously capped momentum. This breakout has culminated in a fresh push toward $4,779, putting Ethereum firmly back into price discovery territory.

The structure of the chart highlights how bulls have regained control. ETH has posted consecutive bullish candles, with strong buying momentum following institutional accumulation trends reported on-chain. The alignment of the moving averages — with the 50-week SMA turning upward above the 100 and 200-week SMAs — signals a strengthening long-term bullish trend.

However, the rapid pace of this climb also raises the risk of short-term exhaustion. ETH is now trading near historically significant resistance levels that align with prior cycle peaks, which could spark profit-taking among traders. If a retracement occurs, $4,300 and $3,800 emerge as key support zones to watch.

Featured image from Dall-E, chart from TradingView