Data shows the Toncoin (TON) Open Interest has registered a spike in the past day. Here’s what could happen next, according to historical trends.

Toncoin Open Interest Has Hit Its Highest Since February

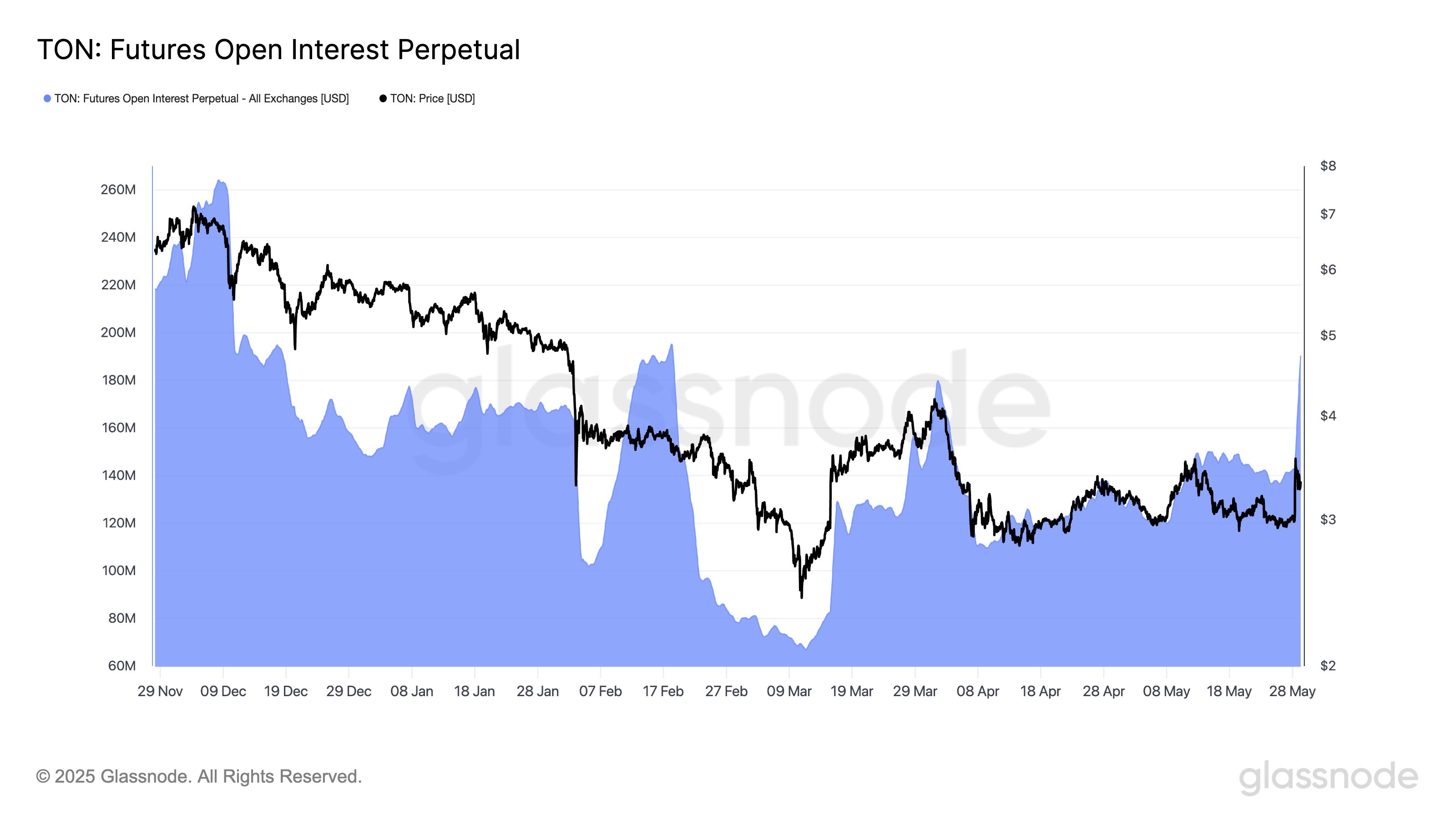

In a new post on X, the on-chain analytics firm Glassnode has talked about the latest trend in the Open Interest for Toncoin. The “Open Interest” here refers to a metric that keeps track of the total amount of perpetual futures positions related to TON (in USD) that are currently open on all derivatives platforms.

When the value of this metric rises, it means the investors are opening up more positions related to the asset on the market. Generally, the total leverage in the sector goes up when new positions appear, so this kind of trend can lead to higher volatility for the cryptocurrency’s price.

On the other hand, the indicator going down suggests that investors are closing their own positions voluntarily or being forcibly liquidated by their exchange. Either way, the asset can behave in a more stable manner following such a trend due to the drop in leverage.

Now, here is the chart shared by the analytics firm that shows the trend in the Toncoin Open Interest over the last few months:

As displayed in the above graph, the Toncoin Open Interest has just seen a very sharp spike, a sign that traders have opened up a large number of futures positions. More specifically, the metric’s value has gone up from $143 million to $190 million over the last 24 hours.

From the chart, it’s visible that this quick 33% jump initially came as the coin’s price witnessed a rapid increase, but interestingly, it maintained its upward trajectory even as the asset saw a pullback.

“Past spikes like this have often preceded corrections – worth watching closely,” notes Glassnode. The last time the Toncoin Open Interest formed this pattern was at the end of March/start of April. What followed back then was a price drawdown of about 32%.

TON isn’t the only digital asset that has seen an uptick in speculation recently. As the analytics firm has pointed out in its latest weekly report, Bitcoin has also been observing a major rise in its Open Interest.

As is visible in the chart, the Bitcoin Open Interest fell to a low of $36.8 billion in April as the cryptocurrency’s price itself went down. Since then, however, the indicator has shot up by 51% alongside the bull rally, reaching the $55.6 billion mark. The report explains that this suggests “a build up of leverage is underway.”

TON Price

At the time of writing, Toncoin is trading around $3.34, up more than 11% in the last 24 hours.