Quick Take

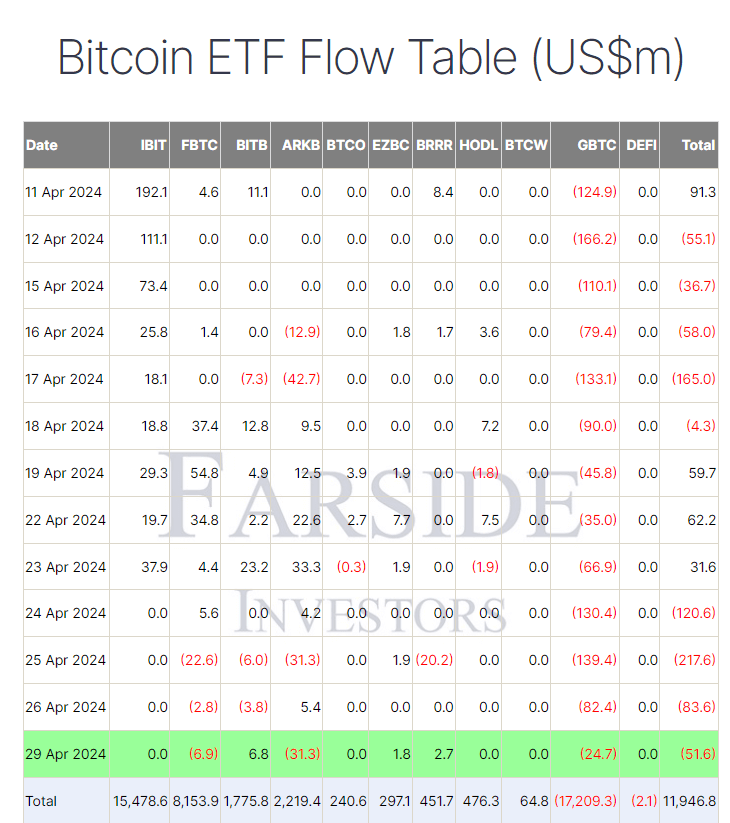

According to the latest data from Farside Investors, April 29 saw an outflow of $51.6 million from US Bitcoin ETFs, marking the fourth consecutive trading day of outflows. While this figure does not represent the lowest outflow during this period, it highlights the prevailing market sentiment.

Grayscale’s GBTC product witnessed an outflow of $24.7 million, the lowest since April 10, bringing its total outflows to $17,209.3 billion. On the other hand, BlackRock’s IBIT saw no inflow or outflow for the fourth consecutive trading day, maintaining its total inflows at $15,478.6 billion, according to Farside data.

Farside data reports that Fidelity’s FBTC experienced another outflow of $6.9 million, marking the third consecutive trading day of outflows. This brings FBTC’s total inflows to $8,153.9 billion. Ark’s ARB saw a substantial outflow of $31.3 million, its second outflow in the past three trading days, taking its total inflows to $2,219.4 billion.

According to Farside data, the total inflows across all ETFs have dropped below $12 billion, currently standing at $11,946.8 billion.

The post US Bitcoin ETFs record fourth consecutive trading day of outflows appeared first on CryptoSlate.