Onchain Highlights

DEFINITION: The number of unique addresses holding at least a value of $1M USD.

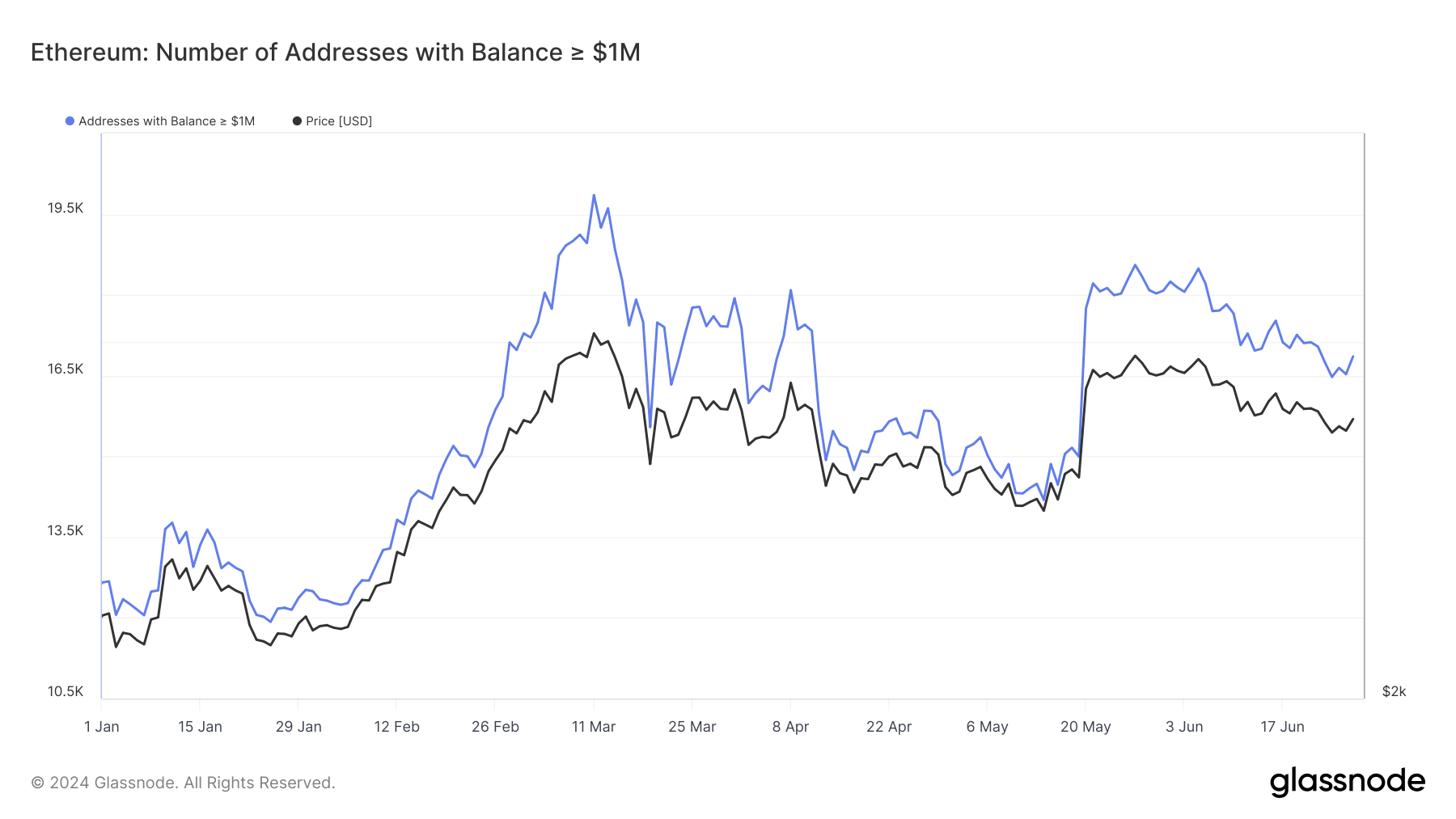

Ethereum addresses with balances exceeding $1 million have shown considerable fluctuation over the past six months. The number of such addresses increased sharply from mid-January to mid-March, peaking above 19,500. This period coincided with a significant rise in Ethereum’s price, which mirrored the trend in addresses. However, by early April, the count of these addresses and the price both saw a steep decline.

Following a brief recovery in late April, the number of high-value Ethereum addresses dropped again, hitting a low around mid-May. The trend reversed sharply thereafter, coinciding with another increase in Ethereum’s price. This pattern highlights a potential correlation between the number of high-value holders and market price movements, suggesting that large investors might be responding to or driving price changes.

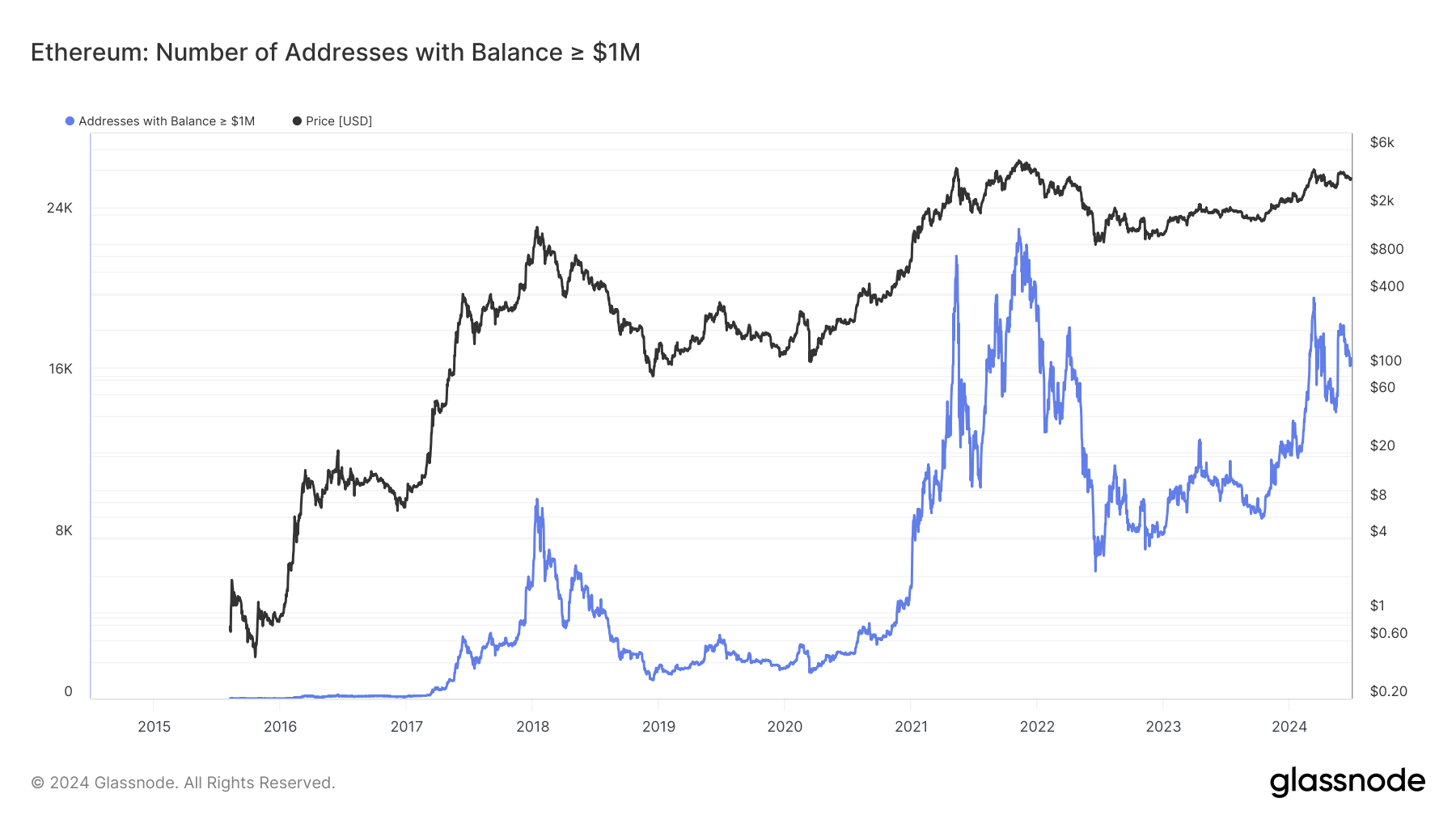

The historical chart further illustrates that while the number of million-dollar addresses has grown significantly since 2017, it remains sensitive to market conditions. The substantial fluctuations observed in 2024 align with broader market trends, reflecting investor sentiment and market volatility. However, movements have been less extreme in 2024 as they have been in previous bull runs.

The post Volatile trend in Ethereum millionaire addresses highlights market dynamics in 2024 appeared first on CryptoSlate.