Markus Thielen of 10x Research unveiled a significant shift in his crypto strategy in response to mounting financial pressures and market instability, as detailed in an investor note released earlier today. Thielen, an influential figure in the analysis sector, cited a concerning outlook on risk assets, which encompasses both technology stocks and cryptocurrencies, primarily driven by unanticipated and ongoing inflation rates.

According to projections from Bank of America, US CPI headline inflation is expected to reach 4.8% by the November 2024 election. Over the past three months, month-over-month CPI inflation has averaged 0.4%. An acceleration at this speed would mean the rate is more than twice the Federal Reserve’s inflation target of 2% by November.

Why 10x Research Sold (Almost) All Crypto And Risk Assets

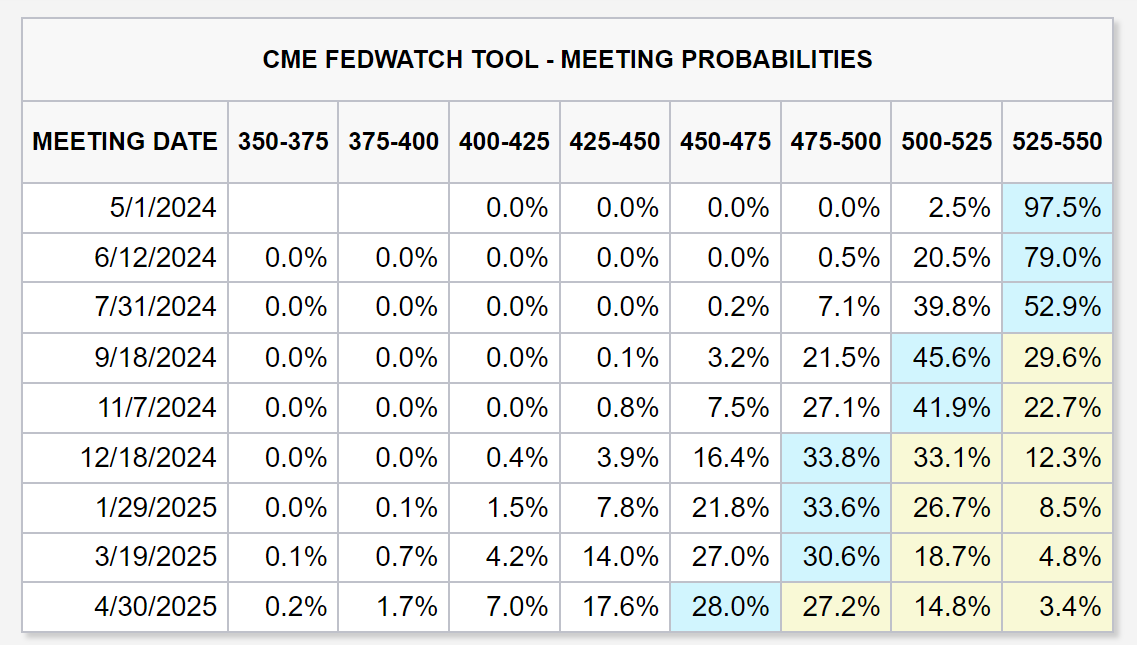

In light of this, 10x Research’s decision to divest from risky assets was catalyzed by an adverse shift in economic indicators. Notably, the US bond market is currently projecting fewer than three Federal Reserve rate cuts this year, a significant adjustment from earlier more optimistic forecasts. According to the CME FedWatch tool, the majority of market participants now think that a rate cut by the Fed will not come before the mid-September FOMC meeting.

Additionally, the 10-year Treasury Yields have reached a peak of 4.61% this month, marking the highest rate since November 2023, further complicating the investment landscape for risk assets including technology stocks and cryptocurrencies.

“Our growing concern is that risk assets are teetering on the edge of a significant price correction,” Thielen stated in the note. “We sold all our tech stocks last night as the Nasdaq is trading very poorly and reacting to the higher bond yield. We only hold a few high-conviction crypto coins. Overall, we are bearish on risk assets.”

The bearish stance is further supported by the disappointing performance of US-listed spot Bitcoin ETFs. Despite the SEC’s approval of nearly a dozen such ETFs in January, which initially spurred a surge in Bitcoin prices, the influx of capital has markedly slowed. This month, the five-day average net inflows into these ETFs plummeted to zero, a stark contrast to the nearly $12 billion that flowed into these investment vehicles earlier in the year.

Thielen’s comments also touched on the broader implications of the upcoming Bitcoin network’s quadrennial halving, scheduled for April 20. This event will reduce the reward for mining a block of Bitcoin by 50%, from 6.25 BTC to 3.125 BTC. While such halvings have historically spurred bullish sentiment and price increases due to a perceived scarcity of Bitcoin, Thielen suggests that the current market conditions might dampen any potential rallies.

“It is essential to understand that trading is a continuous game with high-conviction opportunities. The key is to keep analyzing the markets and uncovering those opportunities when the odds are in your favor. There are times when we advocate for a total risk-on approach and when the priority is safeguarding your capital, enabling you to seize opportunities at lower levels,” Thielen stated.

In a notable exchange with Matthew Graham of Ryze Labs, Thielen defended his firm’s trading strategy amid criticism for what was described as erratic decision-making. Graham pointed to recent fluctuations in 10x Research’s stance on Bitcoin, citing a research note from early April that predicted a potential rally to $80,000, followed by a more cautious view and the recent sell-off.

Thielen responded, “Actually, no. We have been cautious since March 8, and when the triangle breakout failed, we worked with the $68,300 stop loss. This is simply risk-reward trading.” This defense highlights the volatile nature of crypto trading and the necessity for agile strategies in response to rapidly changing market conditions.

Thielen concluded, promising a strong re-entry into the market under more favorable conditions: “Will buy back with both hands at 52,000 – promise.”

At press time, BTC traded at $63,045.