Wealth management firm Choreo today disclosed that it has invested approximately $6.5 million in various spot Bitcoin (BTC) exchange-traded funds (ETFs). Per official details, the firm manages over $27 billion in total assets.

Choreo Reveals Exposure To Bitcoin ETF

According to a new filing with the US Securities and Exchange Commission (SEC), Choreo LLC now holds stakes in multiple Bitcoin ETFs. Its largest position is in BlackRock’s iShares Bitcoin Trust ETF (IBIT), with 51,679 shares valued at more than $3 million as of June 30.

The firm also holds 22,976 shares of the Grayscale Bitcoin Trust ETF (GBTC), worth around $1.9 million at current market prices. Further, it also holds 8,314 shares of the Grayscale Bitcoin Mini Trust ETF (BTC), valued at nearly $400,000.

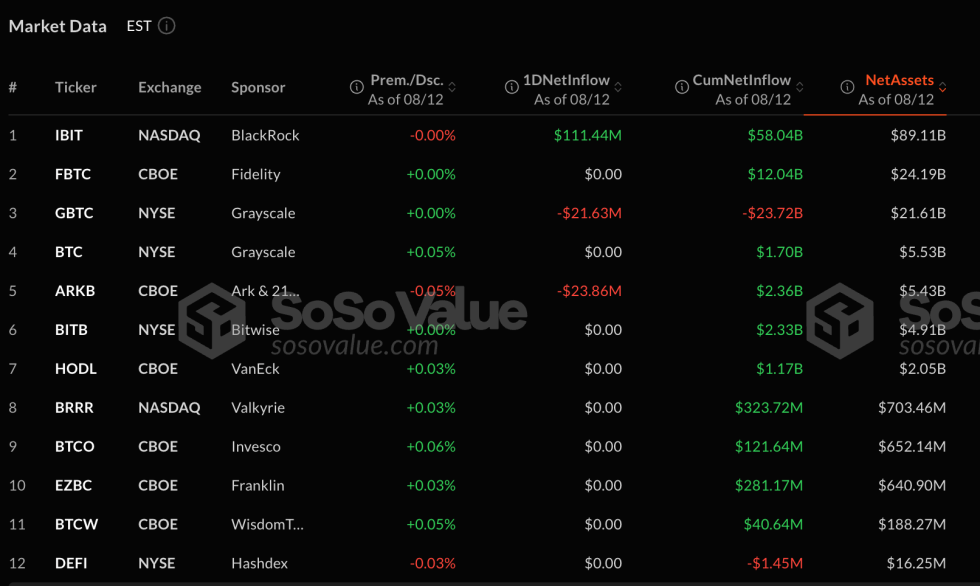

Additionally, Choreo owns 13,607 shares of the Fidelity Wise Origin Bitcoin ETF (FBTC), valued at approximately $1.3 million. Data from SoSoValue shows that BlackRock’s IBIT leads in total net assets, currently worth $89.11 billion.

Notably, spot Bitcoin ETFs recorded four consecutive months of positive inflows, attracting over $17 billion between April and July. In August, however, the ETFs faced a net outflow of $321 million. Meanwhile, the total net assets tied to spot BTC ETFs have surged to over $155 billion. This amount represents 6.48% of BTC’s total market cap.

Beyond wealth management firms like Choreo, an increasing number of educational institutions’ endowment funds are also steadily increasing exposure to BTC ETFs. Recently, Harvard disclosed a $117 million stake in BlackRock’s IBIT ETF.

Most recently, Norway’s sovereign wealth fund increased its indirect exposure to BTC by 192%, year-on-year. The fund’s total exposure now stands at 7,161 BTC.

BTC ETF Euphoria Grips Crypto Market

While BTC continues to trade on the verge of a new all-time high (ATH) – exchanging hands at slightly above $120,000 at the time of writing – institutional interest in BTC ETFs has also been rising at a rapid pace.

For instance, BlackRock’s IBIT ETF reached a whopping $70 billion in assets under management in under a year, marking a record for rapid adoption of BTC-focused regulated financial products.

In the same vein, following US President Donald Trump’s November 2024 election victory, his social media firm – Trump Media – has accelerated its crypto ambitions. Last month, the firm filed for a third ETF, which will track the performance of five different cryptocurrencies.

That said, the financial watchdog is carefully evaluating new ETF applications due to the inherent risks of digital assets. At press time, BTC trades at $121,444, up 1.1% in the past 24 hours.