In the early hours of Monday, a dormant whale moved $21 million worth of 4 DeFi tokens to the crypto exchange Binance. The news received mixed reactions from the community, which worries about an incoming dump amid the recent retrace of the crypto market.

Whale Deposits $21 Million In DeFi Tokens To Binance

On Monday, on-chain analytic firm Spotonchain reported a dormant whale had deposited around $13 million in crypto to Binance. After a year of holding, The whale sent 3,800 Maker (MKR) and 20,000 Aave (AAVE) to Binance.

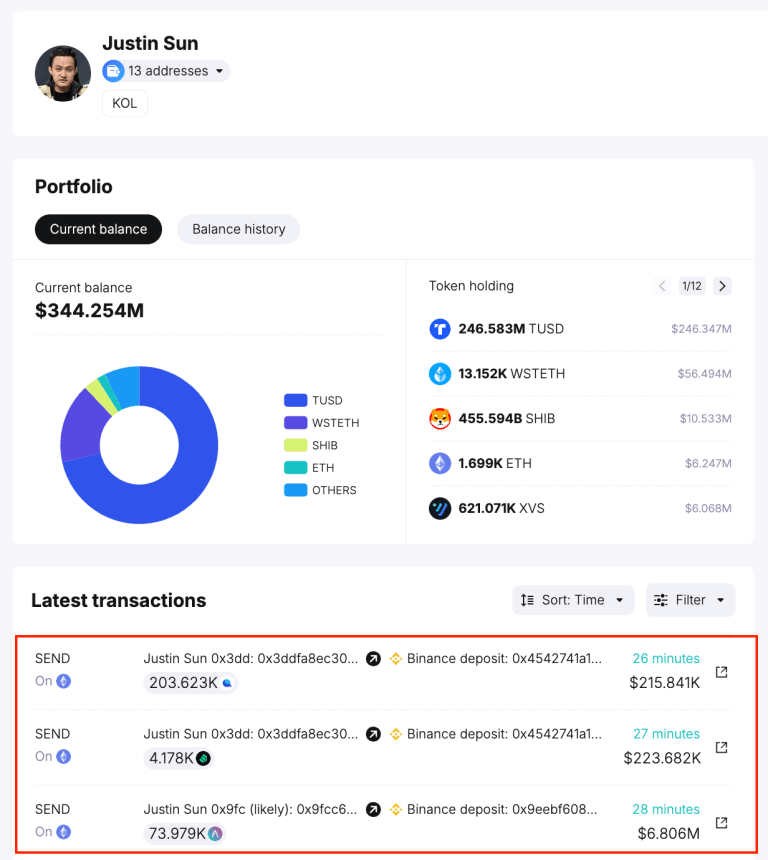

The firm later revealed that the whale was seemingly Tron founder Justin Sun. Three of the 13 addresses believed to be owned by Sun were wallets that conducted the transfers.

Per the post, the whale deposited $21 million worth of 4 DeFi tokens to Binance in 30 minutes. The addresses sent 93,979 AAVE, worth around $11.26 million, and 3,800 MKR tokens.

The addresses purchased the MKR tokens in June 2023 for $2.43 million, acquiring the 3,800 tokens at an average price of $641.81. Meanwhile, the AAVE tokens were bought from June 2023 until January 2024 at an average price of $87.14.

At the time of the post, the crypto whale had around $7 million in estimated profits, $6.74 million from MKR, and $252,000 from AAVE.

Additionally, Sun sent over 4,000 and 200,000 Compound (COMP) and Liquity (LQTY) tokens to the exchange. The transactions account for 4,178 COMP, worth around $245,000, and 203,823 LQTY, worth approximately $217,000.

Are Sun’s Transfers Bearish Or Bullish?

The deposits raised concerns among the crypto community as deposits on exchanges are considered bearish and could significantly decrease a token’s price if dumped.

Nonetheless, some considered Sun’s movements as a bullish signal. An X user stated his optimism, claiming that whales “always deposit during the consolidation before the breakout.”

Similarly, other crypto investors believe it’s “time to load up on DeFi” and that “Justin is about to give us generational entry.”

It’s worth noting that the community closely follows Tron’s founder’s on-chain movements. As reported by NewsBTC, Sun is suspected to be the whale behind some of the massive Ethereum (ETH) purchases from Q1 2024. Sun seemingly bought over $891 million worth of ETH during the buying spree.

Despite the community’s reaction, the 4 DeFi tokens sent to Binance didn’t react significantly to the transactions.

After the news, AAVE saw a mild 1.4% drop to the $91.26 level before recovering the $92 support zone. The token saw a 12.4% drop on Friday following the recent market downturn.

Similarly, MKR saw a sharp 10.6% decline over the weekend, falling from the $2,600 to the $2,300 price range. However, the token has seen a 3.1% price decrease in the last 24 hours. MKR dropped by 1.8% after the news but failed to recover in the following hours, currently trading below $2,400.