Solana (SOL) is entering a pivotal phase after rallying more than 40% since early August, pushing the price to its highest level since February. This remarkable surge has reignited bullish sentiment, with traders and investors now closely watching whether Solana can sustain its momentum or if a period of consolidation lies ahead. The coming days are expected to be decisive in determining the next major price direction for SOL.

Despite ongoing volatility across the broader crypto market, Solana bulls are showing resilience. The asset’s sharp recovery underscores renewed confidence in its ecosystem, driven by strong network activity, DeFi adoption, and its positioning as one of the leading Ethereum competitors. Yet, the key factor supporting optimism comes from on-chain data. According to Lookonchain, whales have been actively accumulating SOL during this rally, signaling strong conviction in its long-term potential.

The presence of large-scale buyers suggests that even amid fluctuations, demand for Solana remains elevated. This behavior highlights a critical dynamic: whales often position themselves ahead of major moves, reinforcing the bullish narrative surrounding SOL. Whether this momentum continues will depend on how Solana reacts to resistance levels in the coming sessions, making this a crucial moment for investors and traders alike.

Whale Moves Signal Growing Confidence In Solana

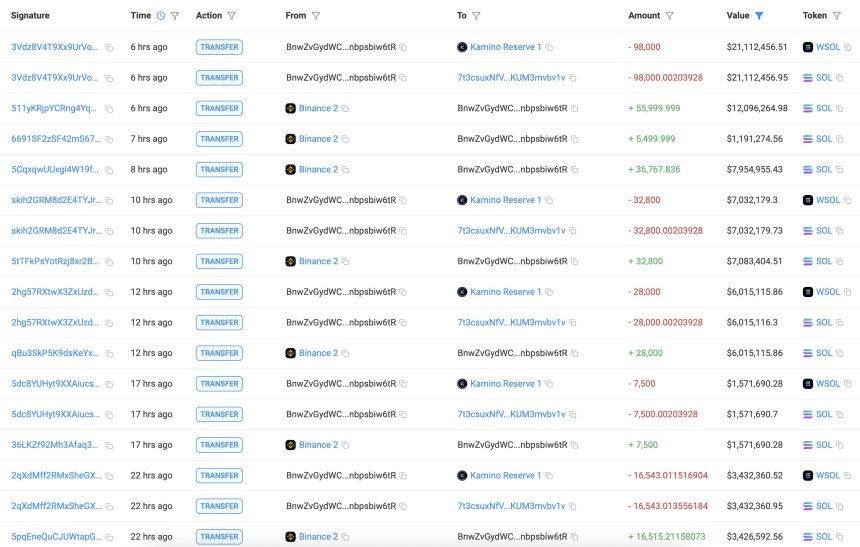

Lookonchain reports that in the past 24 hours, two whale wallets withdrew a combined 376,076 SOL (valued at approximately $80.7 million) from Binance and transferred the tokens to Kamino. This move not only underscores whale confidence in Solana’s long-term potential but also signals a broader trend in the market: investors are rotating capital into large-cap altcoins in anticipation of a rally.

Such large-scale withdrawals are typically interpreted as a bullish sign. By moving funds from centralized exchanges to DeFi protocols like Kamino, whales demonstrate an intent to hold or deploy capital strategically for yield, rather than prepare for near-term selling. This conviction aligns with the broader strength we’ve seen across altcoins in recent weeks.

Ethereum’s recent pause has created a window of opportunity for alternative layer-1 networks like Solana to shine. If ETH continues to consolidate, capital rotation into SOL and other altcoins could accelerate, pushing them into fresh rallies. The market has already rewarded Solana with an impressive surge since early August, and whale accumulation only reinforces the bullish outlook.

Technical Details: Price Testing Key Resistance

Solana is showing strong momentum, trading at $218.91 after a sharp 9.37% daily surge. The chart highlights that SOL is now testing a critical resistance zone not seen since early 2025, marking its highest levels in months. This recovery follows a steady uptrend from the May lows near $140, with the price supported by higher lows and consistent buying pressure.

The 50-day moving average (blue) sits well below the current price at $167.48, reflecting strong bullish momentum, while the 100-day (green) at $177.10 and the 200-day (red) at $163.01 confirm that the medium and long-term trend remains positive. As long as SOL stays above these key averages, the bullish structure is intact.

However, SOL is now confronting a significant resistance barrier around $220–$225, a zone that has rejected rallies in the past. A decisive breakout above this level could open the path toward $250 and beyond, pushing the token into a new bullish phase. On the downside, a failure to break resistance could lead to a retest of support levels at $200 and $185.

Featured image from Dall-E, chart from TradingView