Whales are on the move again, and this time it aligns with one of the biggest ETF buying weeks of the year for Bitcoin and Ethereum. Both Spot Bitcoin and Ethereum ETFs returned to inflows last week, and data shows some whales addresses are also moving their crypto assets from exchanges and into self custody.

On-chain tracker Lookonchain reported that newly created wallets have withdrawn massive amounts of Bitcoin and Ethereum from major exchanges, showing the large-scale accumulation by crypto whales.

Massive Withdrawals From Crypto Exchanges

According to data from SosoValue, Spot Bitcoin ETFs recorded $3.24 billion worth of inflows in the just-concluded week, reversing the $902.5 million outflows seen the previous week. Notably, this week’s inflow number is the largest weekly inflow on record for Spot Bitcoin ETFs this year. Spot Ethereum ETFs, on the other hand, saw $1.30 billion inflows last week, which is another drastic change from last week’s outflows of $795.56 million.

However, this activity is not limited to Spot ETFs alone. Fresh wallet activity shows aggressive accumulation activity among whale addresses moving into self custody. In one instance, on-chain analytics tracker Lookonchain noted that a newly created wallet, identified as 0x982C, withdrew 26,029 ETH worth approximately $118 million from Kraken.

Another newly created Bitcoin wallet, bc1qks, withdrew 620 BTC valued at $76 million from Binance. Both movements are large-scale repositioning of capital away from exchanges, and this is a sign that whales are expecting further price appreciation.

Whales are buying $ETH and $BTC!

Newly created wallet 0x982C withdrew 26,029 $ETH($118M) from #Kraken 8 hours ago.

Newly created wallet bc1qks withdrew 620 $BTC($76M) from #Binance 6 hours ago.https://t.co/8Aa1g0BgWthttps://t.co/qsasXKFHuN pic.twitter.com/iTYhz8jwq3

— Lookonchain (@lookonchain) October 4, 2025

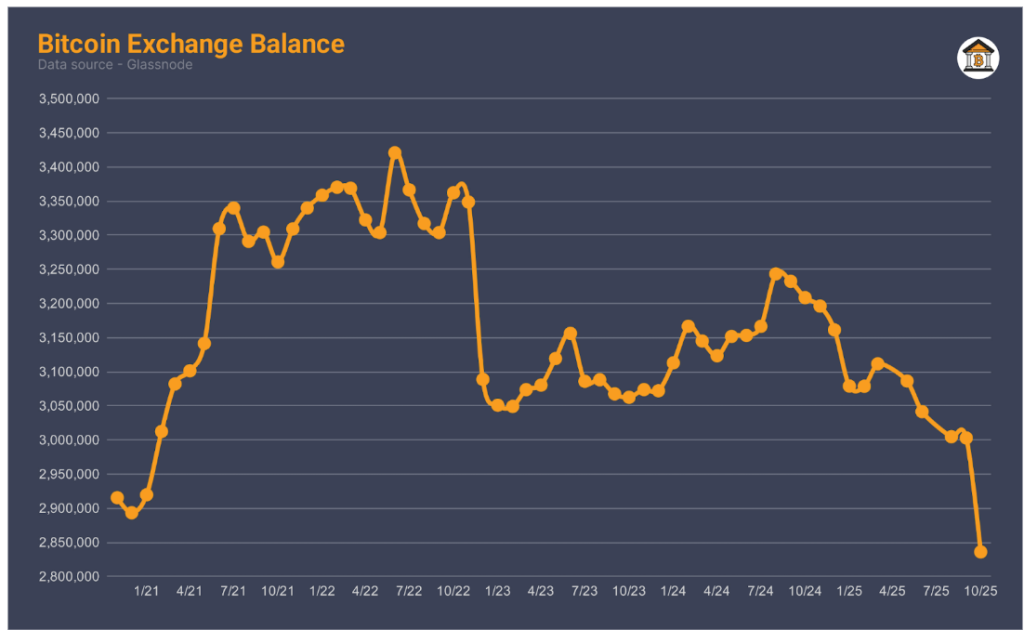

Interestingly, Bitcoin exchange balances have fallen to their lowest level in five years. Almost 170,000 Bitcoin were removed from crypto exchanges in the last 30 days, with the most activity coming in the just concluded week. This has pushed the Bitcoin exchange balance below 2.85 million BTC for the first time since January 2021.

Bitcoin Exchange Balance. Source: @btconexchanges on X

Price Outlook For Bitcoin And Ethereum

The combination of institutional inflows and whale accumulation has been already reflected in the price action of both Bitcoin and Ethereum. Bitcoin has surged past its previous record to hit a new all-time high of $125,506 within the last few hours, and is currently trading around $124,813. This is a drastic change from just a week ago, when Bitcoin broke below $110,000, which caused the Bitcoin Fear and Greed Index to crash to its lowest point since March.

Ethereum has also turned bullish and is trading at $4,575 at the time of writing. Another good week of Spot ETF inflows and whale accumulation continuing at the current pace could cause Bitcoin to extend its rally throughout the week. This, in turn could see Bitcoin break $130,000 before the end of the new week. However, a brief cooldown isn’t off the table. Any pullback could cause Bitcoin to retest $120,000 before the next leg higher.

Still on the bullish case, Ethereum’s price could also push to new all-time highs above $5,000 in the coming weeks.

Featured image from Unsplash, chart from TradingView