Ethereum showed fresh buying pressure this week after reports that a major Bitcoin whale dramatically increased its Ether holdings, a move market watchers say could reshape short-term flows.

Major Whale Moves Into Ether

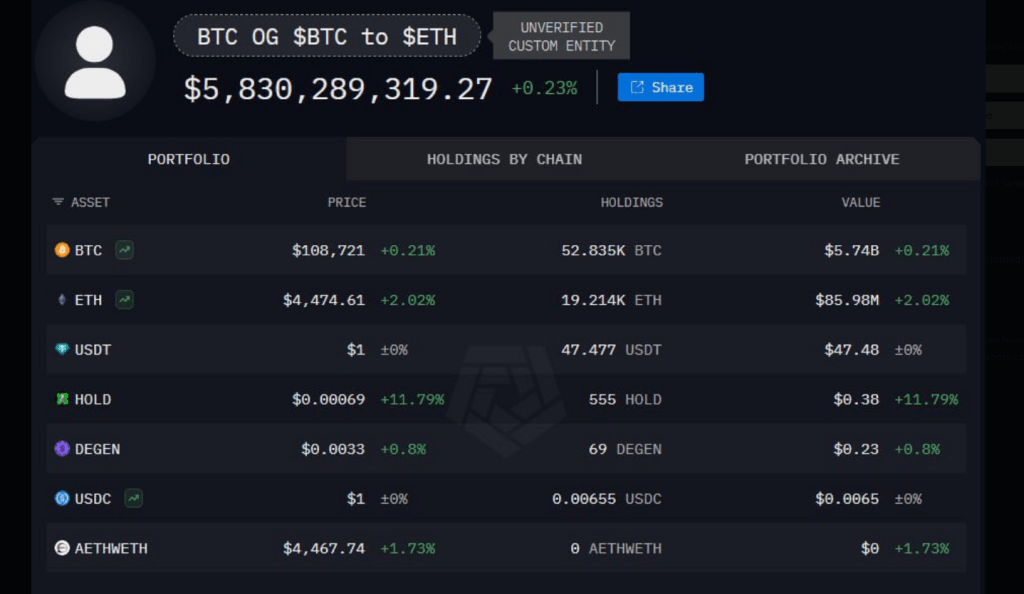

According to reports, one of the earliest and most influential Bitcoin whales bought roughly 820,220 ETH over the course of two weeks, a haul valued at about $3.6 billion at current prices.

The purchases were logged across multiple addresses and have drawn attention because they represent a large transfer of capital into Ether rather than Bitcoin.

Traders say such concentrated accumulation can lift sentiment and draw other large holders into the market.

Ethereum’s latest trading performance has mirrored the big move. At the time of reporting, ETH traded around $4,390, with a 24-hour trading volume of $39 billion and a market cap near $538 billion.

THIS OG BITCOIN WHALE HAS BOUGHT 820,224 ETH WORTH $3.6 BILLION IN JUST 2 WEEKS.

HE DEFINITELY KNOWS SOMETHING

pic.twitter.com/iG9Su2BGZE

— Ash Crypto (@Ashcryptoreal) August 31, 2025

The token was up 2% over the previous day. Those raw numbers underline that demand for Ether remains high even as some parts of the market pull back.

Derivatives activity tells a more mixed story. Reported data shows derivatives volume fell 14% to $61 billion, while open interest climbed 2.90% to $60 billion.

The OI Weighted metric declined -0.0007%, a small drop that indicates a minimal reduction in positioning strength. According to these movements, dealers comment that the market may be consolidating: less new trades but more positions held.

Ether Price Forecast And Sentiment

Mixing technicals with on-chain data, current forecasts point to moderate upside. Based on the latest prediction, Ether is expected to rise 11% and reach $4,870 by October 1, 2025.

Market sentiment is listed as Bullish while the Fear & Greed Index reads 46 (Fear). Over the last 30 days, ETH logged 47% green days and an 9% price volatility reading. Those indicators suggest a market that has room to run, but which still carries meaningful uncertainty.

Analysts have offered a cautionary note. According to analyst Ted, ETH’s recent outperformance versus Bitcoin may pause for a brief retest around $4,000 as liquidity clusters are swept and traders reassess exposure.

He points to order-book dynamics that often trigger a pullback before new upward moves — a pattern that has played out in prior rallies.

$ETH has been holding up really well compared to BTC.

But there’s still a chance of $4K retest.

Just take a look at huge liquidity clusters and you’ll understand.

Just keep one thing in mind: I’m just short-term bearish. pic.twitter.com/D9XIrxr5zq

— Ted (@TedPillows) August 31, 2025

What Traders Are Watching

Investors and desks say they are watching three things: the flow of large on-chain buys, whether derivatives open interest continues to rise, and whether price holds above key support near $4,000.

Reports of whale accumulation have sparked talk of rising institutional interest, but the drop in spot derivatives volume shows some short-term participants stepping back to wait.

Featured image from Meta, chart from TradingView