The crypto market saw significant turbulence last week as a massive futures liquidation event pushed Bitcoin’s price below the $25,000 mark. And while there has been a slight recovery, with BTC hovering around $25,900 at the time of writing, the market remains on thin ice.

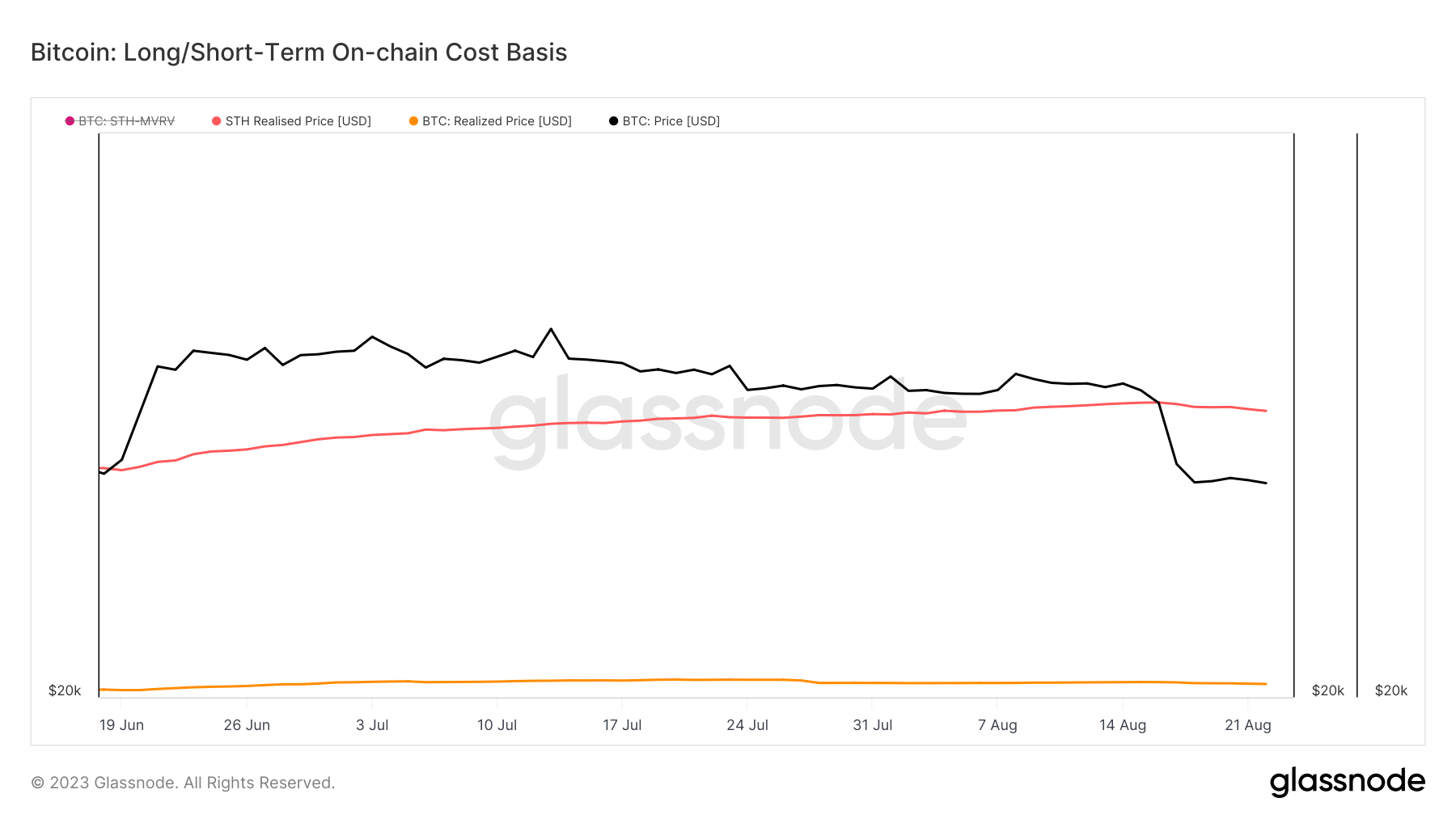

The primary concern? Bitcoin is operating in a top-heavy market.

A top-heavy market has a significant concentration of short-term holders who have acquired their BTC at prices very close to or above Bitcoin’s current spot price. This can be a precarious situation for the market, as large volumes of supply acquired above the spot price create the potential for added selling pressure, further destabilizing Bitcoin’s fragile price point.

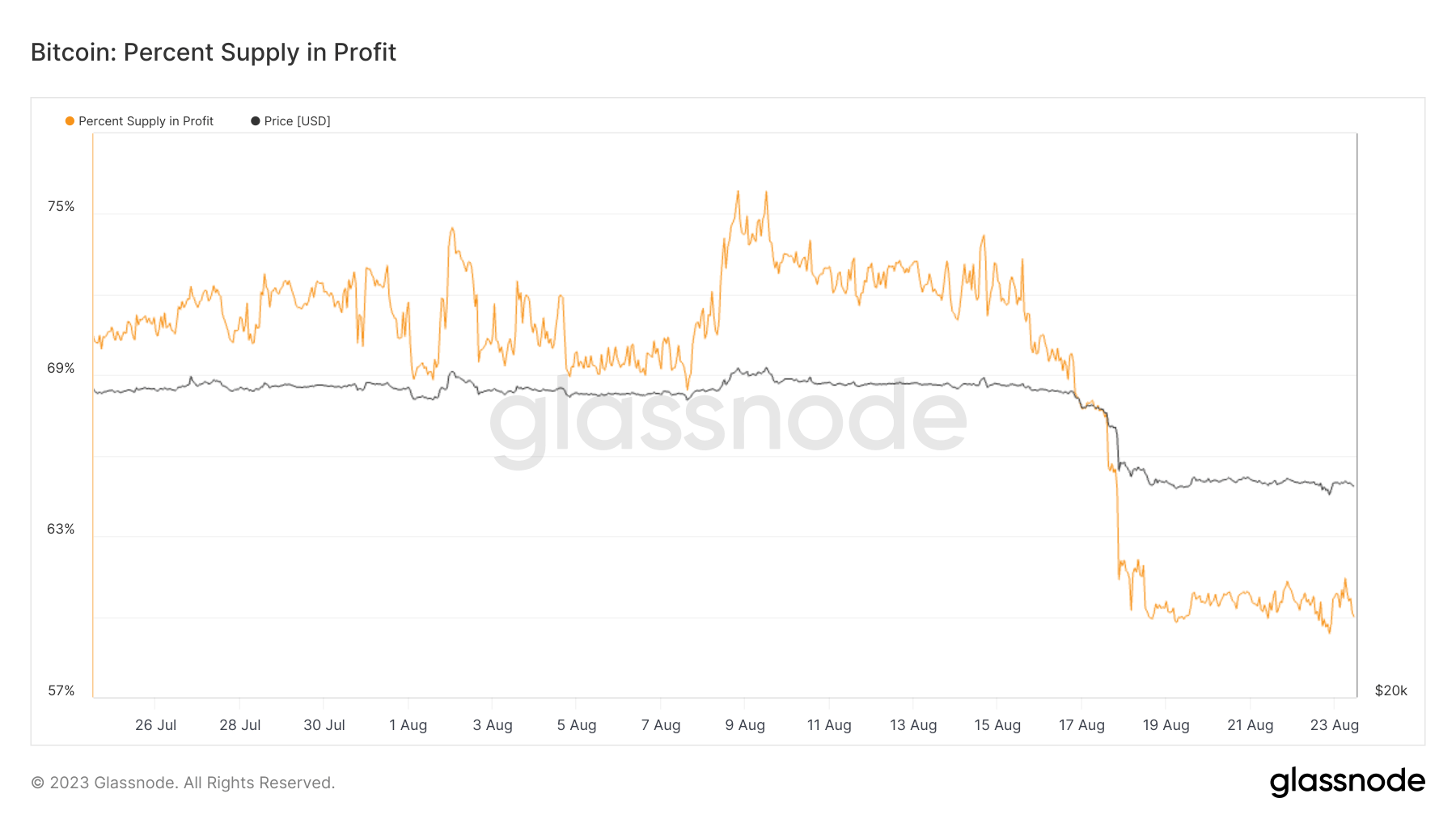

On Agu. 15, Bitcoin was trading at around $29,400, and 73.35% of its supply was in profit. On Aug. 22, when Bitcoin’s price dropped to $25,600, the percentage of Bitcoin’s supply in profit plummeted to 59.35%. This shift indicates that 14% of Bitcoin’s supply fell into an unrealized loss in just a week.

This shows that 14% of the total Bitcoin supply was acquired at a price higher than $25,600. This observation aligns with previous analyses by CryptoSlate, highlighting that short-term holders had been consistently accumulating and holding Bitcoin, reinforcing the trend we’re witnessing now.

So, what implications does a top-heavy market have for Bitcoin and its investors?

Firstly, the presence of a large number of short-term holders can lead to increased volatility. Having acquired their Bitcoin at higher prices, these holders might be more inclined to sell at the first sign of recovery to minimize losses, thereby adding to the selling pressure.

Secondly, this scenario could deter new investors from entering the market, fearing further price drops and increased volatility.

The post What is a top-heavy market, and are we in one? appeared first on CryptoSlate.