The post Why Is Ethereum Falling? Justin Sun Sells $143M ETH appeared first on Coinpedia Fintech News

The crypto market is feeling the heat of bearish momentum. Ethereum has had a rough week, and Justin Sun seems to be right in the middle of it. The Tron founder has been selling off his ETH holdings, and it’s creating ripples in the market. Over the past week, he sold $143 million worth of ETH. This is about half of his ETH holdings. His action resulted in a big price drop for Ethereum. The community has a lot of questions toward him. Is he playing some games that others are unaware of? There are many more questions behind a single question about why is ethereum falling. Let’s explore the factors.

Justin Sun: Selling and Staking

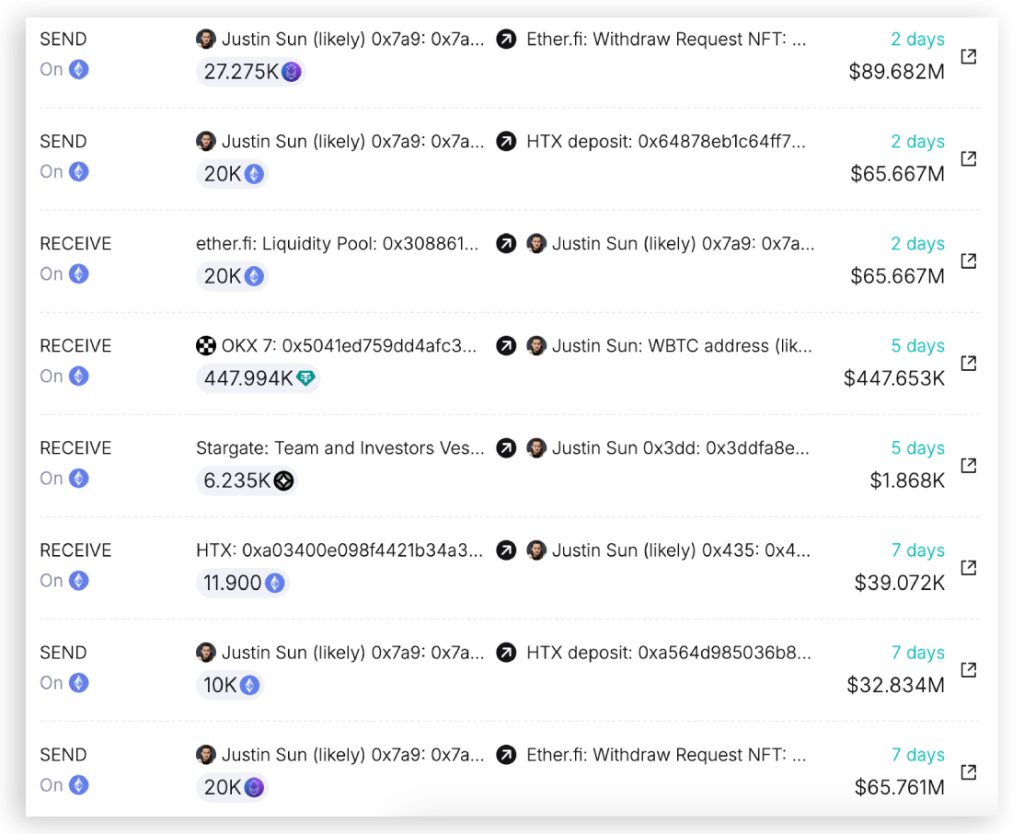

Since November 10, he’s deposited 108,919 ETH into HTX (formerly Huobi), worth around $400 million, according to data by Spot on chain .Most of these deposits happened when prices were near their highs, averaging $3,674 per ETH.

Blockchain experts have noticed Sun is also unstaking large amounts of ETH. Specifically, 42,904 ETH, valued at $139 million, was unstaked from Lido Finance recently. People suspect he might move these funds to HTX as well. With so much activity, it’s no surprise Ethereum’s price has been struggling.

Ethereum’s Price Takes a Hit

Ethereum is currently trading at $3,304. That’s a 17% drop since its recent rejection at $4,000. In just the last 24 hours, it’s fallen another 2.19%. Trading volume is also down, dropping 8.57%.

The sentiment in the market doesn’t look great either. Most traders seem bearish. Futures data shows that 54% of open trades are short positions, and the long-short ratio is at 0.8495. But there’s still a silver lining—78% of Ethereum holders are in profit at the current price.

Looking at technical analysis, Ethereum is nearing a crucial support level at $3,260. If it falls below that, prices could go to $3,000, where the 200-day moving average might offer some stability. Still, with RSI sitting at 39.28 (close to oversold territory) and ADX showing bearish momentum, the outlook isn’t promising.

What’s Next?

The big question is whether Ethereum can hold above $3,260. If not, we might see it drop as low as $2,800, especially if whales like Justin Sun keep selling. Some analysts believe Ethereum is still in a “safe zone” for now. But others warn that low weekend trading volumes and stock market uncertainty could bring more volatility. This might have cleared your curiosity for the question why is ethereum falling. For now, investors should stay cautious. Ethereum’s price swings aren’t new, but the market’s reaction to Justin Sun’s moves has everyone paying closer attention.