Crypto analyst Bull Theory has explained why the Bitcoin price has been crashing recently. The analyst pointed out that Wall Street traders were responsible for the price declines, indicating that these trading desks were manipulating the market for their own benefit.

Analyst Explains Why The Bitcoin Price Is Crashing

In an X post, Bull Theory blamed Jane Street for the Bitcoin price’s constant crash at 10 a.m. ET when the U.S. market opens. The analyst pointed out that BTC erased 16 hours of gains in just 20 minutes after the U.S. market opened. This has notably been happening since early November, when the flagship crypto fell below $100,000. Meanwhile, a similar price action also played out in the second and third quarters of this year.

Bull Theory noted that another analyst, Zerohedge, has claimed that Jane Street is most likely the entity responsible for this Bitcoin price crash. The analyst stated that the chart shows a pattern that is too consistent to ignore, with a clean wipeout within an hour of the market opening, followed by a slow recovery. He added that this is classic high-frequency execution and that it fits Jane Street’s profile.

Bull Theory stated that Jane Street is one of the largest high-frequency trading firms in the world and that they have the speed and liquidity to move markets for a few minutes. The analyst claimed that their behavior is simple: dump BTC at the market open, push the Bitcoin price into liquidity pockets, and then re-enter at a lower price.

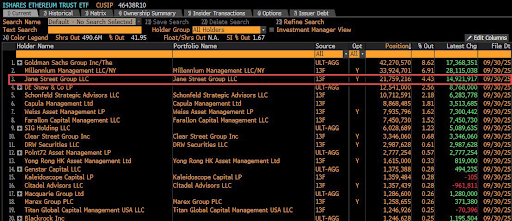

By doing this, the analyst claimed that Jane Street has accumulated billions in BTC. The trading firm is said to hold $2.5 billion worth of BlackRock’s Bitcoin ETF, which is its 5th-largest position. Bull Theory added that this means most of the dump in the Bitcoin price isn’t due to macro weakness but manipulation by this entity. He expects that BTC will continue its upward momentum once these big players are done buying.

Bitcoin At Risk Of A Decline Post-FOMC

Crypto analyst Ali Martinez indicated that the Bitcoin price was at risk of a significant decline following today’s FOMC meeting. He pointed out that BTC has consistently reacted negatively to FOMC meetings, with six out of seven meetings this year leading to corrections for the flagship crypto.

The Bitcoin price had rallied to as high as $94,500 yesterday in anticipation of a third rate cut this year from the Fed. According to CME FedWatch, there is currently a 90% chance that the Fed will lower rates by 25 basis points (bps). A CryptoQuant report noted how these rate cuts have turned out to be a ‘sell the news’ event on the two occasions the Fed lowered rates this year, with the probability of this price action playing out again.

At the time of writing, the Bitcoin price is trading at around $92,600, down in the last 24 hours, according to data from CoinMarketCap.