In a single New-York trading day, XRP surged almost 10%, mirroring a ferocious bid across the entire digital-asset complex and closing Thursday, 8 May at its highest mark in roughly two weeks. Analysts trace the rally to a cocktail of macro relief, order-book mechanics and renewed alt-season positioning—factors that coincided in a narrow window and magnified one another.

Why Is XRP Up Today?

The initial spark came from macro headlines. News of a fresh trade accord between Washington and London tempered fears of escalating tariffs, while word of forthcoming minister-level talks between US and Chinese officials signalled a potential thaw in the world’s most consequential bilateral trade standoff.

The calmer outlook flipped global-macro desks into a risk-on stance just as New York opened, and Bitcoin responded first, catapulting through the psychologically loaded $100,000 handle on a strong spot demand. The vertical move forced short sellers to buy back exposure; that “short squeeze,” by definition self-reinforcing, spilled rapidly into major altcoins and lifted XRP alongside the broader tape.

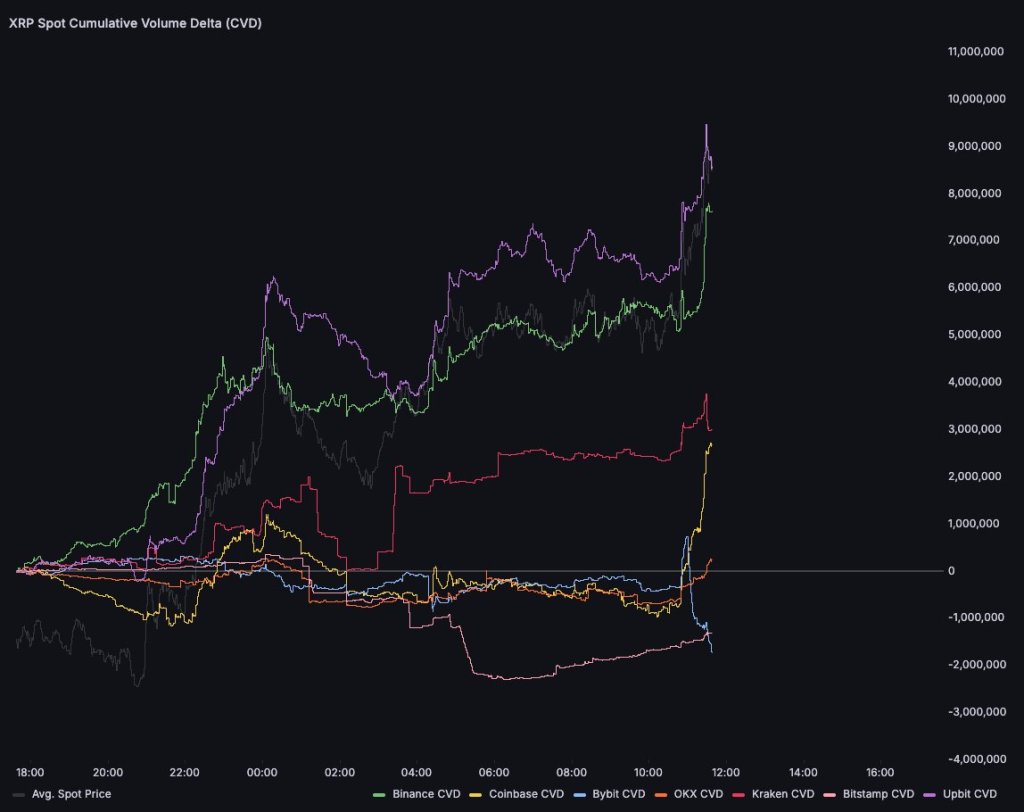

On-chain flow data added a powerful regional twist. Crypto-market analyst Dom (@traderview2) noted that the South-Korean exchange Upbit—historically an XRP bellwether—flipped from net seller to aggressive accumulator in less than forty-eight hours.

“Finally Upbit market changed their tune and are the strongest buyers over the last 24 hours,” he posted to X, specifying that Binance followed closely with a net 9 million XRP absorbed. “We are seeing the strongest taste of aggressive market buying that we have seen in over a week. Key is to see it continue.”

The volte-face was striking because only 6 May the same commentator had tallied 220 million XRP in cumulative net sales on the KRW pair since 11 April—roughly $500 million of distribution. The reversal underscores how swiftly sentiment can shift when liquidity concentrates in a handful of regional venues.

Technicians, meanwhile, drew attention to inter-market breadth. Bitcoin dominance, a gauge that measures the flagship token’s share of total crypto market capitalization, slipped from 65.38% to 64.43%—its sharpest single-day contraction in weeks and a classic tell that capital is rotating into altcoins.

Dom mapped the shift onto higher-time-frame structure, writing that “TOTAL, the total market cap of crypto, has just hit its uptrend it has held over the last 18 months […] This also coincides with the POC of the volume profile since late 2023.”

Point of Control (POC) levels are where the largest amount of volume has historically traded; rebounds from such nodes often act as springboards. In a follow-up post he added, $TOTAL has regained its 2021 highs—yes, all you needed to do was bid the apex of support and the multi-year uptrend.”

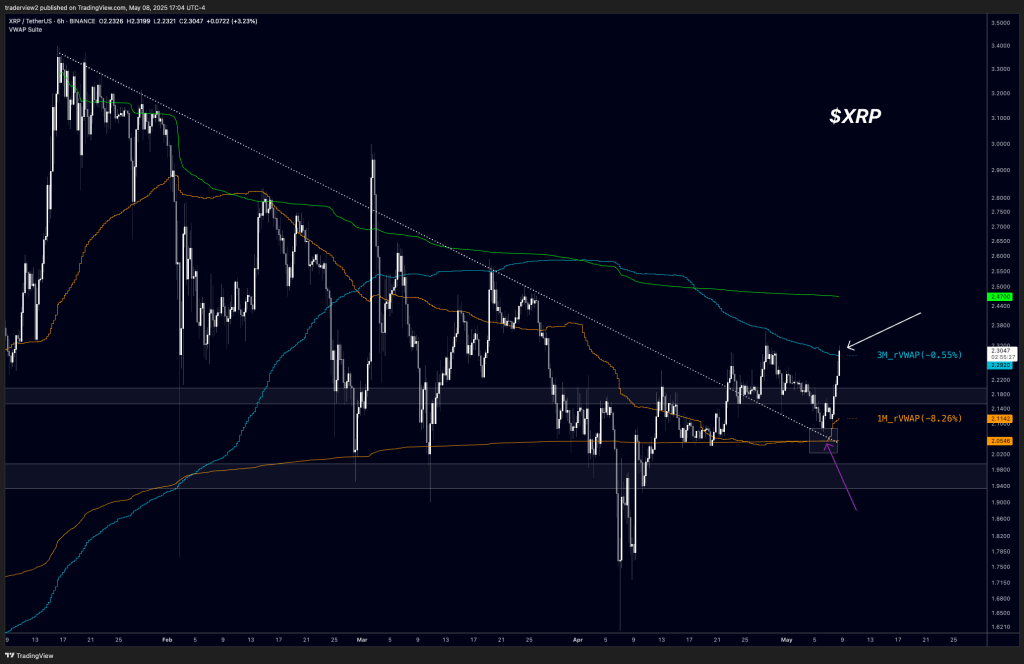

The same pivot is visible on XRP’s own chart. Dom highlighted that bulls “just breached the quarterly VWAP for the first time in 50 days… If it can hold as support, I am looking at the ATH VWAP as the next stop (US $2.47).” While that target lies some distance above Thursday’s closing price, the break of a multi-week volume-weighted average price is, in technician parlance, a changing-of-the-guard signal that often forces trend-following algorithms to flip long.

At press time, XRP traded at $2.31.