Tuur Demeester, a Bitcoin evangelist, has recently shared his views on Bitcoin’s potential to reach the $1 million mark by 2028. Demeester’s view on this topic presents a cautious contrast to some of the more bullish predictions in the crypto community.

This tempered perspective comes when others, such as Samson Mow, express strong confidence in Bitcoin’s ability to hit this milestone following its next halving.

$1 Million Bitcoin By 2028 Is Not Certain

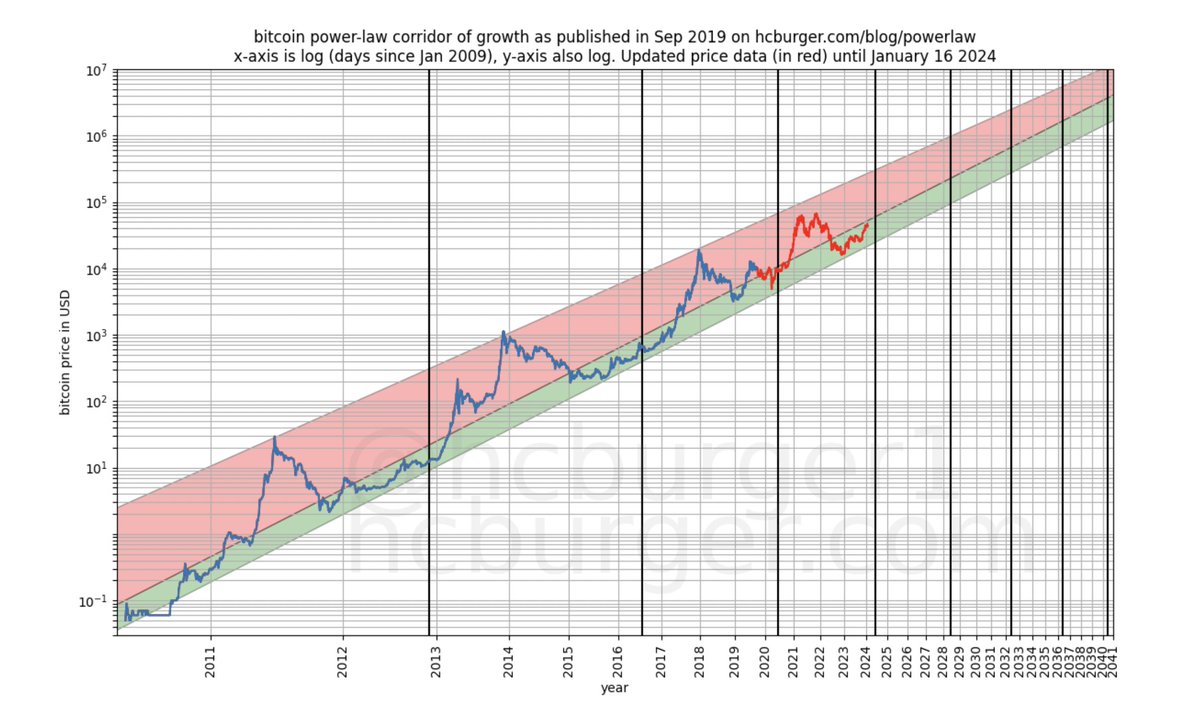

Demeester’s skepticism was articulated in response to a post sharing a graph by investor Fred Krueger, which suggested that Bitcoin might reach the $1,000,000 level by 2028.

While appreciating the graph’s model, Demeester expressed uncertainty, acknowledging the unpredictable nature of the market and its capacity to defy even the most well-constructed models.

Will it take BTC until after summer 2028 to reach $1M? I don’t know, but I do know that every beautiful model (as is this one

) is destined to be broken by Mr. Market. https://t.co/GcmhfL2C16

— Tuur Demeester (@TuurDemeester) February 2, 2024

The anticipation surrounding BTC’s price of $1 million is closely tied to its halving events, which occur approximately every four years. After this year’s halving, the next halving is set to occur in 2028. These events reduce the number of new BTC mined per block by half, limiting the supply and potentially impacting the price.

The upcoming halving, set for April this year, will see the daily minting of Bitcoin slashed from 900 to 450 coins. Such supply changes have historically led to significant price movements, lending credibility to the various models predicting substantial future price increases.

Amid these predictions, an X user, claiming ownership of the growth plot referenced by Demeester, chimed in with insights. They argued that some market laws, like the time value of money in the stock market, are less likely to be broken.

Similarly, the natural adoption rate of Bitcoin might constrain its “explosive” growth, providing room for market movements without breaking the underlying model.

Hi Tuur, this plot is mine. Some laws are not broken by Mr Market, e.g. the stock market grows by ~7% p.a. This cannot be broken to the upside because of the time value of money (essentially).

The time-based power-law likewise is hard to break to the upside because that would go…— hcburger (@hcburger1) February 2, 2024

Diverse Views On Bitcoin’s Future

Other Bitcoin enthusiasts, like Samson Mow, CEO of Jan3, are more optimistic. Mow envisions Bitcoin reaching $1 million, potentially in a sudden surge causing “max pain” for several market players.

This dramatic increase, he suggests, could happen swiftly, within “days or weeks,” though the precise starting point remains uncertain.

My main prediction is the run up to $1M happens in days to weeks. Starting point TBD.

— Samson Mow (@Excellion) January 14, 2024

In analyzing potential triggers for a Bitcoin rally, Mow considers various factors. These include Bitcoin-specific metrics like exchange-traded inflows (ETF), the BTC hashrate, and whale activity on Bitfinex. Additionally, Mow looks at broader economic indicators such as Tether’s USDT assets under management, government debt payments, and Debt-to-GDP ratios.

These are the #Bitcoin macro indicators I’m looking at:

ETF inflows

Hashrate

Finex whale accumulation

200 WMA trend

Tether USDt AUM

Govt interest payments on debt

Debt GDP ratios

Nation-state Bitcoin adoption

Real inflation

M3 money

— Samson Mow (@Excellion) January 28, 2024

Mow believes these factors, combined with nation-state adoption, real inflation rates, and the M3 money supply, could significantly influence Bitcoin’s performance.

Amid the debate, Bitcoin saw quite a surge in the past 24 hours, reclaiming the $43,000 mark with a current trading price of $43,123.

Featured image from Unsplash, Chart from TradingView