The post Will Bitcoin Price Crash? $5.64 Billion in Profits Cashed Out appeared first on Coinpedia Fintech News

Bitcoin (BTC), the world’s largest cryptocurrency by market cap is poised for a significant price decline as investors have realized billions worth of profits in the past 24 hours. Additionally, BTC has formed a bearish price action pattern, further supporting this negative outlook.

$5.64 Billion of Profit Booking

On October 10, 2024, a prominent crypto analyst made a post on X (Previously Twitter) that over $5.64 billion in realized Bitcoin profits were recorded in the past 24 hours. This massive profit-taking in a short period suggests a significant price decline in the coming days.

Current Price Momentum

As of now, BTC is trading near $60,730 and has recorded a price decline of over 2.75% in the past 24 hours. During the same period, its trading volume dropped by 8%, indicating lower participation from traders and investors compared to the previous days. This recent price decline appears to be potentially driven by significant profit-taking.

Bitcoin Technical Analysis and Upcoming Levels

However, CoinPedia’s technical analysis suggests that BTC appears bearish as it has formed a bearish inverted cup and handle price action pattern on the daily time frame. Whenever an asset forms this bearish pattern, it is often seen as a signal for potential price decline.

BTC is currently near the neckline of this pattern, with crucial support at $60,200, backed by the 200 Exponential Moving Average (EMA). If BTC breaks this level and closes a daily candle below $60,000, it could drop to $58,000 or lower.

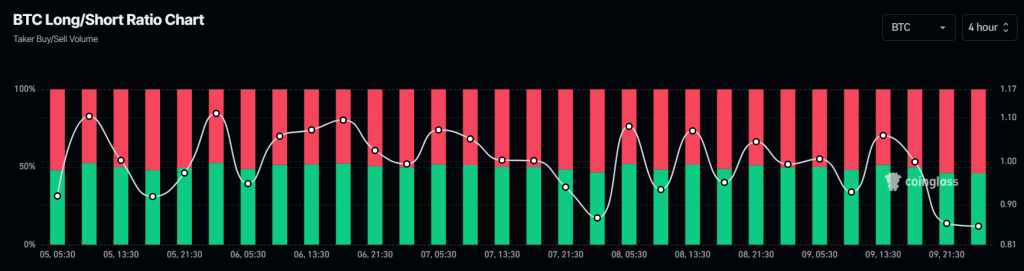

Bearish BTC’s Long/Short Ratio

This negative outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, BTC’s long/short ratio currently stands at 0.931, indicating a strong bearish market sentiment among traders. Meanwhile, 54.05% of top traders hold short positions, while 45.95% hold long positions.

Combining this long/short ratio with technical analysis and recent profit booking, it appears that bears are currently dominating the asset, potentially leading to a significant price decline.