The post Will the Fed Interest Rate Decision Trigger a Crypto Santa Rally or Santa Dump? appeared first on Coinpedia Fintech News

As the Federal Reserve prepares for its final meeting of 2025, the crypto market is bracing for potential turbulence and opportunity. Market indicators, including data from Polymarket, show a 94% probability that the Fed will implement a 25 basis point rate cut on Wednesday, marking the third cut of the year.

The total crypto market cap rose to $3.2 trillion as traders position for the Fed’s rate decision. BTC climbed to $92.5K, with ZEC and AVAX leading mid-cap gains.

Historically, Bitcoin tends to climb into FOMC meetings, experiences some short-term volatility during the announcement, and then often retraces afterward.

Ethereum and Bitcoin have both retraced significantly from their all-time highs, down 36% and 28% respectively, making some investors consider this a potential buying opportunity.

Liquidity Signals Could Decide Crypto Santa Rally vs Santa Dump

The main reason today’s FOMC meeting is being closely watched is the growing speculation around liquidity measures. Analysts and major banks are looking for signals such as potential liquidity injections, early signs of reserve support, or any language from the Fed indicating stress in the banking system.

Crypto markets, which react quickly to changes in liquidity, could see a sharp bullish move if Powell confirms any form of balance-sheet support or easing measures, a scenario often referred to as a “Santa Rally.”

However, recent economic data adds caution to the picture. October’s JOLTS job openings came in higher than expected, bond yields are rising, and inflation remains above the Fed’s 2% target. These factors suggest the bond market is pricing in a more hawkish Fed, which could limit upside and even trigger a Santa Pullback if Powell’s remarks lean toward caution.

Crypto Market Outlook Ahead of FOMC Meeting

Historically, Bitcoin has shown heightened volatility around FOMC meetings. Out of six meetings in 2025:

- Late Jan: -27%

- Mid Mar: -14%

- Early May: +16%

- Mid Jun: -8%

- Jul 30: -6%

- Mid Sep: -7%

This pattern suggests that BTC often faces downside pressure following Federal Reserve announcements. Analysts note that while rate cuts could provide temporary relief, the market’s reaction heavily depends on liquidity signals from Fed Chair Jerome Powell, including hints at new liquidity tools or injections. A hawkish stance, as seen in December 2024, could lead to declines in altcoins.

Bitcoin Shows Bullish Signs

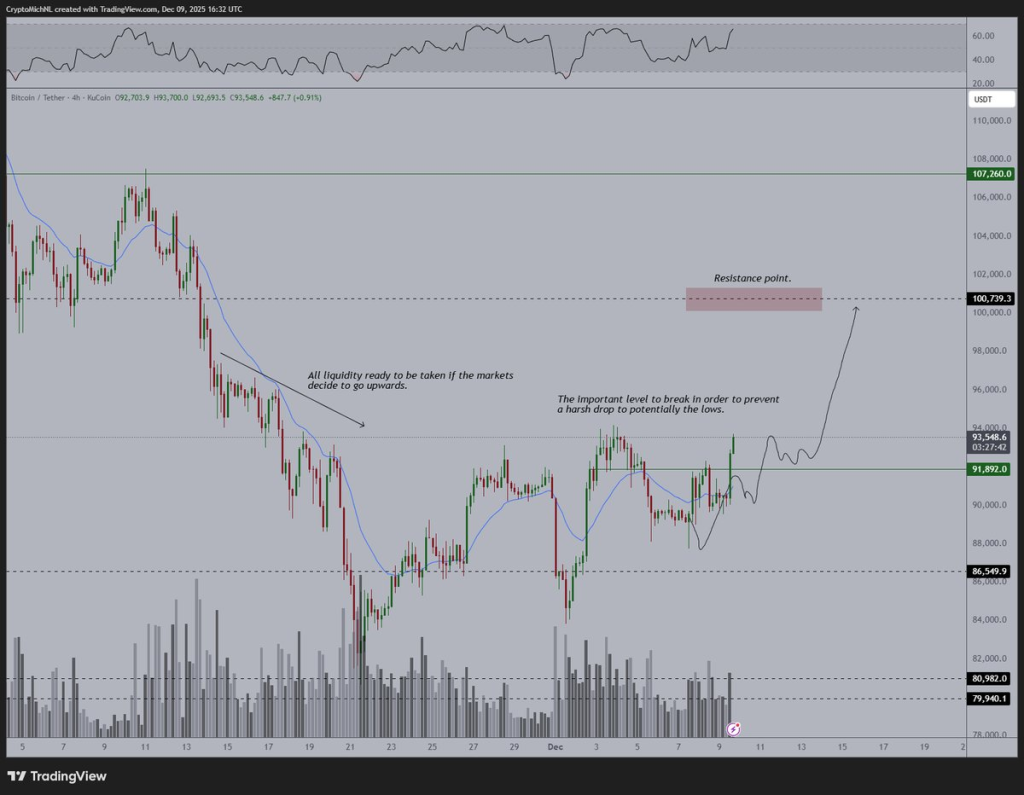

Analyst Van de Poppe highlights that Bitcoin ($BTC) is still following a bullish scenario, with a potential breakout above $92K signaling further upside. Recent strong U.S. labor market data has contributed to a rally, with Ethereum ($ETH) outperforming Bitcoin, indicating growing risk-on sentiment in the market.

Van de Poppe suggests that if Bitcoin maintains support around $91.5K–$92K, it could aim for $100K in the near term.

Cautious Optimism and Key Levels

According to analyst ElonMoney, the crypto market could gain momentum after the FOMC meeting, especially if the Fed implements a rate cut. A favorable outcome could trigger a Santa rally extending into Q1 2026.

However, ElonMoney cautions against blindly going long, advising traders to wait for a solid close above the 7-day and 30-day RVWAP, currently at $92K. From there, Bitcoin may target $96K–$100K, with a sustained return above $100K needed to confirm a broader bullish trend.