The post Will Uptober Momentum Drive the Next OKB Price Rally To $300? appeared first on Coinpedia Fintech News

The OKB price has exhibited one of the most remarkable rallies in 2025, primarily driven by token supply reductions and expanding utility. A permanent burn of over 65 million tokens in August triggered a parabolic surge, placing OKB in the spotlight. As Uptober unfolds, bullish momentum has once again been observed, with recent news suggesting that the token may continue its upward path.

Parabolic Growth After Supply Burn

In August, OKX announced a move mirroring Bitcoin’s scarcity model that slashed more than 65 million OKB tokens to 21 million. Immediately after, OKB crypto experienced a significant surge in value, climbing 475% from a near $44 to reach an all-time high (ATH) of $258.

This supply shock propelled OKB beyond a multi-year upward channel that had been intact for more than five years. The OKB price chart reflects how investors priced in scarcity, with the rally positioning OKB as one of the strongest performers of the year.

Beyond tokenomics power, OKB’s value is also supported by ecosystem expansion. OKX’s blockchain, X Layer, is designed for decentralized finance, payments, and tokenized assets. With high throughput and minimal fees, it has the potential to sustain long-term demand as adoption grows.

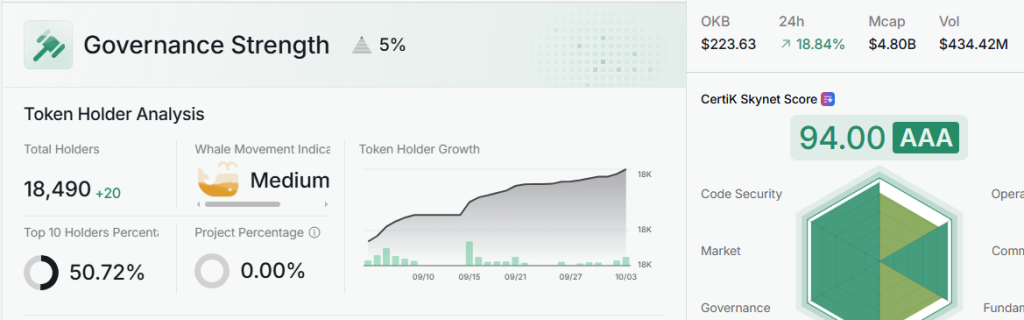

Moreover, the network’s visibility and growing utility continue to attract fresh participants. According to Certik Skynet data, OKB now has 18,490 holders, up from 18,182 just 30 days ago, with the top 10 wallets controlling 50.72% of the supply.

This indicates that large holders remain committed, while gradual growth in retail adoption strengthens market depth.

Symmetrical Triangle Pause and Uptober Breakout

Despite its explosive August gains, momentum cooled in September as OKB price consolidated within a symmetrical triangle. By the close of Q3, the token settled below $190.

However, October brought renewed energy as the price broke out of the consolidation range in line with the seasonal trend to which many often dubbed the month october as “Uptober.”

Currently, OKB price USD trades near $222 after briefly spiking to $237 on intraday charts, following the X post announcement that BTC staking had become available in the US.

Profit-taking trimmed some gains, yet the overall bullish structure remains intact as OKB sustains above its 20-day EMA across major timeframes.

OKB Price Forecast: Targets Ahead

From a technical perspective, the breakout from consolidation sets the stage for a potential retest of the $258 ATH. A decisive move above this resistance could open the path toward $300 in the near term.

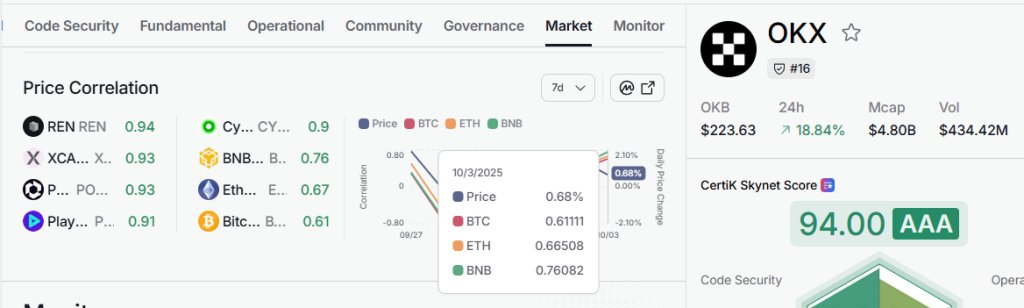

Meanwhile, correlation analysis shows that OKB is moving with more independence compared to BTC and ETH this week, though its performance remains strongly aligned with other exchange tokens like BNB.

With bullish fundamentals, tightening supply, and ecosystem growth, the OKB price prediction leans toward further upside if buying momentum continues. The OKB price forecast highlights $258 as the immediate resistance, followed by $300 as the next milestone that traders are closely watching.