According to on-chain data and market reports, XRP is under fresh selling pressure because a large share of holders are now showing losses.

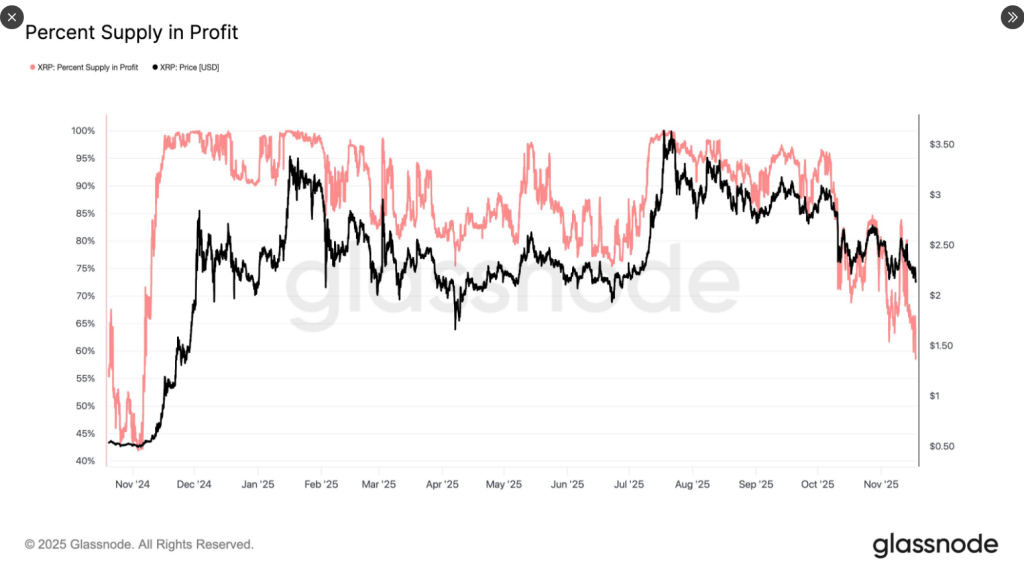

Glassnode reports that 41.5% of XRP supply — or close to 27 billion tokens — sits in loss, the lowest profitability level since November 2024 when XRP traded near $0.53.

At today’s levels, about four times higher than that November figure, a big share of holders bought above current prices and are now exposed.

Holder Concentration Raises Selling Risk

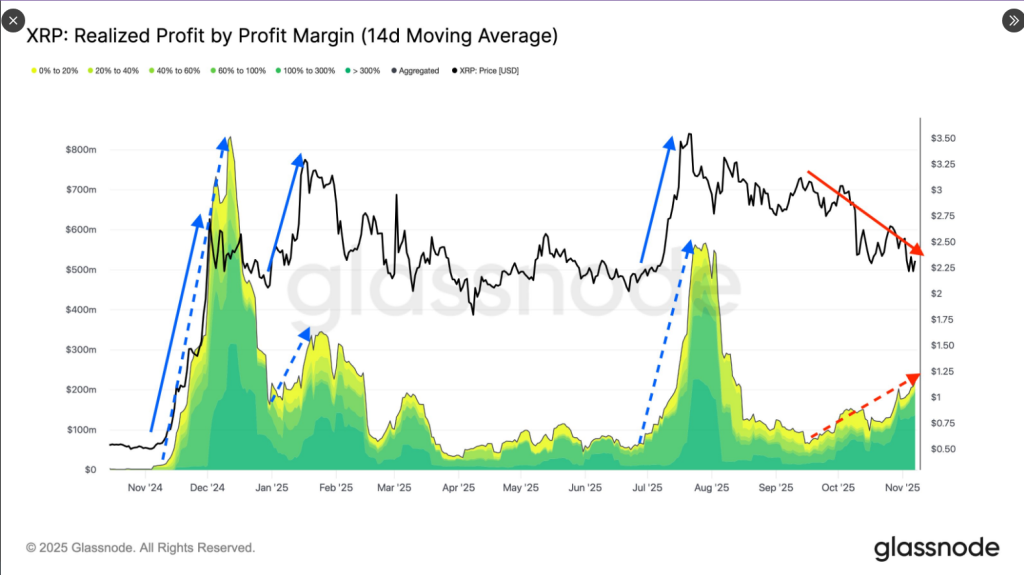

Market analysts say this positioning has changed trader behavior. Tony Sycamore, a market analyst at IG Australia, disclosed that many wallets likely picked up XRP when it was above $3.00 during months including January, July, August, September, and early October.

That means a sizable group is now holding paper losses after the 40%+ slide from the July $3.65 peak. The scale of unrealized losses can encourage some investors to exit if prices keep drifting lower, which would add selling pressure.

The share of XRP supply in profit has fallen to 58.5%, the lowest since Nov 2024, when price was $0.53.

Today, despite trading ~4× higher ($2.15), 41.5% of supply (~26.5B XRP) sits in loss — a clear sign of a top-heavy and structurally fragile market dominated by late buyers.

… https://t.co/CBXPzDalxV pic.twitter.com/UpLNKV7LqD

— glassnode (@glassnode) November 17, 2025

ETFs Could Bring Fresh Demand Or Little Impact

Reports have disclosed a wave of exchange-traded funds tied to XRP that may alter flows. Canary Capital launched the first spot-XRP ETF on November 13 and posted the strongest first-day result for US ETFs in 2025.

Franklin Templeton’s EZRP is scheduled to begin trading on November 18, with funds from Bitwise, 21Shares and CoinShares close behind. Traders hope these products will attract new money into XRP, but history shows initial demand can vary widely and depends on broader market liquidity and risk appetite.

Key Foothold

At the time of reporting, XRP trades around $2.19, down more than 10% in the last seven days. Analysts are watching the $2.16 area as a key foothold.

JUST IN: FRANKLIN TEMPLETON’S SPOT $XRP ETF (EZRP) LAUNCHES TOMORROW.

BULLISH

pic.twitter.com/rmGN1rdVGI

— Amonyx (@amonbuy) November 17, 2025

If that level is defended, a bounce toward the $2.35–$2.60 band could be possible. If it fails, further retracement towards lower levels is a realistic outcome, in particular with a large portion of holders underwater and stop orders possibly clustered beneath current support.

On-Chain Signals Paint A Top-Heavy Picture

According to data from blockchain trackers, the market looks “top-heavy,” meaning that many of those who entered recently paid high prices for their coins and are thus more vulnerable. That pattern often makes rallies less stable until profit-taking pressure eases or fresh buyers step in.

At the same time, activity on the XRP Ledger has been rising, and renewed clarity around rules for digital assets in some jurisdictions has helped sentiment a bit.

In the near term, price action will likely correlate with ETF inflows and whether buyers can defend the $2.15 level. A clear break above $2.60 could relieve selling pressure, while a break below support might trigger further selling by holders trying to limit losses.

For now, XRP is stuck in a battle between the pressure of unrealized losses and new potential flows of capital from ETFs.

Featured image from Unsplash, chart from TradingView