The post Worldcoin (WLD) Price Prediction 2025: Will Polymarket Utility Revive Bullish Momentum? appeared first on Coinpedia Fintech News

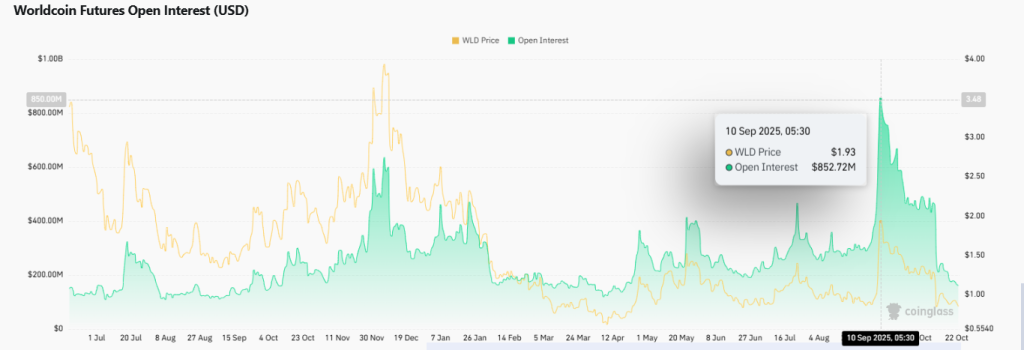

The WLD price has come under fresh pressure after recent data revealed a significant collapse in derivatives open interest. According to a platform, WLD crypto’s open interest has fallen sharply from September’s peak of $852 million to October’s lowest at $160 million, exposing the market to lower liquidity and elevated fragility of the current WLD price structure.

Meanwhile, technical patterns show that WLD price USD broke down from an ascending channel, a structure that previously supported upward momentum. The analyst noted if bleeding continues then the next meaningful support is around $0.40, which could imply a steep correction if the current range fails.

On the upside, the Worldcoin WLD price today at $0.85 reflects a market limping more precisely stuck sideways rather than soaring. This scene is underscoring the absence of fresh bullish conviction. While the token is featured in new integrations, the technical backdrop remains shaky.

A Big Partnership: Polymarket Integration With Worldcoin Brings Real-World Utility

On the fundamental side, Worldcoin’s recent link to Polymarket presents compelling long-term potential for the Worldcoin WLD price prediction 2025 narrative.

With this the World App has embedded Polymarket’s mini-app, allowing users to stake WLD or USDC in prediction markets.

This marks a new utility from identity verification to real-world utility, which could support token demand over time and could show some improvements in price in the remaing months of Q4.

Nevertheless, this utility shift may already be factored into market expectations, and so far it has not triggered a breakout. With the WLD price chart still trading below key moving averages and open interest subdued, the combination of strong fundamentals and weak momentum presents a mixed outlook for now but future outlook remains bullish.

- Also Read :

- XMR Price Breaks Key Levels, Traders Eye $367 Next!

- ,

Technical Outlook: If Support Fails, $0.40 Could Be Next Halt

Technically, the WLD price USD is caught between a critical support range near $0.80 to $1.00 and resistance around $1.15 to $1.35. If the $0.80 floor fails, the breakdown could lead toward $0.40, a steep drop from current levels.

On the flip side, if bulls step in, a move toward the range’s upper border could push toward $1.15, offering 30 to 40% upside from the current baseline.

For now, the Worldcoin price forecast 2025 remains divided, with upside remaining possible but contingent upon a change in sentiment and recovery of open interest, while downside risk is elevated given equity/macro correlations, as well as structural weaknesses. The ascending channel breakdown warns that patience may be required before the next major leg.

FAQs

The WLD price is under pressure due to a sharp collapse in derivatives open interest and a technical breakdown from its previous ascending channel pattern, lowering liquidity.

The long-term Worldcoin price prediction for 2025 remains bullish, supported by new utility like the Polymarket integration, but a sustained recovery depends on improved market sentiment.

Yes, Worldcoin’s utility is expanding beyond identity verification, now enabling real-world use cases like staking WLD in prediction markets through its Polymarket integration.

World

World