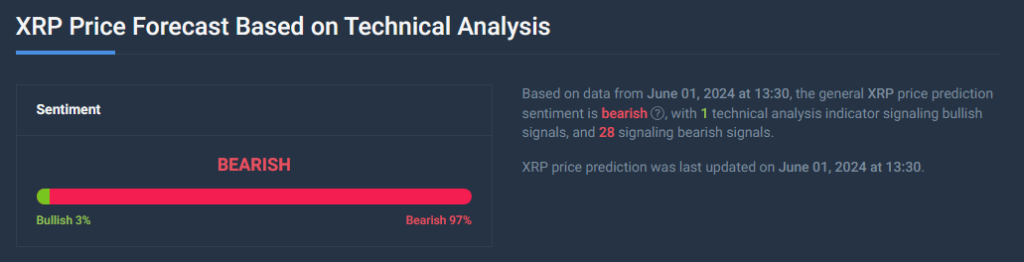

Crypto investors are keeping a close eye on Ripple (XRP) as technical indicators paint a concerning picture for the altcoin’s price. After closing below its 20-day exponential moving average (EMA) for four consecutive days, XRP has entered what many analysts interpret as a bearish zone.

This technical indicator suggests a potential shift in market sentiment, with the average price of XRP over the past 20 days acting as a resistance level. With the current price trading below this key benchmark, analysts fear a decline in demand could be imminent.

At the time of writing, XRP was trading at $0.52, down 0.3% and 3.1% in the last 24 hours and seven days, respectively, data from Coingecko shows.

Demand For XRP Loses Steam

Adding fuel to the bearish fire are XRP’s momentum indicators, which provide insights into the strength and direction of price movements. Both the Relative Strength Index (RSI) and Money Flow Index (MFI) are currently positioned below their neutral points. This suggests that buying pressure behind XRP is waning, with investors potentially looking to offload their holdings rather than accumulate more.

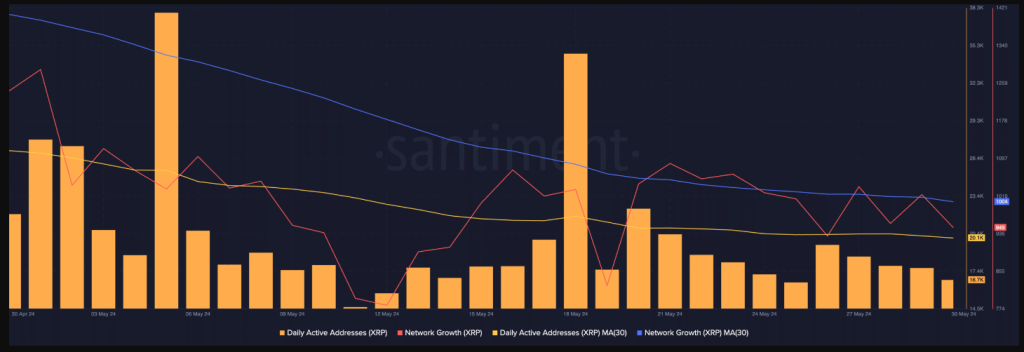

Further dampening the mood is a significant drop in XRP’s active on-chain addresses. According to data from Santiment, the number of daily active addresses on the XRP network has cratered by 30% over the past month. This decline is often seen as a precursor to a price slump, as it indicates a decrease in overall network activity and user engagement.

Profit Amidst The Gloom?

However, there are some glimmers of hope for XRP bulls. An interesting data point reveals that daily traders are still managing to turn a profit. An analysis of XRP’s daily transaction volume in profit compared to loss shows that for every transaction ending in a loss, 1.16 transactions yield profits. This suggests that despite the overall bearish sentiment, short-term trading opportunities might exist for skilled investors who can capitalize on market volatility.

MVRV Ratio Offers A Different Perspective

Another factor that could entice some investors is the negative Market Value to Realised Value (MVRV) ratio for XRP. This metric essentially compares the current market price of XRP with the average price at which all XRP tokens were acquired.

A negative MVRV ratio suggests that XRP is currently undervalued, potentially presenting a buying opportunity for investors seeking assets trading below their historical price points.

XRP Price Forecast

Meanwhile, the current XRP price prediction indicates a 20% rise to $0.626627 by July 1, 2024, despite a bearish market sentiment reflected by technical indicators. The Fear & Greed Index at 72 shows high investor greed, suggesting strong buying behavior but also a risk of overbought conditions and potential price corrections if sentiment shifts.

Over the last 30 days, XRP has had almost an equal number of days with price increases (47%). This shows a balance between buying and selling pressures.

The price has fluctuated by 2%, indicating mostly stable but noticeable changes. This balance suggests the market is steady, contributing to the current bearish outlook despite a positive long-term price prediction.

Featured image from Verywell Mind, chart from TradingView