On-chain data shows that many old coins have moved on the XRP network recently, a sign that proved to be bearish for the coin last time.

XRP Age Consumed Metric Has Registered A Large Spike

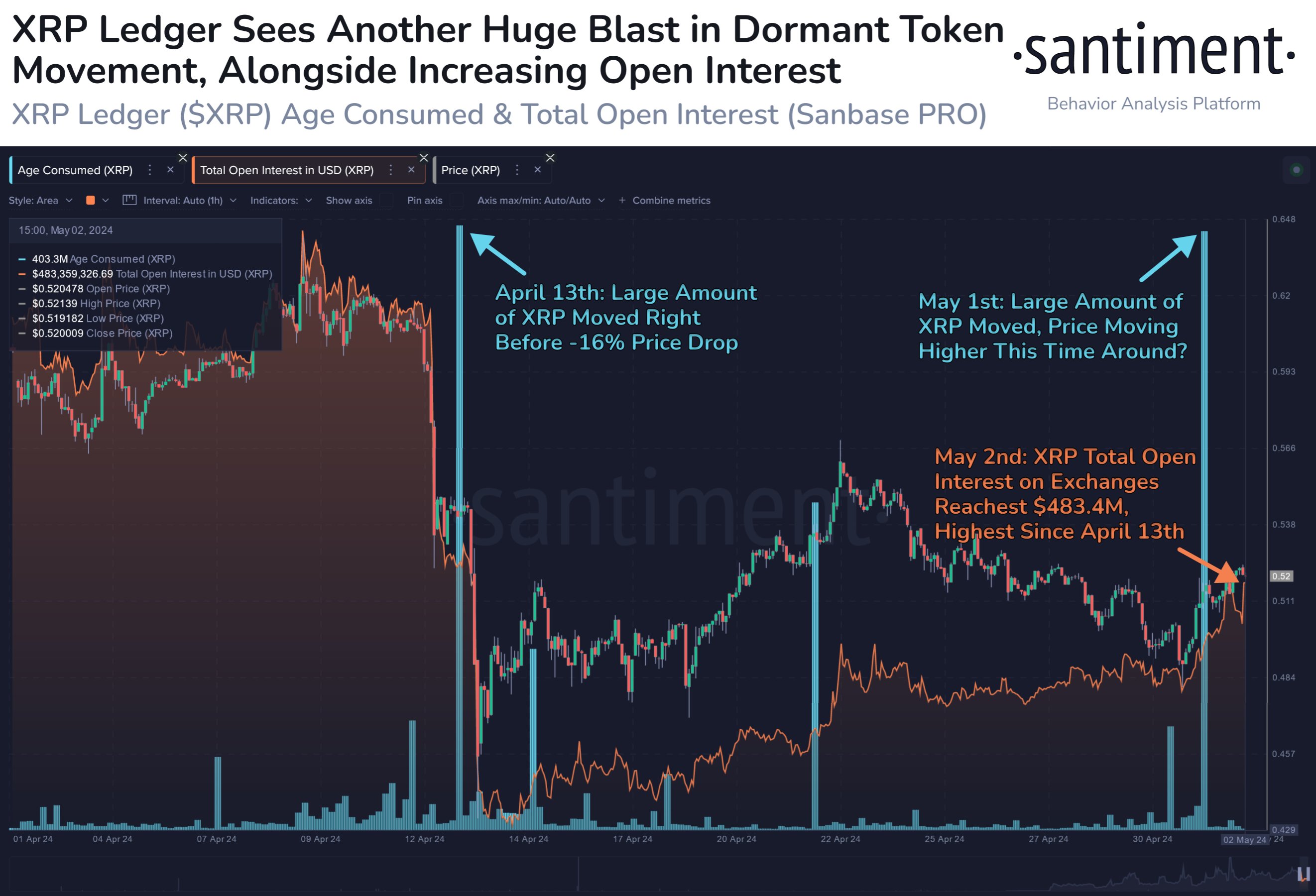

According to data from the on-chain analytics firm Santiment, XRP has just observed a large movement of dormant coins similar to what the asset witnessed last month.

The indicator of interest here is the “Age Consumed,” which shows “the amount of tokens changing addresses on a certain date, multiplied by the time since they last moved,” as per Santiment’s definition.

When this metric has a high value, it means that a large number of coins previously dormant have finally been moved to the blockchain. Old coins are generally less likely to become involved in selling, as they belong to the more resolute hands in the market. As such, any large movements of these coins can be worth noting since it’s not an event that happens too often.

The below chart shows the trend in this indicator for XRP over the past month or so:

From the graph, it’s visible that the XRP Age Consumed registered a sharp spike at the start of this month, implying that some old hands have decided to break their silence.

This latest spike has been quite massive in scale and has been reminiscent of another spike that was seen last month. Interestingly, this previous spike occurred shortly before the price of the cryptocurrency tanked 16%.

Thus, the previous spike would have corresponded to some HODLers moving to sell their coins. It’s possible that the latest large dormant coin movement was also made for a similar purpose, and hence, it can prove to be bearish for XRP.

Santiment points out that this may not be so after all, though, saying:

There is an argument that this old coin movement is related to potential #buythedip interest from key stakeholders, and prices have been climbing mildly since this May spike occurred.

While this dormant coin movement may turn out to be bullish this time around, there is another signal brewing for the asset that can also be something to keep an eye on.

As highlighted in the same chart, the Total Open Interest for XRP, which keeps track of the number of derivative positions currently open on all exchanges related to the asset, has been going up recently.

This metric is now at a 3-week high of $483.4 million, implying that there is a notable amount of speculation in the market right now. Historically, this has led to volatility in the price.

In theory, this volatility can take the asset in either direction, but it’s worth noting that the crash last month occurred after the Open Interest hit extreme levels. So far, though, the indicator hasn’t quite yet reached the same highs.

XRP Price

XRP is yet to make any significant recovery from the crash last month as its price is still trading around $0.52.