XRP has witnessed a strong surge during the past day, but data shows speculative leverage is building up behind the scenes, a potential warning sign.

XRP Has Enjoyed A Sharp Rally Over The Last 24 Hours

The cryptocurrency market as a whole has seen some recovery from the recent crash, but XRP has stood out for its particularly rapid growth. With a jump of 7% over the past day, the coin has managed to return to the $2.19 level.

The chart below shows how the recent performance of the asset has looked:

XRP’s breakaway from the pack has come as Franklin Templeton and Grayscale have launched their exchange-traded funds (ETFs). The products, with tickers XRPZ and GXRP, are now live on the New York Stock Exchange (NYSE) Arca. While the debut has brought with it fresh institutional attention on the cryptocurrency, a potentially bearish signal has been brewing in the background.

XRP Open Interest RSI Has Reached The Sell Zone

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the XRP Open Interest Delta RSI has surged into the overheated territory recently. This indicator basically gauges the speed and magnitude of changes occurring in the asset’s Open Interest, a measure of the total amount of positions currently open on all derivatives exchanges.

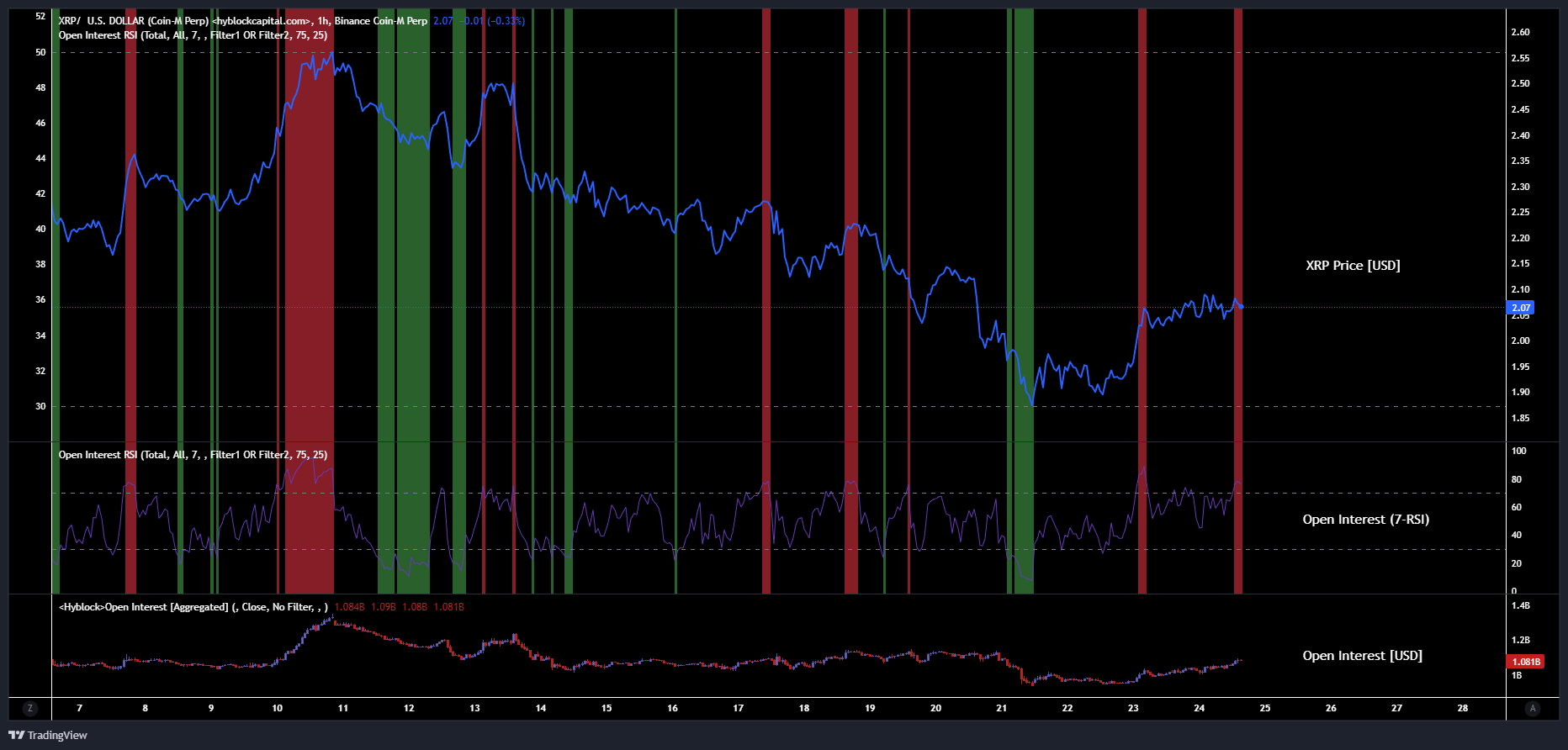

Below is the chart shared by Maartunn that shows the trend in this metric over the past few weeks.

From the graph, it’s visible that the XRP Open Interest Delta RSI has surged above 70 recently, indicating that investors have opened derivatives positions aggressively within a short window. The analyst calls it “a classic sign of speculative leverage.”

The overall Open Interest is still notably down compared to the high earlier in the month, but the latest rapid uptick could be a signal to keep an eye on. In the chart, Maartunn has highlighted the previous instances of this pattern forming. It would appear that breaks from the indicator into this territory have often coincided with local tops.

So far, since the latest sell signal has appeared in the metric, XRP has continued to go up, but it only remains to be seen whether the rally will be sustainable, or if derivatives overheating will prove an obstacle.

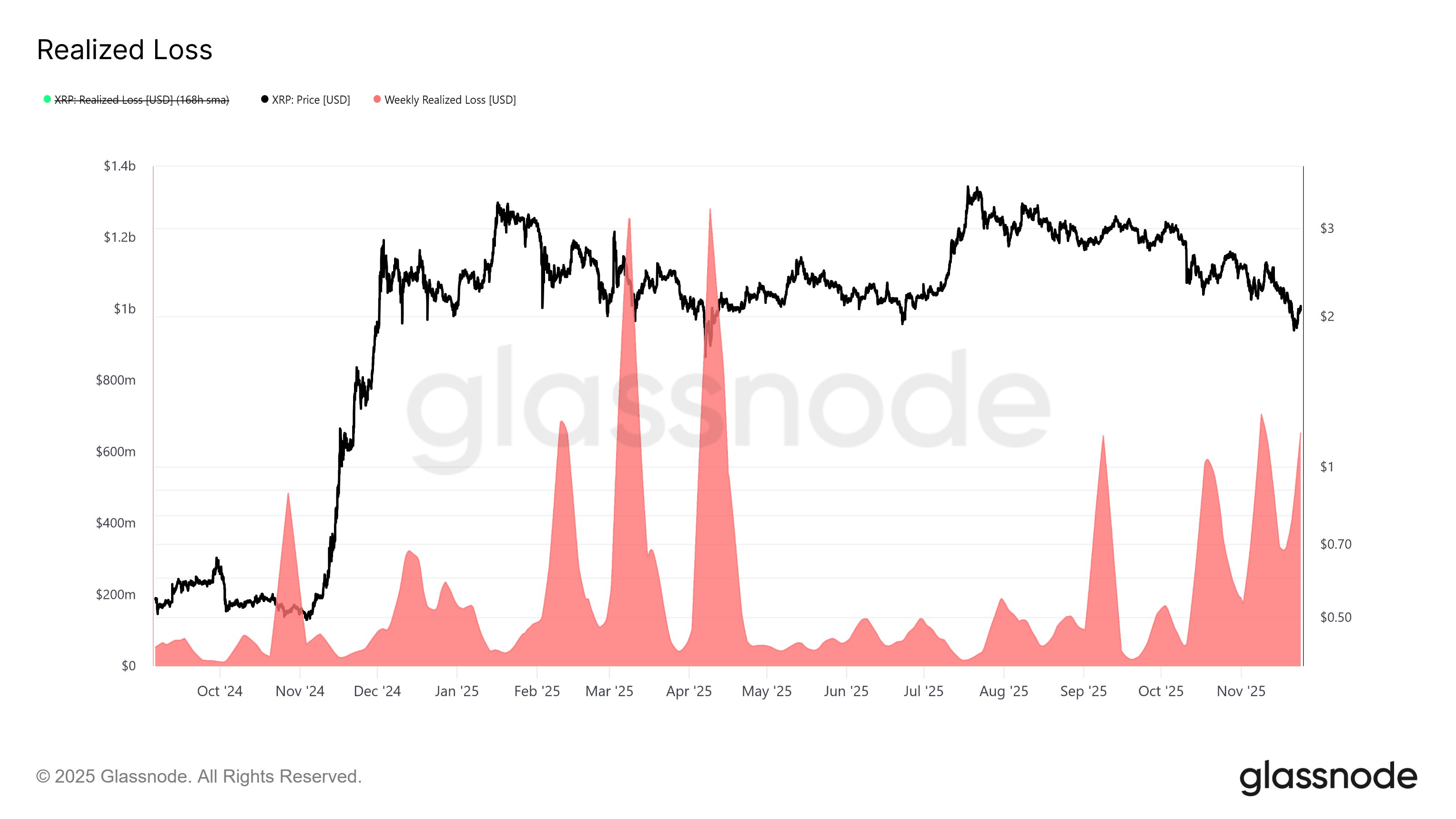

In some other news, the recent XRP drop under $2 triggered a massive loss-taking event, as on-chain analytics firm Glassnode has highlighted in an X post.

As displayed in the above chart, this isn’t the first time this year that the XRP Realized Loss has witnessed a spike after the price retraced to $2. “Since early 2025, each time XRP has retested $2, investors have realized $0.5B–$1.2B per week in losses,” noted Glassnode. “This underscores how heavily this level influences spending behavior.”