Crypto market analyst Ali Martinez is warning that XRP’s latest pullback could extend, citing a cluster of bearish signals across price, on-chain, and behavioral metrics.

Why XRP Could Face A Deeper Correction

In an X thread posted early Wednesday, Martinez opened with: “XRP may be headed for a deeper correction. Here’s why!” and pointed to a Tom DeMark Sequential sell signal on the three-day chart “right at the local top,” which he said “trigger[ed] the ongoing pullback.” His remarks follow a weekend note flagging $2.40 as the “next key support level to watch” after that three-day TD sell signal.

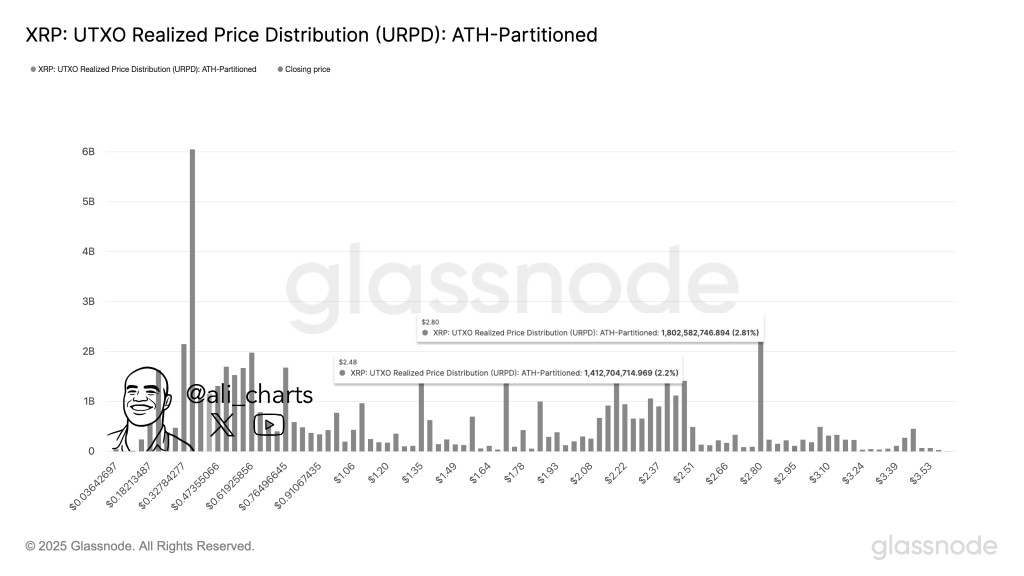

Martinez expanded on market structure, arguing that while the $3.00 area has intermittently acted as support, historical accumulation patterns make $2.80 a temporary buffer, with “real support” beginning below $2.48—a zone he has mapped using on-chain positioning.

He reiterated on Aug. 3 that “past accumulation behavior points to $2.80 as a temporary buffer for XRP, but real support begins below $2.48,” adding that the most consequential level on his dashboard remains $2.40. Independent coverage of his analysis echoed those thresholds, framing $2.80 as a light cushion with heavier demand pockets sub-$2.50.

Flow data has added to the bearish case in the near term. Martinez said whales have offloaded over 720 million XRP, intensifying sell-side pressure in recent sessions; earlier, on Aug. 2, he specified that “whales have sold over 710 million $XRP in the past 24 hours!” That spike in large-holder distribution has been picked up by multiple market trackers and recaps over the past few days.

He also flagged the Market Value to Realized Value (MVRV) signal turning sharply negative. “The MVRV ratio just flashed a death cross,” Martinez wrote, calling it “another sign that a steeper correction could be underway.” The post underscores the crossover as a warning of rising downside risk if short-term holders’ cost basis begins to overhang market value.

While “death cross” language is more commonly associated with moving-average pairs, Martinez uses the term here to describe a momentum break in MVRV curves.

The TD Sequential—a Tom DeMark-designed exhaustion model often used to anticipate trend reversals—has been central to Martinez’s view since late July, when he tracked a three-day “sell” print near the top of the latest rally leg. He has since framed the path of least resistance as lower unless the market can establish sustained closes back above the high-volume node near $3.00–$3.20, while on-chain profiles continue to privilege $2.48–$2.40 as the area of “real” demand. As he put it on Aug. 3: “The next key support level to watch is $2.40!”

For now, Martinez’s roadmap rests on three pillars: an exhaustion sell on the 3-day TD Sequential, large-holder distribution in the hundreds of millions of XRP, and a bearish MVRV crossover, all of which he argues raise the probability of a deeper corrective leg toward the high-$2s and, if momentum deteriorates, the mid-$2s. Whether bulls can defend the shallower buffers near $2.80 may determine if XRP’s decline remains a garden-variety pullback or morphs into a larger reset toward his $2.40 magnet.

At press time, XRP traded at $2.93.