A top Korean Elliott Wave expert has forecasted that XRP may move between $10 and $40 over the next few months, which reflects possible gains of as much as 1,726% from current market levels.

XForceGlobal, Korea’s first ever certified Elliott Wave analyst, is of the view that the cryptocurrency has entered the completion phase of its correction cycle and now stands ready to go into a big bull run.

Technical Pattern Signals End Of Downward Trend

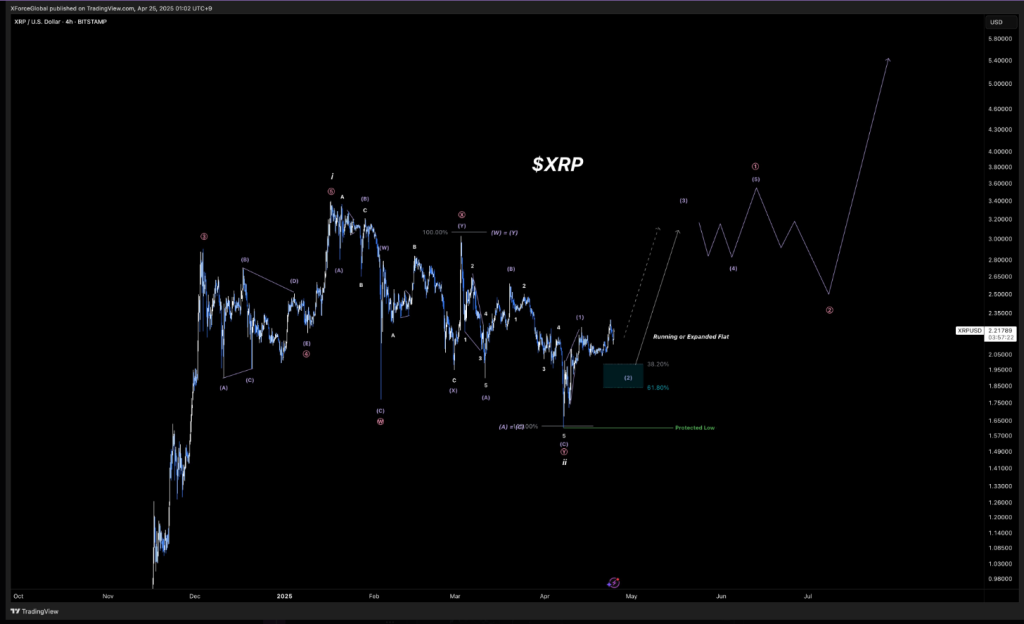

XRP has completed what technical analysts term a “WXY corrective pattern” as per XForceGlobal. The technical pattern has often indicated that a period of a pullback is concluding.

The analyst said Wave W was the initial response of the market to profit-taking once XRP had risen six times in price. Wave X momentarily picked up the upward trend with minimal momentum before Wave Y concluded the correction with another orderly downward trajectory.

The cryptocurrency fell approximately 50% from its January 2025 peak of $3.33 to a low of $1.638. However, it has since rebounded by 34% to trade at $2.20 at the time of reporting.

We’ve been calling for this exact pullback for months.

We are inching that much closer to a historic breakout to $10+.

Progress may be gradual, but it’s undeniable. https://t.co/QxWbJRPhMq pic.twitter.com/9lbnZjaTHz

— XForceGlobal (@XForceGlobal) April 24, 2025

Price Targets Range From $10 To $40

XForceGlobal’s analysis puts XRP in wave 2 of a bigger fifth wave, indicating the next big move would be a strong wave 3. The analyst has had a minimum target of $10, which would be a 350% rise from current levels. His upper target of $40 would be an unprecedented 1,726% rise.

The prediction relies on Elliott Wave Theory, which tries to foresee market movements through patterns of investor sentiment expressing themselves in price waves. The predictions rely on the strength and expansion of waves 3 and 5 within the overall structure of the market.

Korean Markets Act As Leading Indicators

XForceGlobal pointed out that Korean cryptocurrency exchanges play a vital role in the prediction of XRP price fluctuations. In the opinion of the analyst, Korean markets have in the past led in the recognition of significant XRP tops and bottoms.

The similarity between XRP’s Korean won (KRW) chart and its US dollar chart was highlighted as especially significant. “We’re seeing the same structure on both charts. That adds conviction that wave 2 may be complete,” the analyst said.

Investment Strategy Recommendations

Although the recent 40% advance from lows is the current state, XForceGlobal described recent short-term decline as typical market action. The analyst indicated that “smart money” is already accumulating in XRP as retail interest starts coming back.

XForceGlobal compared the strength of XRP’s community against the reported dwindling enthusiasm for Ethereum and Solana. The last stage of this cycle might involve a vertical, parabolic price action, perhaps initiating a new wave of FOMO among investors.

Featured image from CoinFlip, chart from TradingView