XRP is facing a strong resistance level on its path to the $3 price level and above, with the past 24 hours witnessing some sort of rejection at this resistance level. XRP price action has gradually built momentum in May, leading to a sharp move toward the upper $2.60 range. On May 12, XRP briefly touched $2.63 before retreating slightly, now trading around $2.57.

Directly ahead is the major resistance at $2.69, and technical analysis shows that this zone now holds the key to whether XRP can continue its march toward $3.00 or undergo a pullback for consolidation.

$2.69 Resistance Is Technical For XRP Price

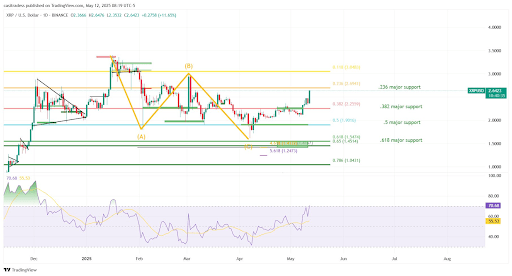

Crypto analyst CasiTrades has highlighted the $2.69 price point as an important resistance level for the XRP price moving forward. According to the analyst’s chart, which accompanied a post on social media platform X, this level represents the 0.236 Fibonacci retracement from XRP’s all-time high and is a key level to watch for correction.

Notably, this zone has led to multiple retracements since December 2024, with each attempt seeing sellers quickly step in to defend it. It even proved difficult to break when XRP broke to reach $3.3 in January, and an order block was created on the daily candlestick timeframe just before the ensuing rally above it.

As noted by the crypto analyst, momentum indicators have remained relatively muted during XRP’s recent rally. The crypto has also completed what appears to be a full 5-wave Elliott count from the analyst. However, instead of a retracement, the price has pressed forward slowly alongside the rest of the crypto market. This slow, controlled push higher often signals strong underlying demand, strong trend, and heavy accumulation.

As it stands, the only thing left to do is to see how the XRP price performs at the $2.69 resistance.

Breakout Or Rejection: Two Opposite Outcomes With High Impact

The analyst warns that the $2.69 level could be a final barrier before XRP is cleared for a run toward $3.00 and beyond. A confirmed breakout, ideally with a strong daily candle close above this level, would invalidate short-term bearish pressures and cause a run above this level.

However, if $2.69 once again proves too strong for bulls to overcome, the altcoin may enter a temporary cooling-off phase. In this case, the next logical support level is around $2.30, which is close to the 0.382 Fibonacci retracement level. This is another breakout/rebound zone that could offer a healthy reset for the XRP price.

In either scenario, the price behavior at $2.69 is expected to set the tone for the rest of May and determine whether XRP can extend its 2025 bullish trend. At the time of writing, XRP is trading at $2.57, up 4% in the past 24 hours.