XRP’s recent recovery has sparked fresh optimism among traders, but what’s happening behind the scenes tells an even more compelling story. This isn’t just a typical bounce; the charts reveal a calculated shift in momentum. Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are beginning to align, suggesting that XRP is approaching a crucial decision zone.

Following the recent downturn in the market, the price is now on a bullish recovery after testing the $1.7 key support level with increasing conviction. If the current momentum continues and resistance zones give way, XRP could be on the verge of a significant breakout. However, failure to build on this momentum could trap the token in another consolidation phase or a deeper retracement.

MACD Signals Brewing Bullish Pressure For XRP

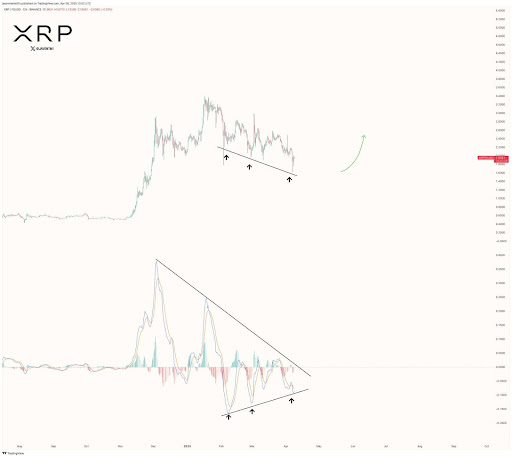

In a recent post on X, crypto analyst Javon Marks pointed out that XRP’s MACD is approaching a critical breaking point, potentially signaling a shift in market momentum. He emphasized that this MACD indicator is showing signs of a bullish crossover, which could mark the start of a strong upward movement.

Coupled with this, Marks highlighted that XRP is currently holding a key Regular Bullish Divergence, where the price has been making lower lows while the MACD is showing higher lows. This indicates a weakening of bearish pressure, setting the stage for a potential reversal.

Marks suggested that this technical setup could be the catalyst for the bulls to take control, potentially leading to a powerful move that breaks through current resistance levels. With this convergence of bullish signals, XRP may be primed for a rally back toward the $3.30+ range, continuing its previous uptrend.

Key Levels to Watch: The Exact Breakout And Rejection Zones That Matter

In order to fully understand the future movements of XRP, it’s crucial to pinpoint the key levels that will either drive the price higher or cause a reversal. Firstly, the breakout zone for the altcoin lies around the $1.97 resistance level.

If the price manages to surpass this threshold with strong volume, it could trigger a surge towards higher levels, including $2.64 and $2.92. This breakout would likely confirm the upward momentum suggested by the MACD and the regular bullish divergence.

On the other hand, a rejection at the $1.97 resistance level might signal a lack of buying interest. Should the asst fail to break above this level, the price could pull back toward lower support levels like $1.7 or even $1.34. A failure to hold these support levels would trigger the potential for a more substantial downturn, with bears regaining control.