On-chain data shows that XRP whales have been making exchange inflows in the past day, a sign that may be negative for the asset’s price.

XRP Whales Have Made Multiple Large Exchange Inflows Today

According to data from the cryptocurrency transaction tracker service Whale Alert, the XRP network has handled a few large transactions during the last 24 hours.

In total, there have been four such transfers, each worth at least $10.9 million. Given the huge scale of these moves, it’s likely that whale entities were responsible for them.

The whales are naturally influential players on the network as they carry large amounts in their wallets. Thus, their transfers can be worth watching, as they may end up causing fluctuations in the market.

How such a transfer would influence the price depends on what the intent behind it was. It’s generally hard to find the exact motive behind any transaction, but depending on what type of transfer it was and which wallets were involved, some hints can perhaps be gathered.

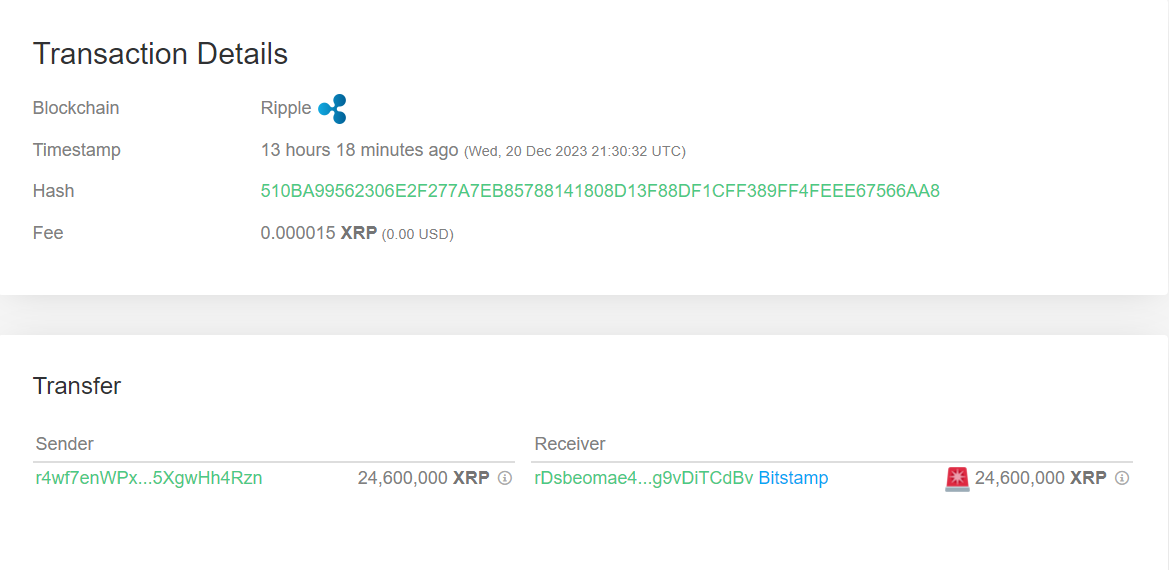

Three of the whale transactions from the past day have been similar in structure. Here are the address details of the first of these large transfers:

As is visible above, this transaction involved a movement of 24.6 million XRP (worth over $15 million at the time the transfer went through) between an unknown wallet and an address attached to the cryptocurrency exchange Bitstamp.

Unknown wallets are addresses unaffiliated with any known central entity, so the sender address here was likely the whale’s personal wallet. One of the main reasons why an investor would transfer coins from their self-custodial wallets to an exchange is for selling purposes, so it’s possible that this humongous holder has made this move to part with the stack.

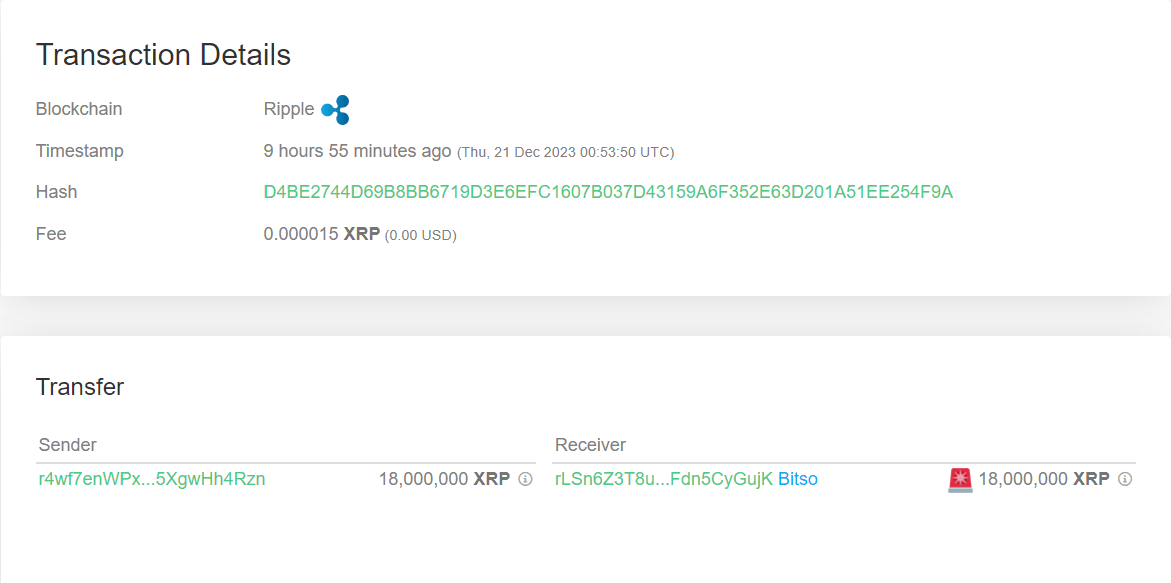

Interestingly, the second exchange inflow transaction from the last 24 hours also appears to have been made by the same whale, as the sending addresses match.

While the receiver in the case of this transaction worth 18 million XRP ($10.9 million) is also an exchange, the platform is Bitso this time, and not Bitstamp as was the case with the other transfer.

The third and final exchange inflow seems to have involved both a different sender and receiver, suggesting that a different whale entirely was responsible for this 20 million tokens ($12.1 million) transfer.

As mentioned earlier, it’s hard to say for sure anything about the intent behind these moves, but given that they are exchange inflows, they can potentially end up proving to be bearish for the cryptocurrency.

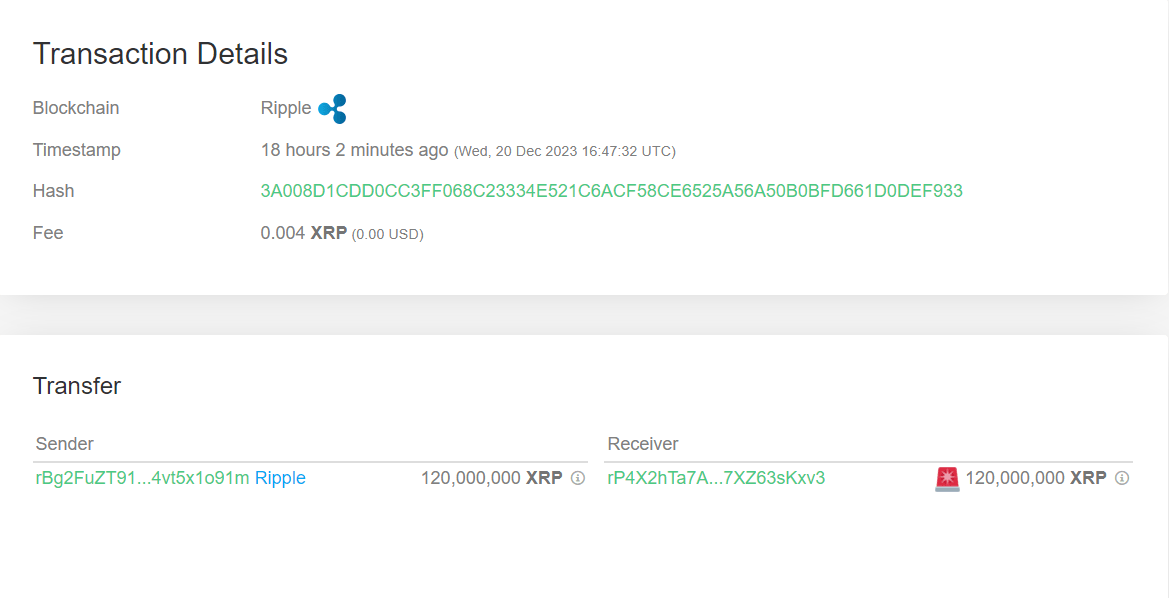

The fourth and the oldest large transaction that has occurred inside this window was actually the largest one and it would appear that Ripple, the company behind the cryptocurrency, was the sender involved.

As is apparent above, the firm has shifted 120 million XRP ($73.8 million) to an unknown wallet. There can be many reasons why the company would have made such a transaction, ranging from a simple change of wallets to a selling move.

Token Price

XRP has mostly been moving sideways recently as it currently trades around the $0.61886 level.