According to recent chart work and on-chain checks, some XRP backers say the token may be gearing up for another big move. Analysts who track past cycles point to patterns that played out in 2017 and 2018 and say similar moves could follow now.

XRP Repeats Past Price Cycle

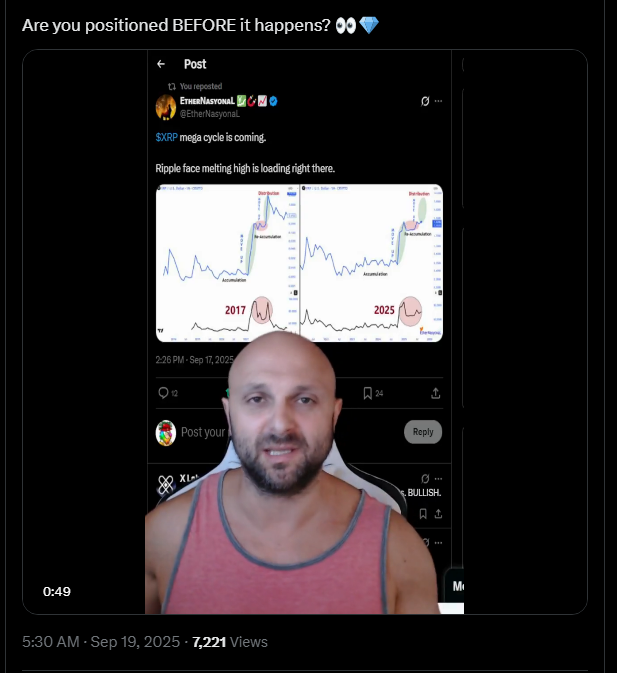

Reports have disclosed that XRP broke a long downtrend in March 2017, running from about $0.0055 to roughly $0.40 by May 2017.

After that first surge, the token cooled and traded sideways for around six months before shooting to $3.31 in January 2018.

According to EtherNasyonal’s charts, the market then entered a long decline and another accumulation phase.

One key detail the analyst highlights is the monthly RSI action: it climbed to about 95 during the first run, fell to roughly 68 in the re-accumulation, then topped 90 during the second leg. These RSI moves are used to argue that the market has room to charge again.

$XRP mega cycle is coming.

Ripple face melting high is loading right there. pic.twitter.com/ow6CnCZCtH

— EᴛʜᴇʀNᴀꜱʏᴏɴᴀL

(@EtherNasyonaL) September 17, 2025

A New Breakout And A Familiar Story

According to reports, XRP’s latest major break came in November 2024 when price moved from about $0.50 and ran to $3.40 by January 2025. After that push, the token consolidated for roughly six months, which some call a re-accumulation phase.

XRP Mega Cycle About To Detonate

$XRP isn’t dead — it’s loading.

The mega cycle is coiled like a spring.

Reg clarity

Ripple building infrastructure

Face-melting highs incomingAre you positioned BEFORE it happens?

pic.twitter.com/Qf8F4Z4WKK

— Ripple Bull Winkle | Crypto Researcher

(@RipBullWinkle) September 18, 2025

EtherNasyonal and other community analysts say XRP has cleared that setup and is poised for the next upward wave. They point to a current 1-month RSI near 68 as a sign of cooling before another possible spike above 90.

The bullish price target being tossed around is $10. One community voice summed it up bluntly: “XRP is not dead; it’s loading.”

538,586 wallets on XRPL have exactly 20 XRP

20 XRP was the minimum reserve from 2013 to 2021.

That’s 10.7 million XRP sitting in these wallets.

— Dr. Artur Kirjakulov (@Kirjakulov) September 17, 2025

On-Chain Numbers And Wallet Behavior

Meanwhile, data from XPMarket’s co-founder Dr. Artur Kirjakulov shows that up to 538,586 XRPL wallets hold 20 XRP each. At a price around $3.1, that 20 XRP equals about $62 per wallet.

Those numbers account for about 7.64% of all XRPL wallets, with the ledger now reporting 7,048,872 total addresses. Reports say nearly 11 million XRP appear to sit idle across many of these wallets. That figure is often cited to make the case for constrained supply if more coins stop circulating.

Meantime, Ripple Bull Winkle and other supporters point to regulatory clarity, new infrastructure work by Ripple, and the arrival of XRP ETFs as forces that could help price.

Featured image from Meta, chart from TradingView