Quick Take

As we approach the last trading month of 2023, set to close on Dec. 29, an intriguing pattern surfaced in the Bitcoin options market on the Deribit exchange. Open interest, a metric representing unsettled options contracts betting on Bitcoin’s future price, is gearing for another option expiry on the last Friday of December.

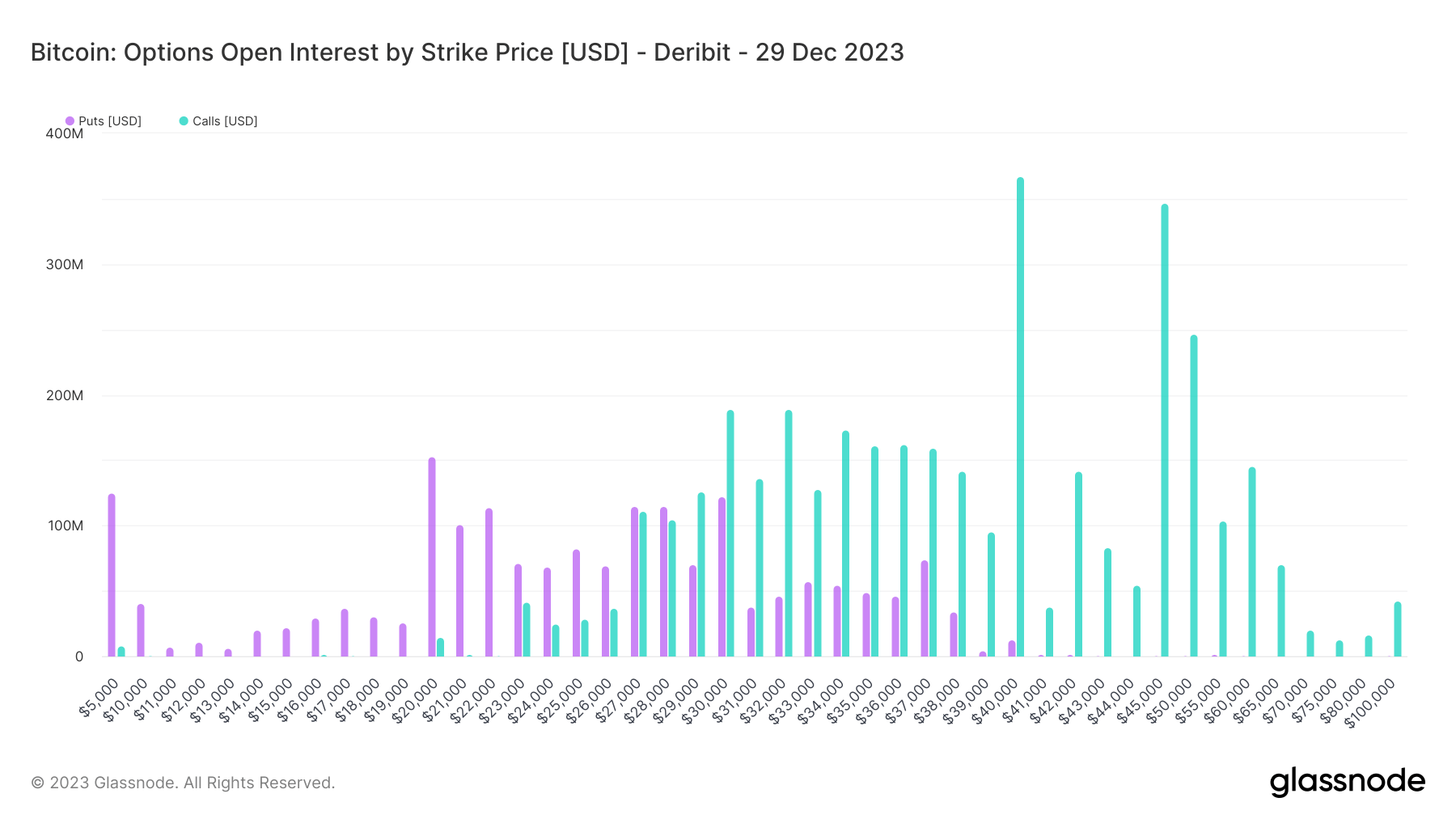

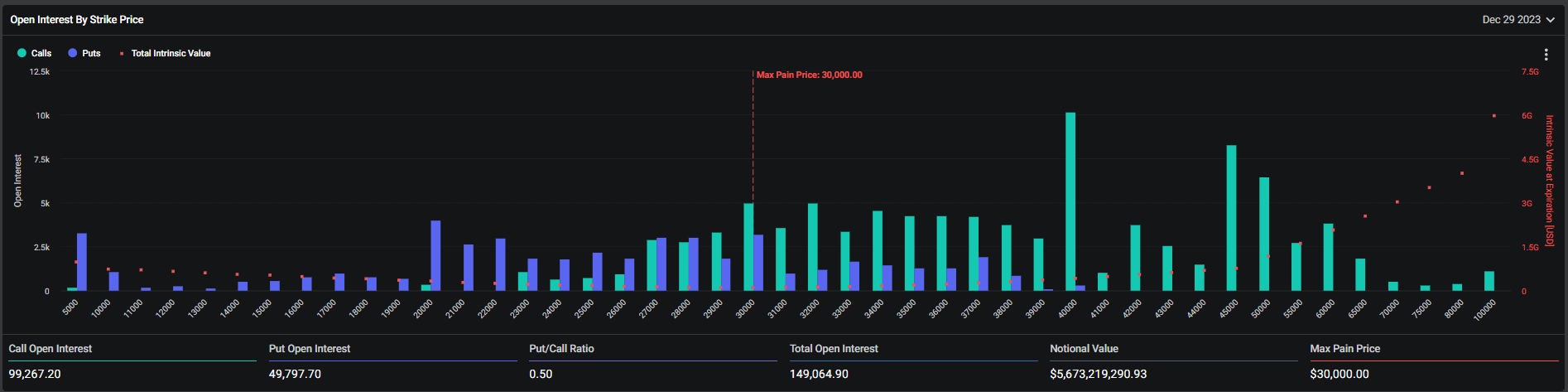

The market is demonstrating an intriguing spread of strike prices — the predetermined prices at which an option can be exercised. The data reveals roughly $368 million in call options at a $40,000 strike price, $347 million at $45,000, and about $250 million at $50,000. These peak values of call options and bets predicting an upward movement in Bitcoin’s price suggest a concentrated bullish sentiment around these strike prices.

Additionally, the current put/call ratio stands at 0.5. This indicates a bullish market trend, as there are two call options for every put option (bets predicting a price drop). Thus, as we head into the closing days of 2023, the Bitcoin options market is presenting a bullish tilt, as indicated by the substantial volume of call options against put options. Roughly $5.7 billion of notional value is set to expire on Dec. 29.

The post Year-end Bitcoin options poised for bullish close with $5.7 billion expiry appeared first on CryptoSlate.