Bitcoin Magazine

Bitcoin Price Stays Above $116,000 As Metaplanet Announces To Close A Giant Raise To Buy Bitcoin

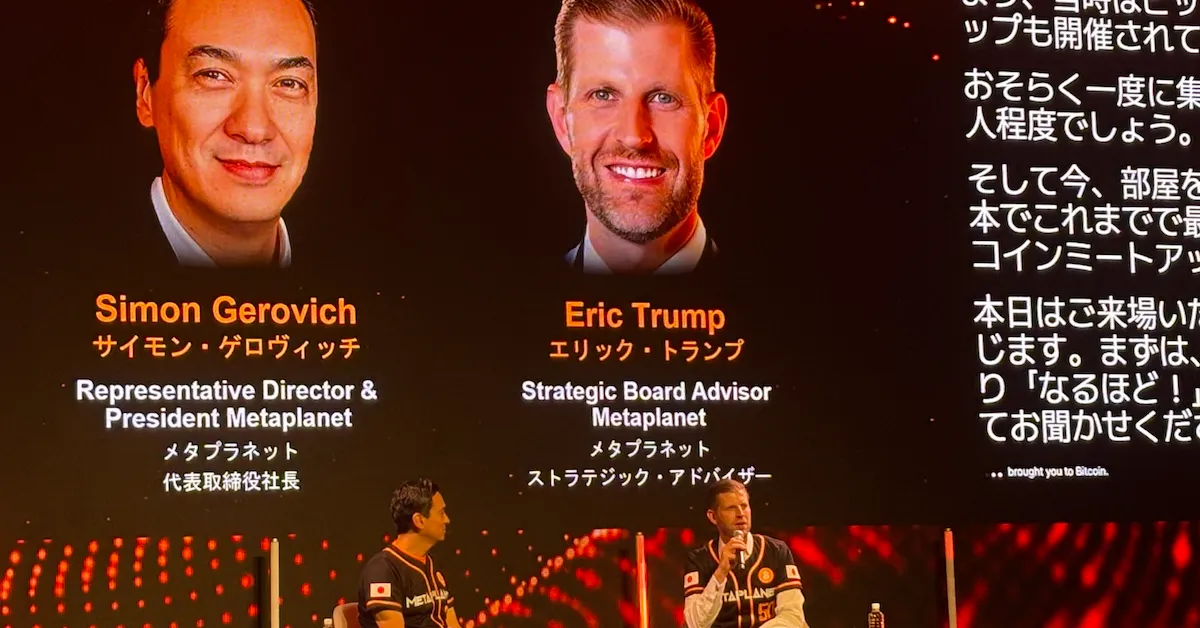

Metaplanet, a Tokyo Stock Exchange-listed company, has announced that it closed a massive $1.4 billion fundraise through an international share offering, with plans to buy Bitcoin with it. The announcement comes as Bitcoin price continues to trade above $116,000, highlighting growing institutional interest in Bitcoin treasury operations.

The Japanese Bitcoin treasury company announced multiple strategic initiatives today, including the establishment of new subsidiaries in both the United States and Japan, as well as the acquisition of the premium domain Bitcoin.jp.

The fundraising initiative attracted significant interest from global institutional investors, including sovereign wealth funds, highlighting the growing mainstream acceptance of Bitcoin treasury operations. The company plans to deploy the capital for Bitcoin purchases between September and October 2025, with other allocated to expanding its Bitcoin income generation business.

Metaplanet’s aggressive expansion comes amid a broader trend of corporations adding Bitcoin to their treasury holdings. Corporate Bitcoin holdings have now exceeded 1 million BTC, representing roughly 5% of Bitcoin’s circulating supply, with new companies entering the space almost daily.

The company’s U.S. subsidiary, Metaplanet Income Corp., will be based in Miami, Florida, with an initial capital of $15 million. The subsidiary will focus on Bitcoin income generation and derivatives operations, marking a significant expansion of the company’s Bitcoin operations beyond simple treasury management.

In Japan, the newly established Bitcoin Japan Inc. will manage media, events, and services related to Bitcoin, operating from Tokyo’s Roppongi Hills complex. The acquisition of Bitcoin.jp positions the company to become a central gateway to Japan’s Bitcoin ecosystem.

The Japanese market offers unique advantages, including a favorable low interest rate environment and tax benefits for individual investors through NISA accounts. Combined with Japan’s position as the world’s second-largest capital market, these factors create compelling opportunities for Bitcoin treasury operations.

The company’s strategic moves reflect growing competition in the Bitcoin treasury space, with corporations increasingly viewing Bitcoin holdings as a critical component of their financial strategy. Metaplanet’s fundraise represents one of the largest capital deployments into Bitcoin by a publicly listed company in 2025.

Institutional investors particularly noted the company’s potential to issue Bitcoin-backed preferred shares in the future, with the expanded Bitcoin Net Asset Value (BTC NAV) providing a foundation for innovative financial products. The company has implemented a 60-day lock-up period for management and major shareholders, demonstrating a commitment to long-term value creation.

As Bitcoin price maintains its position above $116,000, Metaplanet’s ambitious expansion underscores the growing institutional appetite for Bitcoin exposure through publicly listed vehicles. The company’s multi-faceted approach, combining direct Bitcoin acquisition with income generation activities, represents an evolution in corporate Bitcoin strategy that could serve as a template for future institutional adoption.

This post Bitcoin Price Stays Above $116,000 As Metaplanet Announces To Close A Giant Raise To Buy Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

Metaplanet successfully raises $1.4 billion, including from sovereign wealth funds, to buy more

Metaplanet successfully raises $1.4 billion, including from sovereign wealth funds, to buy more