Bitcoin Magazine

Bitcoin Price Briefly Surges Past $92,000 As ‘Bitcoin Breaks 4-Year Cycle’

The bitcoin price climbed above $92,000 over the weekend, off of lows near $88,000. The bitcoin price reached $92,203 at its seven-day high.

Bernstein analysts argue that recent price movements signal a structural shift in Bitcoin’s market cycle. In a note to clients, the firm said the traditional four-year cycle—historically peaking every four years—has broken.

Bernstein sees Bitcoin entering an elongated bull cycle, fueled by persistent institutional buying that offsets retail selling.

Despite a roughly 30% correction, ETF outflows have remained minimal, under 5%.

The bank raised its 2026 price target to $150,000, projecting the cycle could peak in 2027 around $200,000. Bernstein maintains a long-term 2033 target of roughly $1 million per BTC.

Meanwhile, Wall Street bank JPMorgan remains bullish over the next year. Its analysts maintain a gold-linked, volatility-adjusted BTC target of $170,000 over the next six to twelve months, factoring in price fluctuations and mining costs.

Strategy and the Bitcoin price

Strategy (MSTR), the largest corporate Bitcoin holder, remains central to institutional market dynamics. The company owns roughly 660,624 BTC, with an enterprise-value-to-Bitcoin holdings ratio (mNAV) of 1.13.

JPMorgan notes this ratio above 1.0 is “encouraging,” suggesting Strategy is unlikely to face forced sales of its holdings.

Strategy has also built a $1.44 billion U.S. dollar reserve to cover dividend payments and interest obligations for at least 12 months, with plans to extend coverage to 24 months. Bernstein maintained its Outperform rating on MicroStrategy but lowered its price target from $600 to $450, reflecting the recent market correction.

Just today, Strategy said they bought 10,624 BTC last week for about $963 million, paying an average of $90,615 per coin. This brings its total holdings to 660,624 BTC, acquired at an average cost of $74,696 per bitcoin, with a current market value near $60.5 billion and unrealized gains of roughly $11 billion.

The purchase marks Strategy’s largest recent buying spree as market volatility eased. Its shares rose about 3% in early trading Monday, rebounding from a Dec. 1 low near $155, though they remain over 50% below their six-month peak.

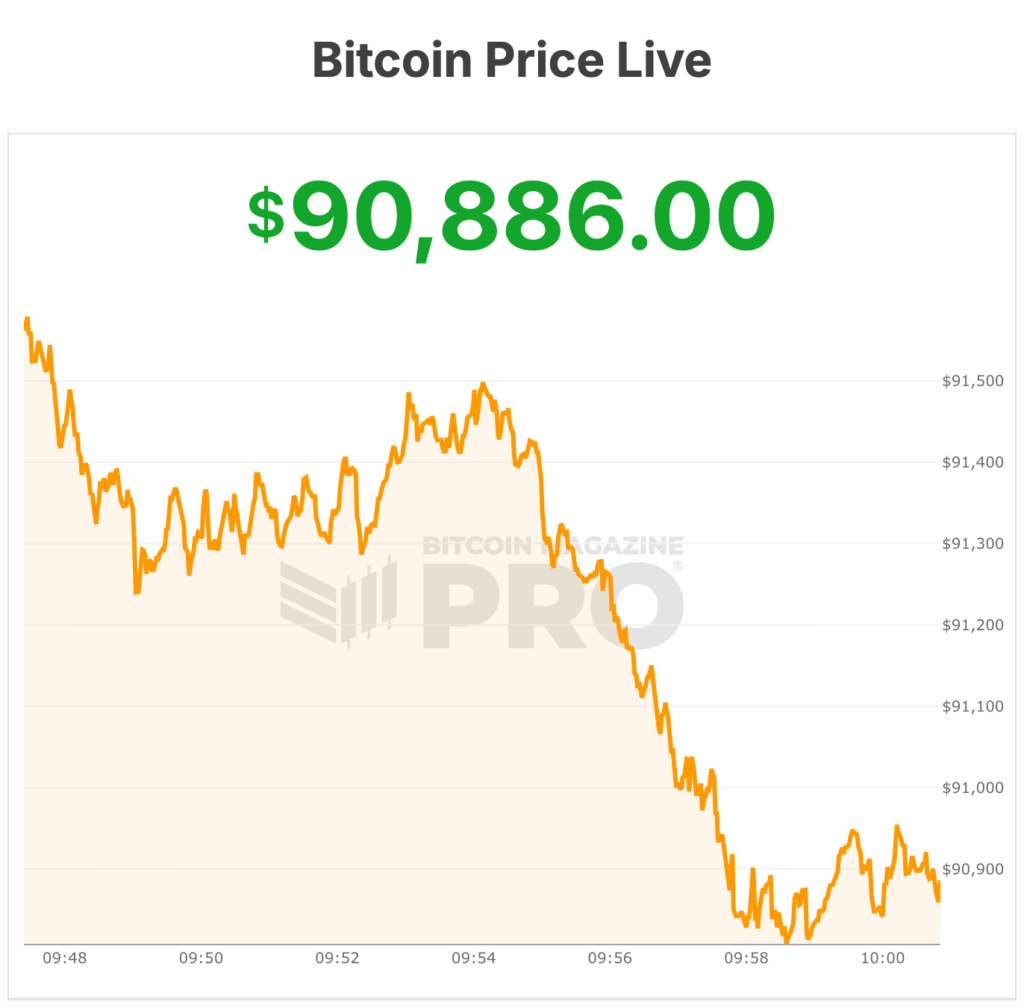

As of right now, the bitcoin price trades at $90,886, up 3% in the past 24 hours, with a 24-hour trading volume of $46 billion.

The cryptocurrency’s market capitalization now stands at $1.82 trillion, with a circulating supply of 19.96 million BTC and a maximum supply capped at 21 million.

This post Bitcoin Price Briefly Surges Past $92,000 As ‘Bitcoin Breaks 4-Year Cycle’ first appeared on Bitcoin Magazine and is written by Micah Zimmerman.