David Krueger, a crypto analyst on X, thinks Bitcoin (BTC) will tear higher, surging by 100% to 200% within five months, fueled primarily by fear of missing out (FOMO) once the coin breaks above $50,000.

Will Bitcoin Break Above $50,000 And Rally To $100,000?

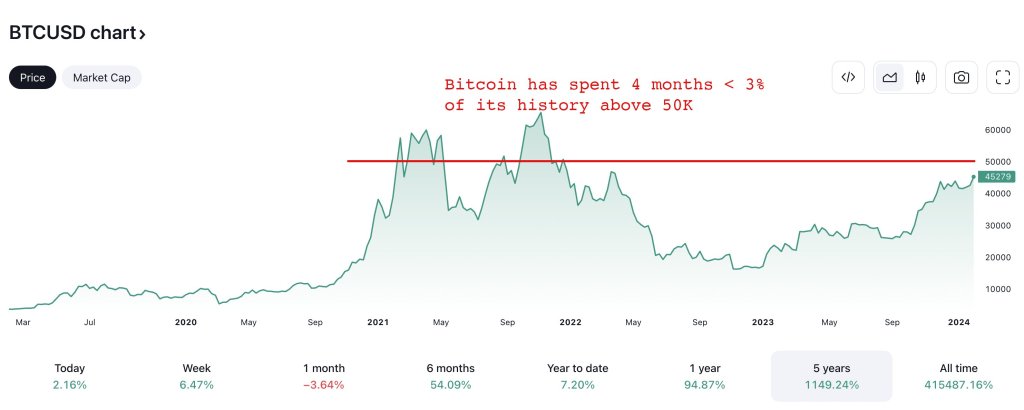

Citing Tom Lee’s historical analysis, Krueger believes FOMO typically kicks in when Bitcoin trades above a price level “exceeding 97% of its historical days.” Lee is the co-founder and researcher at Fundstrat.

Zooming at the development in the monthly chart, the analyst notes that this price point sits at $50,000, a key psychological level that bulls have failed to overcome since the bull run from mid-November 2023.

Accordingly, if Lee’s analysis and the analyst’s assertion come true, BTC prices will likely float higher in the sessions ahead. However, what’s unclear is when BTC will clear this $50,000 level, paving the way for $100,000 and even $200,000 five months after the decisive breakout.

When writing, BTC prices are firm and rallying. The coin is trending above $46,500 and will likely clear above January 2024 highs of around $48,700. Even so, whether the current uptrend will cause excitement, possibly creating FOMO, is yet to be seen.

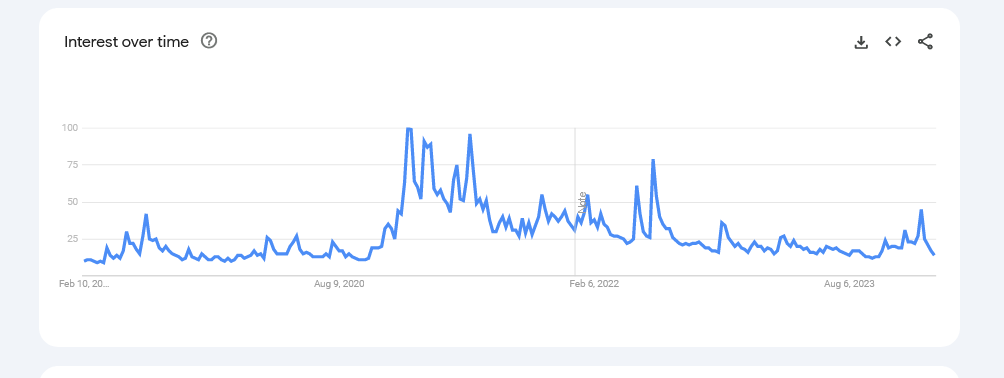

Looking at Google Trends data and organic search related to Bitcoin, interest is fizzling out. Data shows that the number of people searching for Bitcoin in the United States has dropped and is at around early 2021 levels. Even so, around that time, Bitcoin prices began trending higher, eventually rising to as high as $69,000.

Halving And Spot ETF Issuers Loading Up More Coins

While FOMO appears elusive at spot rates, another analyst offers a different perspective. In response to Krueger’s outlook, the analyst notes that sharp interest in Bitcoin historically arrives around six months after halving, lasting up to 18 months. This event and steady or increasing demand create a supply-demand imbalance that may pump prices.

Bitcoin will halve its miner rewards in early April 2024. It is an event that may anchor bulls, setting the base for more gains as projected by analysts.

The coin might also edge higher considering the pace at which spot Bitcoin exchange-traded fund (ETF) issuers have been buying BTC in the past few weeks since the product was approved in mid-January 2024.

With Wall Street players like Fidelity, BlackRock, and other crypto firms like Bitwise loading up more coins, BTC will likely be more scarce than it has been after past halving events.