Data shows the cryptocurrency futures market has gone through a $152 million liquidation squeeze as Bitcoin has broken past $47,300.

Crypto Futures Market Sustains Large Liquidations, Majority Shorts

The past day has been a volatile time for the cryptocurrency sector as coins across the space have enjoyed positive returns, with Bitcoin, in particular, breaking past the $47,000 barrier with a strong surge for the first time since the post-ETF slump.

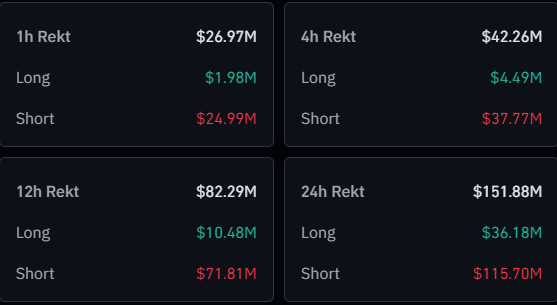

As is usually the case, this sharp price action has resulted in some chaos over the futures side of the market. Below is a table from CoinGlass that shows how the liquidations have racked up in the futures market over the last 24 hours:

In total, the cryptocurrency futures market has registered liquidations amounting to almost $152 million in the past day. Out of this, about $82 million of the flush has occurred within the past twelve hours alone.

As these liquidations have majorly been triggered by a sharp move in the prices of the assets, it’s not too surprising to see that shorts have taken the brunt of the liquidations.

More than $115 million of this futures flush involved the shorts, equivalent to almost 75% of the total liquidations. Mass liquidation events like the one in the past day are popularly known as “squeezes.” Since this squeeze was short-heavy, it would be an example of a “short squeeze.”

During a squeeze, liquidations can go through a waterfall effect and in the process, amplify the price move that triggered them. The shorts today have fed into the rally, which is why the upswing in Bitcoin has been notably sharp.

As for how the contribution to the liquidation event looks like per symbol, the below table displays the data for it.

Unsurprisingly, Bitcoin topped the liquidation charts with around $54 million contracts squeezed, while Ethereum (ETH) came second at $24 million. Solana (SOL) was the altcoin with the highest amount of liquidations at $7 million.

Among the top 20 cryptocurrencies by market cap, SOL’s returns of more than 4% are only bested by BTC’s 6% jump, which may be why the alt has seen significantly more liquidations than the other coins in the sector.

Historically, squeezes like the one from the past day haven’t exactly been something rare in the sector. This is down to the high volatility that most coins in the sector experience on the regular.

This is also compounded by the fact that extreme amounts of leverage (even equal to 100x the position or more) can be easily accessible on many platforms, so the market can stay overleveraged in general, making it ripe ground for liquidations to cascade together in the form of a squeeze.

Because of these factors, the cryptocurrency futures market can be risky ground to tread for the uninformed trader.

Bitcoin Price

Bitcoin is finally witnessing the break many had been waiting for, as the coin has now surged beyond the $47,300 level.