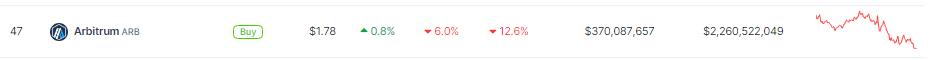

Arbitrum (ARB), the Ethereum Layer 2 scaling solution, has experienced a recent price drop, falling below the $2 mark after a brief attempt to establish a new price floor. This decline, attributed to several factors including increased selling pressure and bearish technical indicators, raises questions about the token’s short-term trajectory while highlighting long-term potential.

Selling Spree Triggers Downward Spiral

The price decline began with a surge in selling pressure, most notably from Convex Finance. Over the past 24 hours, the DeFi giant offloaded 901,392 ARB tokens, valued at $1.63 million, at an average price of $1.8 per token.

This move, representing a profit of over $400,000 since acquiring the tokens in an airdrop last year, triggered a domino effect, with other investors following suit.

$ARB price dropped ~9% in the past 24 hours!@ConvexFinance further deteriorates the price by selling 901,392 $ARB ($1.63M) for 559.4 $ETH at ~$1.812 in the past 45 minutes.

They received those $ARB from the DAO airdrop in Apr 2023, which was then worth only $1.2M.

Token flow:… pic.twitter.com/09al0a71Oj

— Spot On Chain (@spotonchain) February 22, 2024

Bearish Indicators Reinforce Downtrend

Technical indicators on the daily timeframe chart further paint a bearish picture. The short-term moving average (SMA), previously acting as support around the $2 mark, has flipped to resistance. The Relative Strength Index (RSI) dipped below the neutral line, suggesting a dominant downward trend, albeit a weak one.

Despite the decline, signs of resilience emerge. The token experienced a slight recovery of 0.2%, currently trading around $1.88. Additionally, the Funding Rate on derivatives platforms like Coinglass remains positive at 0.014%, indicating that buyers still hold some control, albeit with less aggressiveness compared to before.

Low Derivative Interest: A Point Of Caution

However, the derivative market paints a less optimistic picture. Open Interest, a metric reflecting the total amount of capital locked in futures contracts, stands at around $254 million, indicating relatively low interest in ARB compared to other tokens. This lack of engagement could potentially limit upward momentum and price stability.

Long-Term Prospects Remain Promising

Despite the recent price dip, Arbitrum boasts strong fundamentals and long-term potential. Its fast and affordable transactions, coupled with growing developer adoption and ecosystem development, continue to attract interest. Recent partnerships like ApeCoin’s ApeChain launch on Arbitrum further solidify its position as a leading Layer 2 solution.

While the current price movement suggests a period of consolidation, Arbitrum’s long-term prospects remain promising. Investors should carefully consider market trends, technical analysis, and fundamental factors before making any investment decisions.

Featured image from Kamil Pietrzak/Unsplash, chart from TradingView