A Binance representative confirmed in a Jan. 30 email statement sent to CryptoSlate that the platform is now allowing institutional investors to secure their trading collateral through a third-party banking partner.

Binance’s solution, described as a “banking triparty” arrangement, has been under development for the past two years and directly addresses the primary concern of counterparty risk, a significant consideration for institutional investors. This model enables investors to manage risk effectively while optimizing capital efficiency by pledging collateral in traditional assets.

While details about the specific banking partners remain undisclosed, Binance emphasized active engagement with various banking entities and institutional investors expressing interest in the arrangement.

The platform introduced the pilot scheme for this solution last November, allowing collateral held with the banking partner to be in fiat equivalents, such as Treasury Bills.

Before this development, Binance clients were limited to holding their assets on the exchange itself or through its custodial service provider, Ceffu. However, concerns arose following the U.S. Securities and Exchange Commission’s lawsuit against Binance, questioning the exchange’s crypto wallet custody practices and its relationship with Ceffu.

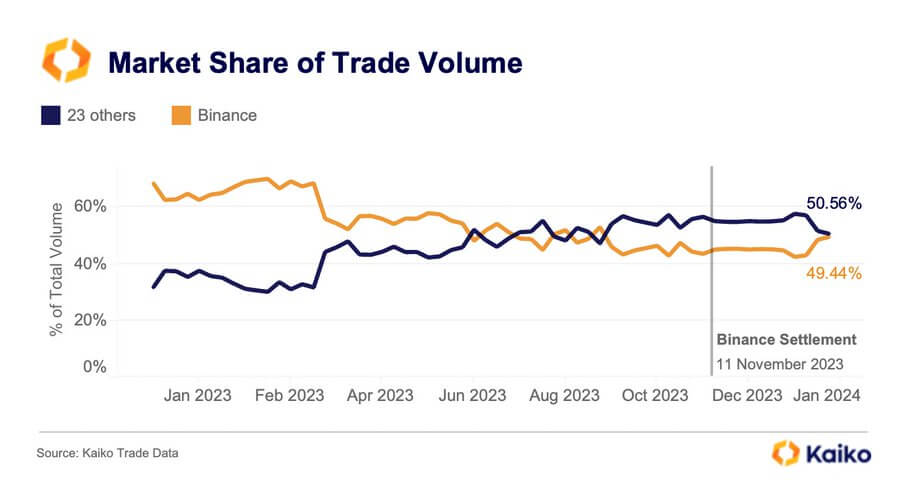

Binance market share recovers.

Binance market share is steadily growing to previous heights after its run-in with several financial regulators across different jurisdictions impacted its operations last year.

In response to this significant turnaround, Binance CEO Richard Teng expressed his optimism with a succinct “Keep Building” post on social media platform X.

The post Binance allows customers to custody trading collateral off exchange as market share recovers appeared first on CryptoSlate.