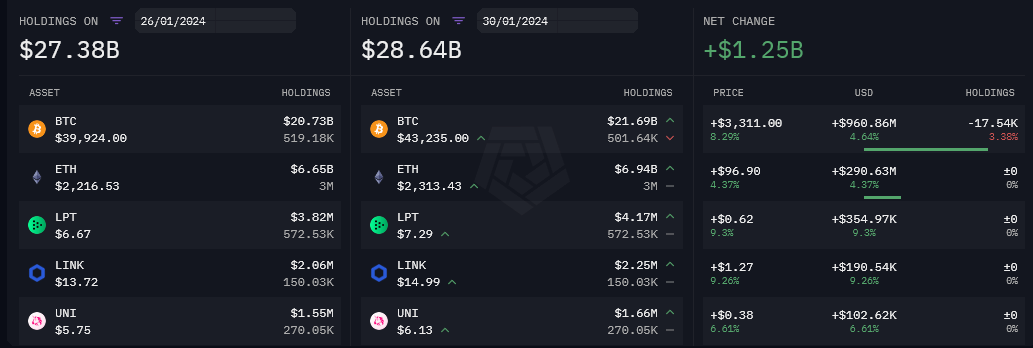

Following a persistent decline in Bitcoin outflows from the Grayscale Bitcoin ETF, Bitcoin’s recent surge from $39,900 to over $43,500 has seen the value of Grayscale’s crypto holdings grow by $1.25 billion since the end of last week.

While roughly 18,000 BTC has left the fund since Friday, as per Arkham Intelligence data, the price increases across the board offset this. Grayscale’s Bitcoin holdings are up $968 million, while its Ethereum holdings are up $298 million.

Given that spot ETFs settle in cash and not Bitcoin, even though there is less Bitcoin in the fund, Grayscale’s fees, at 1.5%, are higher. At present, annual revenues, based on current holdings, are estimated to be $429 million, with Bitcoin at $43,400.

The post Grayscale crypto holdings up $1.2 billion since last week as Bitcoin surges appeared first on CryptoSlate.