Data shows the Bitcoin Coinbase Premium has been negative for a while now, a sign that institutional selling has been occurring behind the scenes.

Bitcoin Coinbase Premium Gap Has Turned Quite Negative Recently

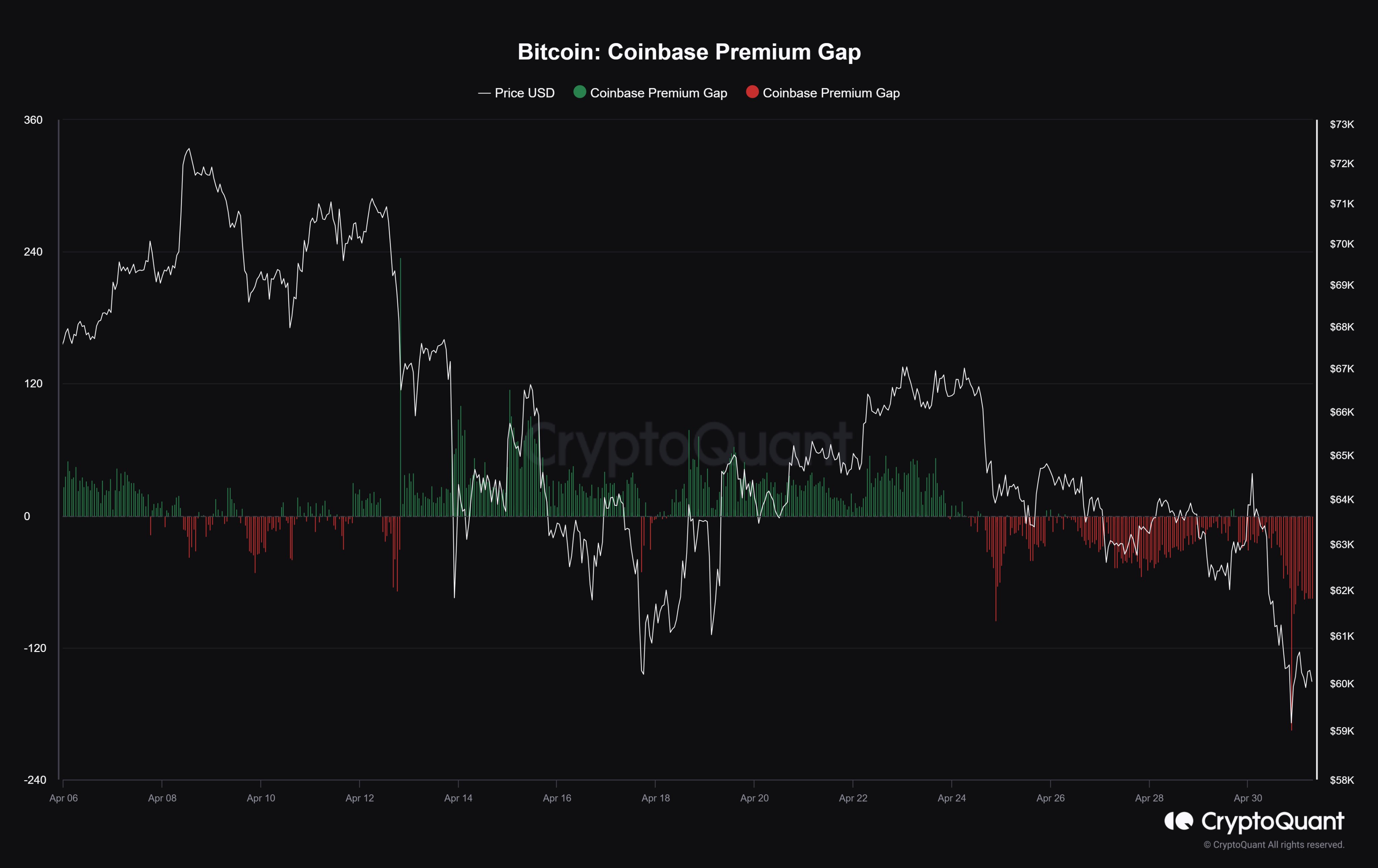

As pointed out by CryptoQuant Netherlands community manager Maartunn in a post on X, the Bitcoin Coinbase Premium Gap has been negative for seven straight days.

The “Coinbase Premium Gap” is an indicator that keeps track of the difference between the BTC prices listed on the cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair). When the value of this metric is positive, it means that the price listed on Coinbase is greater than on Binance right now. Such a trend implies the buying pressure is higher (or alternatively, the selling pressure is lower) on the former than the latter.

On the other hand, the indicator being red suggests the presence of higher selling pressure on the Coinbase platform, which has pushed the price of the asset lower on it.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the past year:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap has been negative for the past week or so, implying that the selling pressure on Coinbase has been higher than on Binance.

Recently, the indicator has assumed some especially sharp negative values, which have coincided with the recent crash that the cryptocurrency has observed. This could suggest that selling on the platform may be behind the crash.

This has actually been the pattern observed in 2024 so far, as the asset’s price has seemed to be sensitive to changes in the metric. When the rally was ongoing earlier, the indicator had been at highly positive levels, but this buying seems to have ended now.

Coinbase is popularly known to be used by the American institutional entities, while Binance has a more global userbase. As such, the indicator’s value reflects how the behavior of the US-based institutional traders differs from that of the global investors.

Since the Bitcoin price has been reacting to movements in the Coinbase Premium Gap this year, it would appear that these whales have been driving the price action.

The latest red values of the indicator would imply that these investors have been participating in a selloff recently. As long as this streak of negative levels continues, it’s possible that Bitcoin will continue to observe bearish price action.

A flip towards the positive, on the other hand, would suggest at least sideways movement around the current levels, if not outright a switch towards bullish momentum. It now remains to be seen what moves the Coinbase users will make in the coming days.

BTC Price

At the time of writing, Bitcoin is floating around $58,600, down over 7% in the last seven days.