The Bitcoin price continues to trend below $60,000 as a 20% decline triggered a brutal market-wide crash. This has exposed multiple critical support points for the cryptocurrency, some of which the price has already fallen below. In light of this, a crypto analyst known as Norok has revealed the level the BTC price must not fall below to maintain its bullish trend.

Bitcoin Price Must Hold Above $51,800

In an analysis posted on the TradingView website, crypto analyst Norok revealed that $51,800 is now the most important support level for Bitcoin. Norok pointed out that Bitcoin has since returned to its last support level which was last seen in December 2023, making this a crucial support.

In the meantime, the support that had been built up by bulls at the $62,000 level has since been broken by bears and has now been turned into resistance. Nevertheless, the crypto analyst does not believe that the Bitcoin price has turned bearish, despite the crash that has rocked the crypto market.

For Norok to turn bearish, he stated that the BTC price would have to break down below support at $51,800. According to him, such a move will invalidate whatever bullish thesis is in play for Bitcoin, ending the bullish trend of 2023-2024.

In the short term, Norok identifies $56,900 as a level that bulls must hold. He explains that this could help to reinforce the current bullish trend. “Price must hold here at this Support and then it can recapture the cloud to resume to Bullish Trend,” the crypto analyst said. “This is a highly decisive moment in Price action today.”

BTC Suffers As A Result Of ETF Outflows

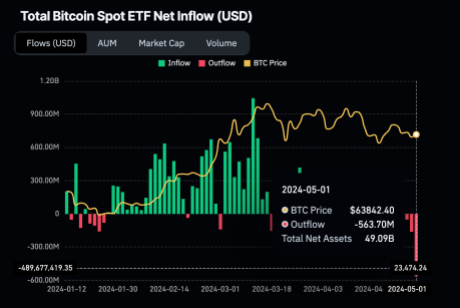

One major driver of the Bitcoin price decline in the last few weeks has been a turn from inflows to outflows in Spot Bitcoin ETFs. Since these ETFs require the issuers to hold BTC to support the assets they are selling to investors, inflows are incredibly bullish as these issuers have taken to buying BTC to fulfill this requirement.

However, with investors beginning to withdraw their funds, the reverse has been the case, leading to a high selling pressure in the market. Spot Bitcoin ETFs have now recorded six consecutive trading days of outflows, reaching an all-time high outflow record $563.7 million on Wednesday, according to data from Coinglass.

If these outflows continue, then the BTC price could continue to decline, and at the current rate, the pioneer cryptocurrency might be testing Norok’s $51,800 soon enough. However, a turn toward inflows would mean issuers have to buy BTC and this can translate to a price recover.