Bitcoin Magazine

Bitcoin Price Crashes to $94,000 and New Six-Month Lows

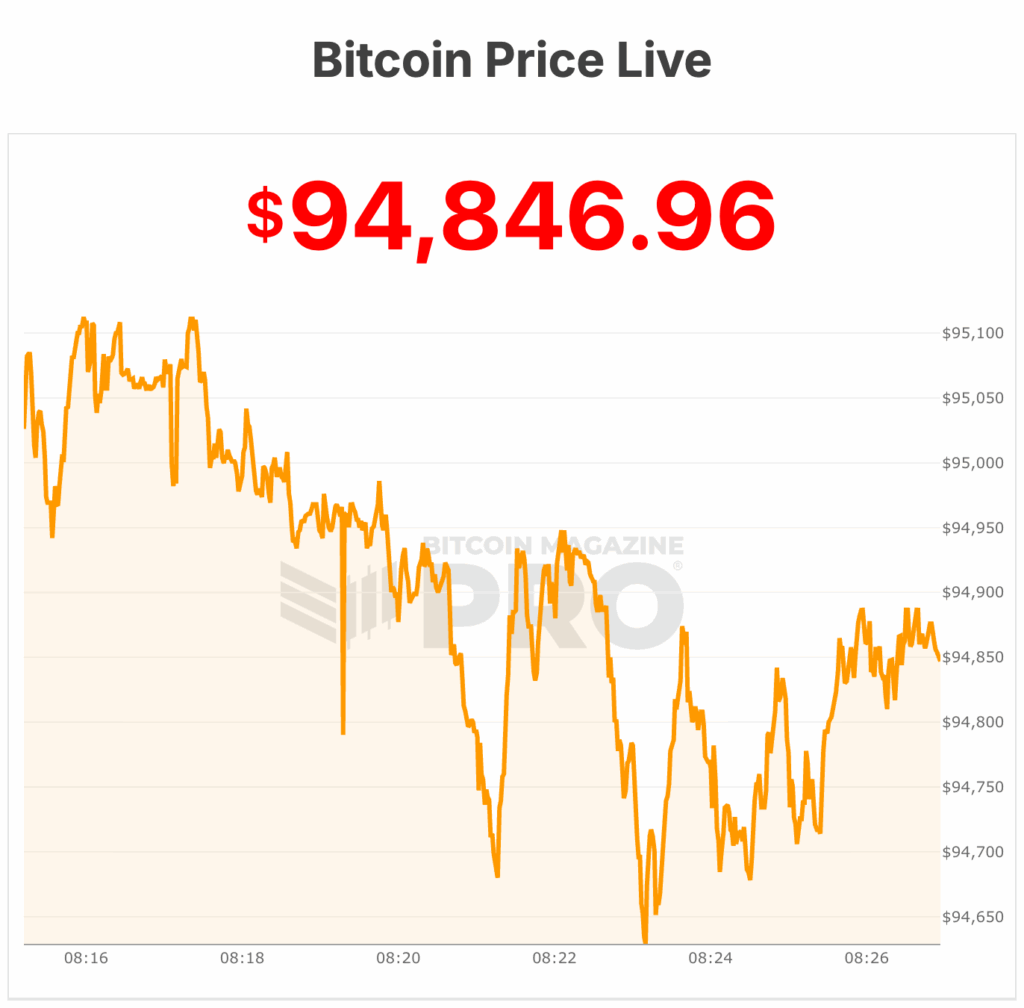

Bitcoin price fell sharply today, sliding from an intraday high of $104,000 to $94,480, wiping out earlier gains and marking a decisive breakdown in price action.

Twelve hours ago, the Bitcoin price hit above $100,000 and then consistently bled down from the upper $101,000s to lows of $94,480.

Ethereum dropped below $3,100 at times and crypto stocks like Coinbase ($COIN) and Strategy ($MSTR) are trading in the red in pre-market trading.

Also, the Bitcoin Fear and Greed Index has plunged to a new “Extreme Fear” low, signaling deep market anxiety even as long-term holders stay the course.

The price dropped to these levels after weeks of weakening demand, heavy long-term holder sell-offs, and persistent outflows from spot Bitcoin ETFs. More than 815,000 BTC — nearly $79 billion — were sold by long-term holders in 30 days, while ETFs saw hundreds of millions in daily outflows, draining liquidity at the worst moment.

Futures funding have turned negative, roughly $550 million in positions have been liquidated as of November 13, and options traders rushed to buy protective puts ahead of a $4 billion expiry, reinforcing bearish momentum.

Macro pressure is adding fuel: tech stocks are sliding, key U.S. economic data is delayed, and uncertainty around the Federal Reserve’s rate path is elevating risk aversion.

Bitcoin has broken major technical supports, including its 200-day moving average and key Fibonacci levels, with analysts warning that a decisive drop below $97,000 could open the path toward $92,000–$74,000.

According to Bitcoin Magazine Pro data, the last time Bitcoin price was near these levels (sub $94,000) was in early May.

Bitcoin price: Who is selling Bitcoin?

One possible reason why the bitcoin price is dropping is long-term holders unloading at record levels. Data from CryptoQuant shows they’ve sold about 815,000 BTC in 30 days — the most since early 2024 — while spot and ETF demand weaken.

Institutional buying has also dropped below daily mining supply, intensifying sell pressure. Prices hover near the crucial 365-day moving average around $102,000, and failure to rebound could trigger deeper losses, according to Bitcoin Magazine Pro analysis.

Analysts at Bitfinex say the current bitcoin pullback mirrors past mid-cycle retracements, with the drop from October’s high matching the typical 22% drawdown seen throughout the 2023–2025 bull market.

“It is important to note too, that even at the $100,000 level, approximately 72 percent of the total BTC supply remains in profit,” Bitfinex analysts wrote to Bitcoin Magazine yesterday. They believe a short relief rally is likely but that a sustained recovery will require fresh demand.

According to The Block, JPMorgan analysts say bitcoin price’s current estimated production cost of $94,000 acts as a historical price floor, suggesting the bitcoin price is near the bottom now.

The analysts believe that rising network difficulty has pushed production costs higher, keeping bitcoin’s price-to-cost ratio near historical lows. The analysts maintain a bold 6–12 month upside projection of about $170,000.

Large bitcoin price swings aren’t driven by small retail investors—they’re driven by whales, institutions, and leveraged market structures. Whale wallets holding thousands of BTC can move more volume than entire exchanges, and even a single transfer can shift sentiment in low-liquidity conditions.

Meanwhile, ETF flows, hedge funds, and corporate treasuries now dominate daily market direction, with billions in inflows or outflows dictating whether Bitcoin rallies or plunges.

All this comes as the U.S. government has reopened after a record 43-day shutdown, the longest in history, following President Trump’s signing of a funding bill late Wednesday.

Under the bill Trump signed Wednesday night, funding for most federal agencies will run out at midnight on Jan. 30.

While federal operations are resuming, recovery will be slow. At the time of writing, Bitcoin’s price is $94,470.

This post Bitcoin Price Crashes to $94,000 and New Six-Month Lows first appeared on Bitcoin Magazine and is written by Micah Zimmerman.