Bitcoin Magazine

Bitcoin Price Craters to $88,000, But JPMorgan Maintains $170,000 Target

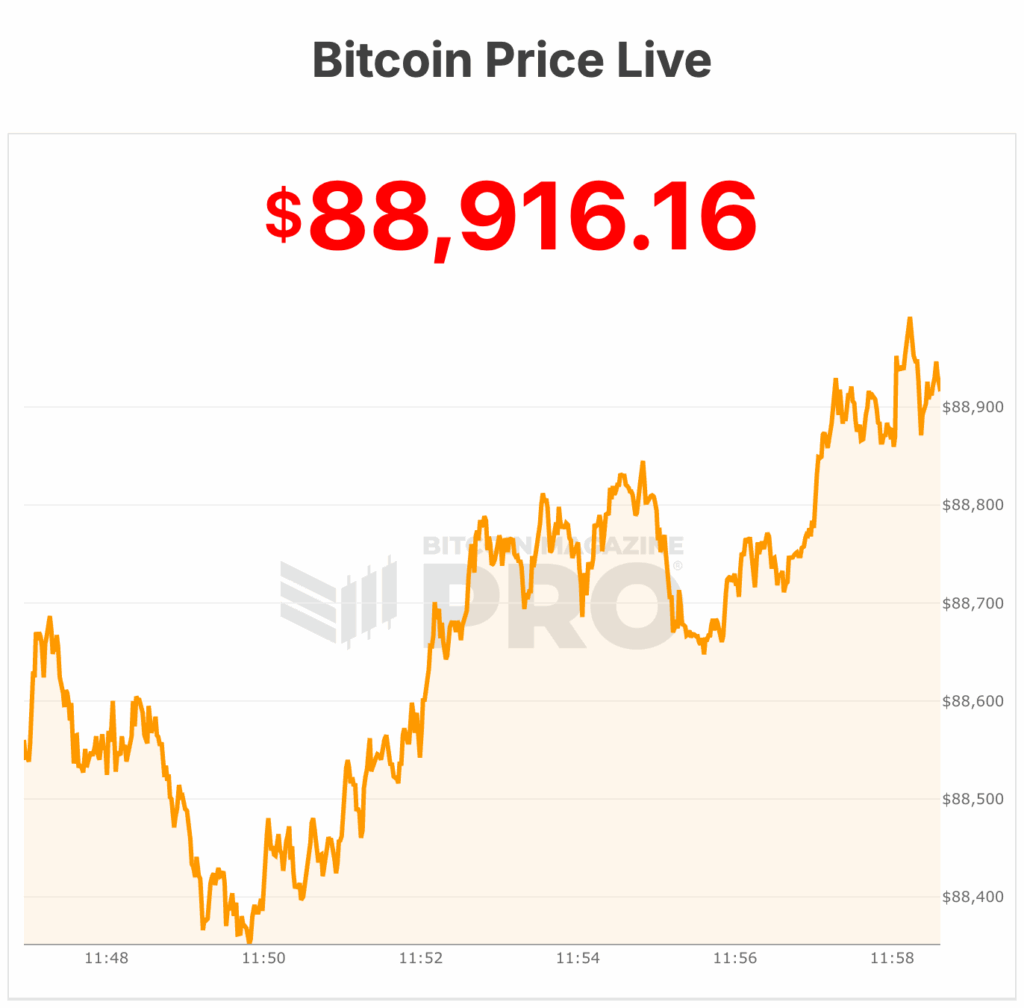

Bitcoin price plunged to $88,000s on Friday, down over 4% in the past 24 hours. The cryptocurrency is trading near its seven-day low of $88,091, and about 4% below its seven-day high of $92,805.

The global market capitalization for Bitcoin now stands at $1.77 trillion, with a 24-hour trading volume of $48 billion.

Despite the recent drop, Wall Street bank JPMorgan remains bullish on the Bitcoin price over the long term. The bank continues to maintain its gold-linked volatility-adjusted BTC target of $170,000 over the next six to twelve months.

Analysts say the model accounts for fluctuations in price and mining costs.

One key factor in the market is Strategy (MSTR), the largest corporate Bitcoin holder. The company owns 650,000 BTC. Its enterprise-value-to-Bitcoin-holdings ratio, known as mNAV, currently stands at 1.13.

JPMorgan analysts describe this as “encouraging.” A ratio above 1.0 indicates Strategy is unlikely to face forced sales of its Bitcoin.

Strategy has also built a $1.44 billion U.S. dollar reserve. The reserve is designed to cover dividend payments and interest obligations for at least 12 months. The company aims to extend coverage to 24 months.

Bitcoin mining pressure

Mining pressures continue to weigh on Bitcoin. The network’s hashrate and mining difficulty have fallen. High-cost miners outside China are retreating due to rising electricity costs and declining prices. Some miners have sold Bitcoin to remain solvent.

JPMorgan now estimates Bitcoin’s production cost at $90,000, down from $94,000 last month. Falling hashrates can push production costs lower, but the short-term effect is sustained selling pressure from miners.

Institutional investors also show caution. BlackRock’s iShares Bitcoin Trust, or IBIT, has recorded six consecutive weeks of net outflows. Investors pulled more than $2.8 billion from the ETF over this period, according to Bloomberg.

The withdrawals highlight subdued appetite among traditional investors, even as Bitcoin prices stabilize. Analysts note that the trend marks a reversal from the persistent inflows seen earlier in the year.

The broader market is still recovering from the October 10 liquidation event. That crash wiped out over $1 trillion in crypto market value and pushed Bitcoin into a bear market.

Although the Bitcoin price has recovered some ground this week, momentum remains fragile.

JPMorgan analysts now say Bitcoin’s next major move depends less on miner behavior. Instead, it depends on Strategy’s ability to hold its Bitcoin without selling. The mNAV ratio and reserve fund provide confidence that the company can weather market volatility.

Other potential catalysts remain. The MSCI index decision on January 15 could impact Strategy’s stock and, indirectly, Bitcoin. Analysts say a positive outcome could trigger a strong rally.

Last week, Strategy’s Michael Saylor disputed MSCI index disputes and clarified that Strategy is a publicly traded operating company with a $500 million software business and a treasury strategy using Bitcoin, not a fund, trust, or holding company.

He emphasized the firm’s recent activity, including five digital credit security offerings totaling over $7.7 billion in notional value.

Bitcoin price analysis

Bitcoin Magazine analysts believe that the bitcoin price correlation with Gold has recently strengthened mainly during market downturns, offering a clearer view of its purchasing power when analyzed against Gold instead of USD.

Breaking below the 350-day moving average (~$100,000) and the $100K psychological level signaled Bitcoin’s entry into a bear market, dropping roughly 20% immediately.

While USD charts show a 2025 peak, Bitcoin measured in Gold peaked in December 2024 and has fallen over 50%, suggesting a longer bear phase.

Historical Gold-based bear cycles indicate potential support zones approaching, with current declines at 51% over 350 days reflecting institutional adoption and constrained supply rather than cycle shifts.

For now, bitcoin price hovers near $88,000.

This post Bitcoin Price Craters to $88,000, But JPMorgan Maintains $170,000 Target first appeared on Bitcoin Magazine and is written by Micah Zimmerman.