Bitcoin Magazine

Bitcoin Price Freefalls Down to $91,0000 and New Lows

Bitcoin price has tumbled to its lowest level in six months, trading from below $92,000 to the $95,000s range today, only less than six weeks from hitting a record highs near $126,000 in early October.

The roughly 30% decline comes as traders grapple with renewed uncertainty over whether the Federal Reserve will cut interest rates at its December meeting.

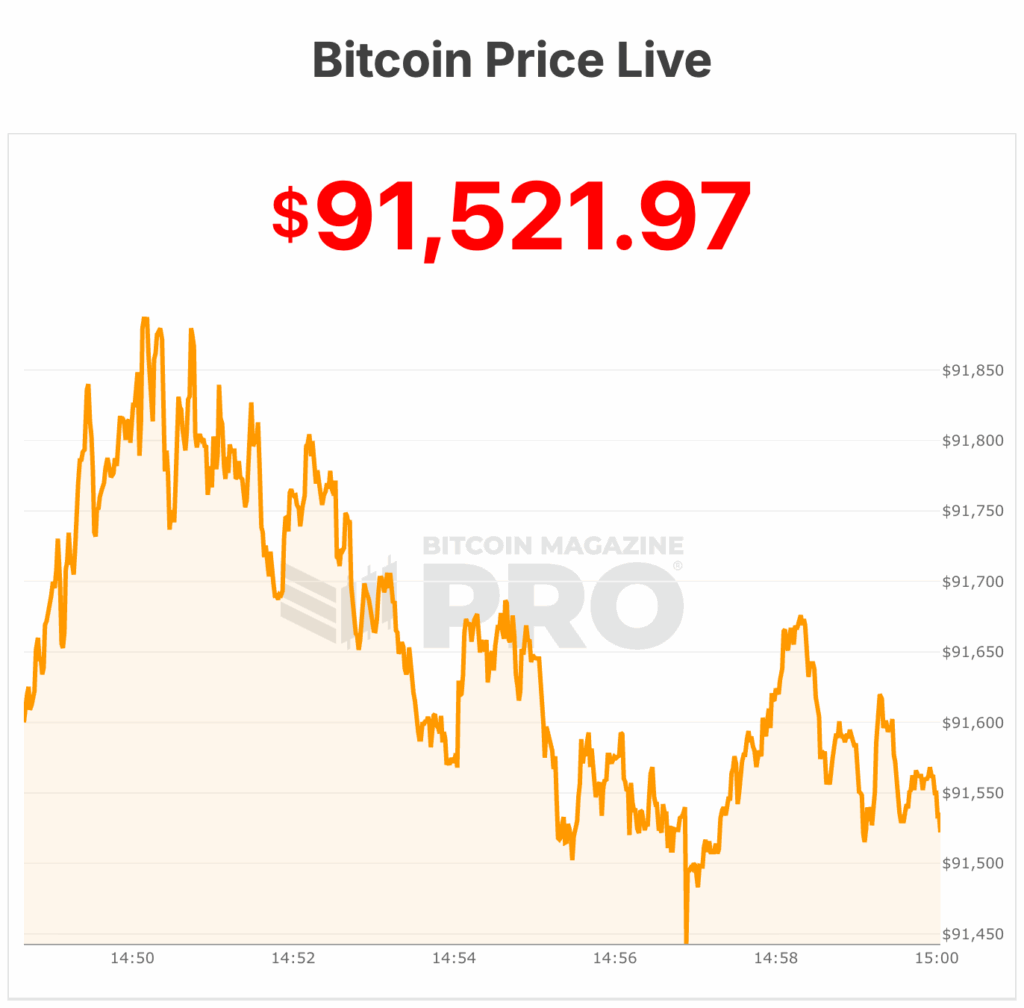

At the time of publishing, the lowest Bitcoin price recorded today was $91,158, per Bitcoin Magazine data.

Missing economic data from last month’s 43-day government shutdown has left policymakers in a cautious stance, with Fed Chair Jerome Powell noting that “a further reduction in the policy rate…is not a foregone conclusion.”

Boston Fed President Susan Collins echoed the sentiment, suggesting it may be “appropriate to keep policy rates at the current level for some time” to balance inflation and employment risks.

Analysts say a sharp shift in market sentiment is driving the latest crypto downturn. Henry Allen of Deutsche Bank warned that investors shouldn’t “underestimate the impact” of the Fed’s increasingly hawkish stance, which has often lined up with broad market sell-offs.

Big institutions are pulling back too: crypto ETFs saw $1.8 billion in outflows last week, including a hefty $870 million pulled from Bitcoin products on Thursday alone.

Bitcoin price is also losing steam as excitement over Donald Trump’s pro-crypto agenda fades. The massive November 2024 rally — driven by hopes for friendly regulation and even a proposed Bitcoin treasury — reversed after Trump floated 100% tariffs on Chinese imports.

That shock triggered one of the largest liquidation events in crypto history, erasing about half a trillion dollars in hours and leaving major assets struggling to regain momentum.

Technical indicators aren’t helping sentiment. Bitcoin price flashed a “death cross” on Sunday, a bearish chart pattern where short-term averages slip below long-term trends. Still, analysts like Benjamin Cowen note that past death crosses often appeared near market bottoms, hinting a rebound may not be far off.

Altcoins are sliding alongside the Bitcoin price. Ethereum dropped below $3,000 today and Solana each dropped roughly a third since early October, feeding into a broader $1 trillion wipeout across the crypto market.

The market’s next key catalyst will likely be the Federal Open Market Committee’s December rate decision, which could determine whether Bitcoin price sees further losses or a potential “Santa rally” in the coming weeks.

Bitcoin price and crypto stocks continue slumping

Crypto-linked stocks are facing significant losses amid broader market turbulence and declining cryptocurrency prices. At the time of writing, Coinbase Global Inc (NASDAQ: COIN) is trading at $260.26 USD, down $23.74 (‑8.36%) today, reflecting reduced trading activity and lower fee revenue as the Bitcoin price struggles.

Strategy Inc Class A (NASDAQ: MSTR) sits at $191.59 USD, down $8.16 (‑4.09%), showing strong correlation with Bitcoin’s recent pullback. Miners are also under pressure, with MARA Holdings Inc (NASDAQ: MARA) down $0.85 (‑7.10%) at $11.14 USD and Riot Platforms Inc (NASDAQ: RIOT) down $0.49 (‑3.55%) at $13.46 USD.

Strategy recently made its largest Bitcoin purchase since mid-summer, acquiring 8,178 BTC last week for approximately $835.6 million. According to an SEC filing and a post by Michael Saylor on X, the purchases were made at an average price of $102,171 per bitcoin. This brings the company’s total holdings to 649,870 BTC, with a cumulative cost of roughly $48.37 billion and an average price of $74,433 per coin. Strategy reports that its Bitcoin yield has reached 27.8% year-to-date.

At the time of the announcement, Bitcoin price was trading near $94,000, while Strategy’s stock ($MSTR) was down about 2% in premarket trading, at $195.86. The recent acquisition was primarily funded through the issuance of preferred stock.

Earlier this month, the company raised around $715 million via its new euro-denominated preferred series, STRE (“Steam”), which was aimed at expanding its high-yield offerings to European investors. This move highlights Strategy’s continued commitment to building its Bitcoin exposure while leveraging financial instruments to support large-scale purchases.

This post Bitcoin Price Freefalls Down to $91,0000 and New Lows first appeared on Bitcoin Magazine and is written by Micah Zimmerman.