The fourth Halving has now been completed for Bitcoin. Here’s how the miners have reacted to the event regarding their total hashrate.

Bitcoin 7-Day Average Hashrate Hit New All-Time High Recently

Halving is a periodic event for Bitcoin in which its block rewards—that is, the rewards that miners receive for solving blocks on the network—are permanently cut in half.

This event takes place roughly every four years, and the latest one was completed just recently. This was the fourth Halving the cryptocurrency has gone through, and its block rewards have now come down to 3.125 BTC from 6.25 BTC.

Bitcoin miners earn their living from two sources: the block rewards and transaction fees. Historically, however, the former has been a much more dominant income stream, as transaction fees have often stayed relatively low.

Since the Halvings drastically affect the block rewards, these events are naturally relevant for the miners. One way to track how the miners react to these events is through their hashrate.

The “hashrate” refers to the computing power the Bitcoin miners have connected to the network. Changes in this value can reflect the sentiment among the miners.

When the indicator goes up, it means that miners are finding the blockchain attractive to mine on right now. On the other hand, a decline could imply that some miners are finding it unprofitable to mine BTC and have decided to disconnect from the network.

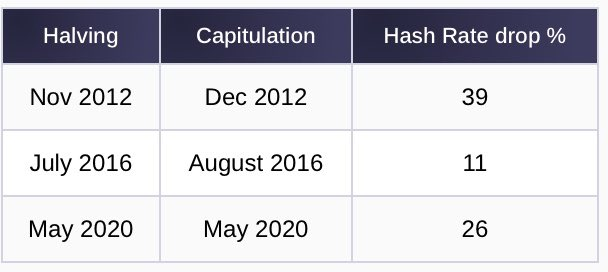

As analyst James Van Straten pointed out in a post on X, the Bitcoin mining hashrate has always gone down following Halving events.

But what about this time? Are miners capitulating? Here is a chart that shows the trend in the 7-day average Bitcoin mining hashrate over the past year.

As the graph shows, the 7-day average Bitcoin hashrate actually set a new all-time high (ATH) of 650 EH/s on the day of the Halving. This could mean that miners weren’t worried about the Halving, or they may just have made a final push to get in on the higher block rewards while they still lasted.

The metric has declined since the event, implying some miners have disconnected. The indicator, however, is still floating around 629 EH/s, suggesting that the drawdown isn’t significant and that the hashrate continues to be around ATH levels.

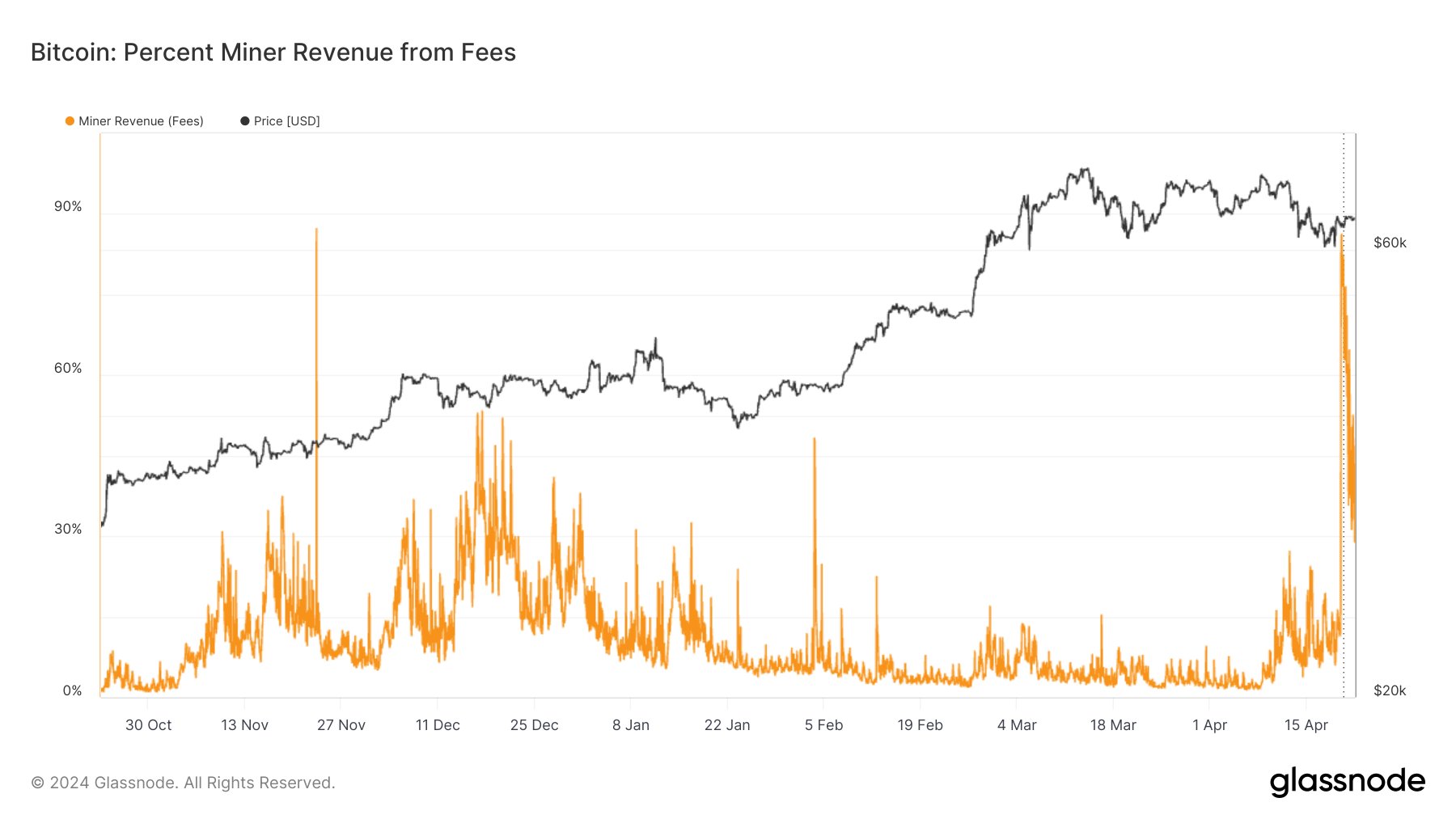

Thus, only a few miners have been shaken out so far. However, this still doesn’t necessarily mean that miners are more persistent this time. As Straten has discussed in another X post, the miner revenue from the fees has been quite extraordinary since the Halving.

This spike in transaction fees has come due to the arrival of Runes for the cryptocurrency, a new protocol that allows users to create fungible tokens on the Bitcoin network.

While the hype has cooled down a bit, as fees now account for 30% of the total miner revenue instead of more than 75% as it was earlier, the revenue percentage they are contributing to is still quite high compared to the past, and this may be the reason why miners are sticking around post-halving.

BTC Price

At the time of writing, Bitcoin is trading at around $66,100, up more than 3% over the past week.